Algorithms now help companies to find the best candidates, reduce turnover and predict how a future employee will integrate the company. We provide an overview below.

Since the advent of recruitment sites, which include LinkedIn and more recently Facebook, technology has become a major tool in the sector and predictive services abound.

One such example is Google for Jobs, which is based on artificial intelligence algorithms and automatic learning or even EasyRecrue, a kind of video interview at the pre-selection stage.

You have everything to gain

These new tools ensure the company will save time and money during the pre-selection phase of the hiring process.

Be careful of ready-to-use models. Machines do need guidance. The company must carefully define its aims and the context. Those are the basis of the model that will be used to match the candidate and the vacancy.

If the aim is to find the most suitable candidates, it’s also about ensuring their long-term fulfilment. The predictive model can analyse a candidate's history in previous functions or situations in order to predict his future behaviour.

A FocusRH study aims to prove the superiority of this kind of model : the benefits of which include a pre-selection period that is 75% shorter, a 50% decrease in the number of candidates seen and a (solid) drop in staff turnover to only one year. Even the overall cost of the recruitment process would be 20% lower.

HR and AI go hand-in-hand

Predictive models utilization don't mark the beginning of the end of human contact in the hiring process.

There are two reasons for this:

- Humans and machines possess different kinds of intelligence. Yet emotional aspects and relations of influence play an important role in the recruitment process. For example in the cases of atypical applicants who could otherwise be discarded by the machine without human intervention.

- Pay attention for the imitation effect which would limit the choice of applicants to very similar profiles, while workers’ complementarity is also a key element of entrepreneurial success.

Conclusion: machines clearly dominate when it comes to collecting and processing data (the pre-selection phase), but human recruiters are the only ones capable of perceiving emotional aspects and assessing the quality of relationships between people. They therefore retain the advantage in the final choice.

16.12.2024

The digital divide persists

“It's not just the elderly who lack digital skills, young people and workers are also affected,” says Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chair of DigitAll.

Despite the acceleration in digitalisation, many people are being left behind. In Belgium, 40% of the population between the ages of 16 and 74 are at risk of digital exclusion. Although older people are often seen as the most vulnerable group, younger people are also struggling in the digital age. Among young people aged between 16 and 24, almost a third lack basic digital skills, with a peak of 52% among those with a low educational attainment.

Figures that are surprising to say the least, considering young people grow up surrounded by digital tools.

"People often assume that young people are digital natives because they are adept at using social media. But making a TikTok video or scrolling through your Instagram feed doesn't necessarily mean you know how to carry out online banking transactions or complete an application form.

Does poverty play a significant role in the digital divide?

"Absolutely. For 25% of people living in poverty, a smartphone is their only digital device. Although they provide a basic form of access, smartphones are often inadequate for important tasks such as preparing a CV or filing a tax return. Without a computer or a stable internet connection, many digital opportunities remain out of reach for those who don't have access to these tools.

What are the other reasons for this digital divide?

"People often lack the necessary basic digital skills because they never learned them. They may not know how to use a search engine, attach a file to an e-mail, or download an app. Without this knowledge, the digital world becomes inaccessible. Furthermore, there is also the issue of digital stress. Many people worry about making mistakes, being hacked, or their privacy. Some people deliberately choose not to use digital services even though they have the skills. Technology instils a sense of distrust and unrest in them, creating a significant barrier.”

How can companies help close this gap?

"Companies can play a key role on several levels. In addition to being a social problem, digital exclusion is also an economic challenge. Today, less digitally adept individuals are both customers and potential employees. Being aware of this as a company is the most important first step. But it’s also essential to provide support to your staff. For example, employees at the municipal parks and greenery service in Ghent received training on how to file their tax returns online. These kinds of initiatives give people practical skills and confidence. In addition, companies need to do a digital check. To measure is to know. Just because someone uses a laptop daily, it doesn’t mean they have digital skills."

What does BNP Paribas Fortis do specifically to promote digital inclusion?

"We have launched several initiatives. In 2020, we established DigitAll, a platform for sharing knowledge and best practices around digital inclusion. Today, we bring together more than 130 organisations. DigitAll has developed a range of tools, including a checklist that companies can use to test how accessible their apps and websites are. A simple interface can make the difference between joining or dropping out for people who are less digitally adept. Since 2021, the bank has also supported a chair at the VUB that investigates the link between digital inclusion and human rights."

How important are tools in bridging the digital divide?

"User-friendly tools are a must. We have partnered with Emporia, a manufacturer of user-friendly smartphones for the less digitally adept. We pre-install our app for customers who buy one of their smartphones."

We mentioned digital stress earlier. How can you mitigate this?

"With awareness campaigns. We want our customers to use our tools with confidence. The bank also takes its less digitally adept customers into account. Thanks to our partnership with bpost, all our customers can go to their local post office for all basic banking transactions."

Do companies stand to benefit from promoting digital inclusion?

"They do. Digital inclusion requires a sustained effort from all stakeholders, including governments and educational institutions. No one should be left behind. Companies that act now can contribute to a more inclusive society while also securing their own future in an increasingly digital world.”

“Without key digital skills, many digital opportunities remain out of reach.”

“A simple interface can make the difference between joining or dropping out for people who are less digitally adept.”

“Limited digital skills remain an obstacle to closing the digital divide.”

Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chairman of DigitAll

22.06.2023

Shipping: focus on the impact of decarbonisation and energy transition

At the end of May, BNP Paribas Fortis and the University of Antwerp brought together a number of experts to discuss the many challenges involved in decarbonising the shipping sector. What are the key points to remember?

Established 12 years ago, the BNP Paribas Fortis Chair in Transport, Logistics and Ports - linked to the University of Antwerp - conducts in-depth research to find concrete and innovative ways of creating an increasingly resilient – and sustainable – maritime ecosystem.

Building on the success of its first two major events in 2017 and 2019, the Chair has decided to do it again this year. On 25 May 2023, a number of experts and stakeholders from the port and maritime transport sector gathered at the BNP Paribas Fortis premises in Antwerp to discuss the impact of decarbonisation on the maritime ecosystem.

Here are their main findings...

1 – We need to move up a gear

Shipping is currently the most carbon-efficient form of commercial transport in terms of CO₂ emissions per tonne and kilometre. But it can do better.

So far, industry players have favoured quick wins, such as modifying ship propellers and adjusting speeds. But on 25 May, the experts agreed that now is the time to experiment with new fuels and technologies, and move towards (near) zero emissions. The pace of change is accelerating, but there's no silver bullet yet. The costs (and risks) are huge.

2 – International regulation, please (and only one)!

The regulatory framework is complex and constantly evolving.

The International Maritime Organisation (IMO), which reports to the UN, is committed to reducing the carbon emissions from all ships by 40% by 2030 and by 70% by 2050 compared to 2008.

The European Union has committed to reducing greenhouse gas emissions from shipping by at least 55% by 2030, compared to 1990 levels. By 2024, an Emissions Trading Scheme (ETS) will apply to all ships of more than 5,000 gross tonnes sailing to or from EU ports.

In short: things are moving, and in the right direction. The problem, according to industry players, is that numerous regional and supra-regional programmes continue to coexist. This leads to administrative and financial overload.

On 25 May, all those involved agreed on two points: firstly, that a single international policy is essential, as this is a global sector; and secondly, that players who do not comply with the rules must be sanctioned.

3 – The transition to carbon neutrality will be costly

The investments required to build new greener ships is estimated at $5 trillion by 2050. The cost of modernising the existing fleet is not yet known, but it will not be zero. In addition, the investment required to renew port infrastructures promises to be huge.

4 – Fuel and/or preferred technology: uncertainty reigns

What will be the fuel or technology of the future? Opinions are divided.

Many types of low-emission fuels are likely to coexist for some time. Electricity will only be used on coastal vessels, ferries and some tugs. Large ships will use liquefied natural gas (LNG) or liquefied petroleum gas (LPG), methanol, ammonia and possibly even biofuels.

Long-distance shipping will initially depend on heavy fuel oil, possibly with carbon capture and storage. Hydrogen has potential, but its density, storage and handling raise questions. Wind, solar and nuclear power are also in the mix.

But the real problem at the moment is that while the number of ships that can run on cleaner fuels is increasing, these fuels are not yet sufficiently available internationally. In other words, supply is much lower than demand.

5 – Banks play a key role

Banks have a key role to play in financing the energy transition. In 2019, eleven financial institutions – mostly European, including the BNP Paribas Group – launched the Poseidon Principles to support the transition to low-carbon shipping. This global framework makes it possible to measure and disclose the carbon intensity of bank loans in the maritime sector. There are now 24 signatories, including Japanese financial institutions. And that’s good news.

Want to know more?

Presentations, videos and photos from the 25 May event are available on this page.

07.12.2020

Scale-up concludes mega contract in the midst of the coronavirus crisis

The Antwerp-based scale-up IPEE transforms ordinary toilets into innovative products. BNP Paribas Fortis is more than just the financial partner. IPEE have already come into contact with the right people via the bank’s network several times.

“The traditional urinal has no brain. The infrared eye simply detects that someone is standing in front of the urinal. The result? A lot of wasted water and misery”, says Bart Geraets, who founded IPEE in 2012 together with Jan Schoeters.

The scale-up devised new measuring technology that makes it possible to detect through the ceramic of a urinal when someone is urinating or when the urinal is blocked. With this innovative technology, the scale-up designed urinals that use half as much water and toilets that can be operated without touching them.

Sleek design

“IPEE is an atypical scale-up that innovates in a sector where little has changed in the past few decades”, says Conchita Vercauteren, relationship manager at the BNP Paribas Fortis Innovation Hub.

Jan Schoeters: “At first we mainly focused on durability. But we soon felt that with non-residential applications, the potential water saving is subordinate to the operational aspect. We had to be able to offer added value for each stakeholder in the purchasing process.”

We opted for sleek designs to appeal to architects and end users. The simple installation attracts fitters and maintenance people see the advantages of the sleek design - that is easy to clean - and toilets that do not overflow.

New investors

Until 2015, Schoeters and Geraets, along with Victor Claes, an expert in measuring methods and originator of the IPEE technology, put their energy into product development and market research. The financing came mainly from money that they collected in their network of friends, fools and family.

They had to go elsewhere to obtain the funds for production and marketing. Geraets: “We had a product, but it wasn’t ready to sell. To take that step, we needed investors.”

Looking for new investors was a challenge. Schoeters: “We aren’t software developers and we don’t work in a sexy sector. So we miss out with a large target group of investors.”

The young scale-up attracted the attention of Ronald Kerckhaert, who had sold his successful company, Sax Sanitair, at the end of 2015. “He pushed us to think big, more than we dared ourselves. And he never headed for an exit. His express goal was to put our product on the world market”, says Schoeters.

Growth path

IPEE has achieved impressive growth since then. The product range was expanded and new sectors were broached: educational institutes, office buildings and hospitals. The technology is now used by Kinepolis, Texaco, Schiphol and Changi Airport (Singapore).

“We very soon turned to Asia, because new technology is embraced more quickly there”, Geraets explains. The IPEE technology is distributed in Singapore - where the scale-up has its own sales office - China, Thailand and Vietnam, among other places. About half the turnover comes from abroad, although the coronavirus crisis will leave its mark this year.

Supporter

“My biggest headache is achieving healthy growth”, says Bart Geraets. One advantage for IPEE is that in coronavirus times, hygiene stands high on the agenda. The scale-up's touchless toilet facilities meet that demand.

At the same time, the shortage of water and the need to use water sparingly is very topical. Geraets: “We notice that in these strange times we are gaining an even bigger foothold. In the midst of the coronavirus crisis we concluded a contract with the world’s biggest manufacture of toilet facilities. Now it’s a matter of further professionalising our business, the personnel policy and the marketing.”

The company’s main bank is an important partner here. Schoeters: “It is more than just a financial organisation. We have already come into contact with the right people via the bank’s network several times. Our bank feels more like a supporter that is also putting its weight behind our story.”

02.06.2020

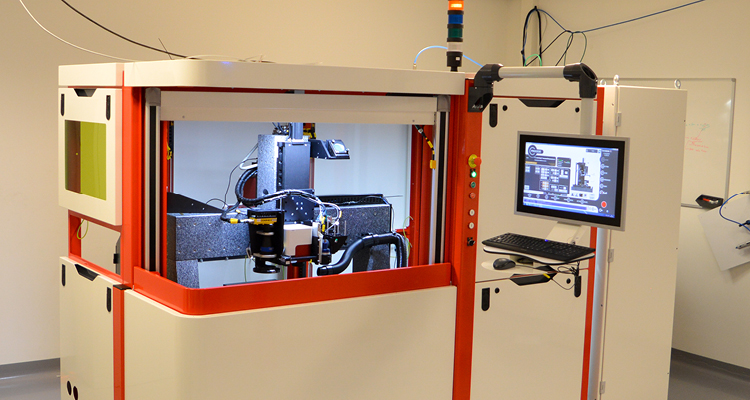

#StrongerTogether Lasea decontaminates masks using lasers

Lasea conceives precision laser solutions for high-tech industry. Faced with the coronavirus crisis, the Liège enterprise revived an old project to decontaminate surgical masks – and respond to the shortage of face coverings.

The secret weapon of Lasea is the femtosecond laser. This has an accuracy of 0.2 micron, 200 times smaller than a hair. Lasea’s high-tech equipment is notably used in horology, electronics, medicine and pharmaceuticals. Given the shortage of surgical masks, the Liège enterprise revived an old project for decontaminating, as Lasea CEO Axel Kupisiewicz explains.

“We had tested laser decontamination 20 years ago. At the time, the project had no commercial outlets. With the coronavirus crisis, we proposed using it to decontaminate used surgical masks. That’s how we joined a consortium managed by the University of Liège to develop a decontamination chain. Usually, it takes many months, even years, to carry out the tests and obtain certification. Thanks to the collaboration between the university and the Walloon government, everything was done in a few weeks.”

Reinvention thanks to a crisis

Lasea proposed two decontamination techniques. “For the first, we used a laser device manufactured by Aseptic Technologies from Gembloux, which we adapted to meet local needs,” explains Mr Kupisiewicz. “For the second, we have entered into a partnership with Optec, in Mons. This latter solution makes it possible to treat three or four times as many masks each day.”

Lockdown has also generated a new dynamic within the business. “We launched a brainstorming session to refine the strategy for the coming years. The result: a new organisation after the move to our new building, financed by BNP Paribas Fortis. On the other hand, the widespread use of videoconferencing has created a new dynamic at the heart of the company. Previously, the Belgian team, who were gathered physically on site in Liège, were in a way privileged in meetings with their French, American or Swiss colleagues, present via videoconferencing. Now, everyone is on an equal footing because everyone is behind their screen by themselves. It’s one of the interesting aspects of lockdown that has created a global spirit in an international group.”

A relationship of trust

“BNP Paribas Fortis has been by our side since the beginning, 21 years ago,” recalls Mr Kupisiewicz. “First via the local branch in Sart-Tilman and now, for seven years, via Corporate Banking. Given Lasea’s developments, enlargement to several banks was necessary, but BNP Paribas Fortis remains the primary bank. I place huge importance on personal relationships and a climate of trust. Be it the branch manager or staff at Corporate, our relationship managers know our activities and our products. It’s important: they understand the issues we face and as a result they know our financial needs.”

“Since the beginning of the crisis, the bank has asked if we need support to develop this project of decontaminating masks. We have been able to implement these solutions by redeploying our teams and we have not needed a large injection of capital. We have, on the other hand, welcomed the moratorium on repayment of capital on all our investment credits.”