Due to the low interest rates, it is uncertain whether insurers will achieve the mandatory minimum return. Unfortunately it is not the insurer, but you, as an employer, who is responsible for this guarantee. Will it be reduced?

The second pillar, the supplementary pension acquired through professional activities, is for your employees the main way to bridge the gap between their statutory pension and the pension amount they wish to receive. The system is well-known. You pay a percentage of your employees' gross salary into a pension pot (employer's contributions). In a number of cases they also contribute a percentage (personal contributions). Usually this is a group insurance, sometimes a pension fund.

The invested capital becomes available when the employee turns sixty, but for tax purposes it is more interesting not to collect it before the 62nd birthday. The vast majority of people opt for payment in the form of capital: they receive a one-off amount. The rest opt for the system of a lifelong annuity and receive a monthly income for the rest of their lives. As a rule of thumb: for each EUR 100,000 in accrued capital, you receive approximately EUR 500 per month.

Rising degree of coverage

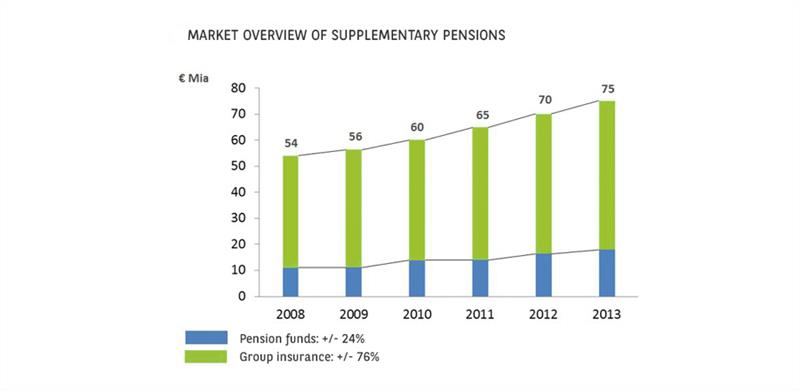

Are you already providing a second pillar at your company? If so, then you are not the only one. Pension plans for companies are in the meantime widespread... but are certainly not yet found everywhere. The commissions are growing steadily by billions of euros, on average by almost 7% a year:

(Source: Assuralia & FSMA)

But many Belgian employees currently still have no access to the system. Benoit Halbart, Director Marketing & Communication AG Employee Benefits - Health Care, says:

“The degree of coverage is rising, from 35% in 1999 to 75% in 2013. This is mainly due to the success of the sectorial plans. Through these sectorial plans, employees in small companies are catching up with manual workers and executives. Some sectors and profession groups are lagging behind: the interim sector, the distribution sector and the joint committee 200, the supplementary national joint committee for employees. It's high time that all companies establish a second pillar.”

The second problem is the sometimes very low premiums. In the sectorial plans, for 51% of the employees only 1% to 1.75% of their salary goes towards the pension scheme. For 48%, it is even less than 1%. Far too little, says Benoit Halbart:

“A contribution of 3% is a first step, but not enough. The additional replacement ratio is then about 6%.”

In its policy statement, the Michel I government states that salary increases can be partly used to increase the contribution level to at least 3%. It asked the social partners to negotiate this percentage. In addition, your employees will be able to take the initiative to voluntarily accrue a supplementary pension in the second pillar, which will be financed by salary deductions. The employee can determine the amount, within certain limits, and the deductions enjoy the same tax benefits as the personal contributions in a traditional pension scheme. A good idea, says Benoit Halbart:

“In most sectorial plans there is still no sign of personal contributions. In the other pension plans, 60% of middle management and employees and 40% of manual workers pay mandatory personal contributions.”

WAP guarantee

The WAP guarantee ('Wet op de Aanvullende Pensioenen', Act concerning Supplementary Pensions) on minimum returns is a hot topic in the second pillar. It is employers, rather than insurers or fund managers, who are responsible for guaranteeing this minimum return at the end of the line. This is a unique arrangement which does not exist anywhere else in the world.

Until recently, the WAP guarantee amounted to 3.25% of employer's contributions and 3.75% of personal contributions. However, in mid-October 2015 the social partners concluded an agreement to amend the guarantee. Beginning on 1 January 2016, the system will become a variable one, where the guaranteed annual annuity will amount to a given percentage of the average return on 10-year government bonds, calculated over a period of 24 months. The resulting figure cannot in any case be lower than 1.75%, nor can it exceed 3.75%. Benoit Halbart:

"So far, the WAP guarantee has not given rise to any problems. Due to the low interest rates, we at AG Insurance reduced our guaranteed return for new contributions to 1.5%, but through the profit-sharing scheme our customers are assured of a return of 3.25% on all contracts until 2016.

If interest rates remain low, problems may arise for employers in the long term. Employers may then have to make additional deposits when an employee retires. This may inhibit the willingness of employers to further extend the second pillar."

27.06.2016

The first pension pillar: some improvements, yet still problematic

The Pension Committee's points system is more transparent and restores the link between length of service and the statutory pension. But it does not solve the problem of its affordability.

If you received one euro for every sentence which has the words 'pension' and 'problem' in it, you would soon be very rich. And no longer troubled by the pension problem. Shame. The statutory pension – the 'first pillar' of the pension system – is giving Belgium a collective headache. The problem is well-known: due to the ageing population there are increasingly fewer working people and increasingly more pensioners, who are also living longer. The recession is the icing on the cake: the government debt is rising and tax revenue is falling. This mix of factors is causing a 'perfect storm' in our distribution system – in which the working people are paying for the current pensions.

The points of the Pension Committee

Avoiding the storm? A pension system is like a tanker which can only be forced into a new direction little by little. The Pension Committee, set up by outgoing Minister of Pensions Alexander De Croo, tried to do so by drawing up a Pensions Report and proposing a new pensions system. What are the key aspects?

- Working longer yields a higher pension, and that pension is calculated on the basis of a points system. For each year that you earn as much as other employees, officials or self-employed persons earn on average in one year, you receive one whole pension point. If you earn less or do not work full-time, you receive less. If you work or earn more, you receive more. One point corresponds to a specific pension amount. The points system would allow for variations, for instance for heavy and arduous professions, and periods of sickness or unemployment. Everyone must be able to see, year on year, how many points they have accumulated.

- The career length is also undergoing changes: if you want to take early retirement, you must have worked 42 years. Part-time retirement and part-time work is also an option. A notable point: the three regimes (employees, officials and self-employed) continue to exist but are gradually converging.

Peter De Keyzer (Chief Economist at BNP Paribas Fortis) has praise for various ideas:

“The points system restores the link between length of service and the pension amount. The system is also more transparent: you can see how many points you have accumulated. Given that the points system will be introduced for the three regimes, they will be better comparable and can gradually converge. I also see some drawbacks. For example, the report is too non-committal about the link between the retirement age and life expectancy. In 20 years, we will, on average, live 6 years longer.”

Further reforms necessary

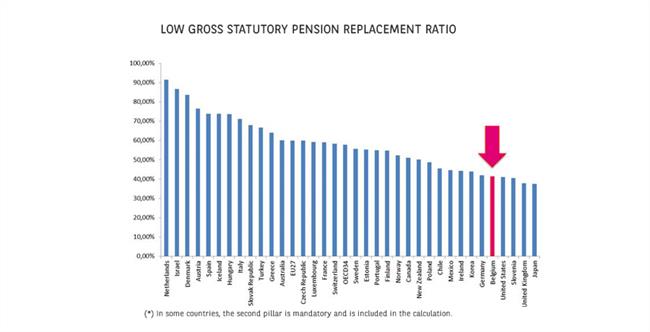

In the meantime, the new government is preparing a pensions reform. A few measures have already been made known. The retirement age has been increased to 67 years of age. The rest is still unclear. If the government retains the proposed points system, it will have to decide how much a pension point is worth. But we should not expect any miracles. The statutory pension will not suddenly make us rich. On the contrary. The replacement ratio (the pension expressed as a percentage of the last salary) is not high at the moment and will probably stay that way. In this respect, Belgium is one of the failures in the western world, as this graph shows:

(Source: OECD – Pensions at a glance (2013))

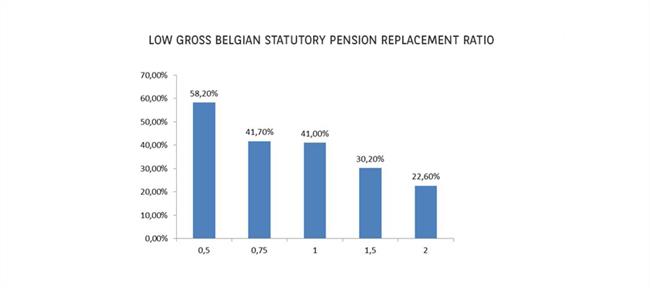

Pension contributions are no longer capped (the more you earn, the more you contribute), but the statutory pension is: how ever much you contribute, you will never get above a certain ceiling. The impact of this is most noticeable for those with higher incomes. For employees with an average salary (EUR 46,100), the replacement ratio of the statutory pension is 41%. When you earn double this amount, it is less than 23%. This graph shows a few figures:

(Source: OECD – Pensions at a glance (2013))

27.06.2016

Is a pension fund suitable for your company?

The vast majority of company pension plans are of the group insurance type. An alternative are the pension funds. Is your company eligible?

In Belgium, group insurance is by far the most popular way of setting up a company pension scheme. According to Assuralia, approximately 95% of employers outsource the second pillar to an insurer. In some cases, a pension fund is nevertheless a viable alternative. In Belgium, there are approximately 200 pension funds – good for 1% of the employers and more than 1 million active participants. In terms of technical commissions, they take up about 24% of the market. The sectorial plans in the construction, metal and non-profit sectors are, for example, pension funds. What is the difference with insurance? And who is eligible?

- An insurance plan has advantages. You outsource it and it requires no further attention on your part. The insurer also guarantees a certain return. But there are also disadvantages. The guaranteed return is currently very low and will probably remain so for a while. And there is not much you can do, because it is the insurer who decides on the allocation. The insurer is also obliged to invest conservatively. An insurance plan has to comply with strict rules, such as a guaranteed minimum annual return. Finally, you have to be satisfied with one party who arranges all aspects of the service.

- A pension fund operates differently. The company (or the sector) establishes an OFP, an organism for the financing of pensions. This allows it to be free and flexible when making decisions about all aspects of the company pension scheme: who will take care of the administration, who will be the actuary and who will be managing it. You also decide on the allocation. An OFP is not aiming for a fixed yearly return, but for an average return over the long term. In this way, you can define a risk profile with which you feel comfortable, consisting of an appropriate mix of bonds, equities, etc., in the hope of achieving a higher return. It is up to the asset manager to guide the organisation and to find a good balance between risk and return. To have a pension fund, your organisation has to be of a certain size and scale. A significant part of the annual costs are the fixed costs for the actuary and administration, and partially fixed costs for the management by the asset manager. This can remain reasonable in proportion to the size of the pension fund.

The message is: dare to compare the two options. An insurance plan is not set in stone. If you decide to change to a pension fund, the insurance can be phased out or you can transfer the amount to the fund. The important thing is to review the existing contract and possible costs, and to properly negotiate with your insurer.

Insurance plan vs. pension fund

Insurance plan

- Guaranteed minimum annual return

- The insurer is obliged to invest conservatively

- Ease of use of an all-in-one solution

- Also an option for small organisations

Pension fund

- No guarantees, but a real chance of a higher return

- Investment strategy and risk level to be determined in consultation

- Requires active participation of the organisation (OFP)

- A certain size and scale is required to bear the annual charges

25.04.2016

The third pension pillar: peace of mind or greater return?

In the third pillar your employees face a dilemma. Do they choose the peace of mind of pension savings insurance or the chance of greater returns from a pension savings fund?

As it is so interesting from a fiscal point of view, you probably also participate in pensions savings in the third pillar. Good to know: the government has frozen the maximum permitted savings amount at EUR 940 per year until 2018. Other tax rules have also recently been amended:

- The final tax on the accumulated capital drops from 10% to 8%.

- However, that final tax will be collected earlier. Until now it was levied on the 60th birthday. This was a tax in full discharge: the deposits made between the 60th and 65th birthday were no longer taxed. In the new system, 1% is deducted each year from 2015 to 2019, calculated over the value of the savings on 31 December 2014. That is therefore 5% in total. This deduction is an advance on the final tax. On your 60th birthday you will pay the final tax of 8%, less the deducted collections for the years 2015 to 2019. In short: 3%.

Still, the third pillar (individual savings with a tax benefit) remains a no-brainer. Even with the lower interest rates, the return is better than a savings account and the tax benefit is still 30%. Less black-and-white is the choice between a pension savings insurance and a pension savings fund. What do you recommend to your employees?

Risk-return ratio

Pension savings insurance offers a capital guarantee and a minimum return. It is a risk-free formula. A pension savings fund is an investment fund managed by a bank or brokerage firm. They invest your money in a variety of equities and bonds. Neither the capital nor the return are guaranteed. But in the long term, you can usually expect a higher return.

There is one piece of advice you can give your employees on their first day: start saving for your pension as early as possible. Eric Vanbrusselen (General Manager Business Development Life Insurance with AG Insurance) says:

“The traditional strategy in the third pillar is to start young! If you choose savings insurance, you take advantage of the effect of the combined interest rate. The longer you save, the more pronounced the snowball effect is. If you choose a savings fund, the long term may ensure that shocks on the stock exchange are evened out.”

The choice between savings insurance and a savings fund is not as black-and-white as it sometimes seems. There are, for instance, risk-graded formulas in savings funds, which vary between dynamic (with, for example, 70% equities and 30% bonds), neutral (50-50) and conservative (30-70).

Bart Van Poucke (BNP Paribas Investment Partners) says: “The choice depends on your risk profile and your age. Young people, who like the idea, can allow themselves to take a little more risk. If investors are confronted with a crisis such as that seen in 2008, then there is still time to recoup the losses.

After your 40th birthday you must start to watch it all a bit more closely. If you have had a few good years with a dynamic savings fund, you can consider changing to a more defensive savings fund or savings insurance. In this way you avoid losses due to difficulties on the stock markets just before you retire. If this is still the case, nothing will stop you leaving the money where it is until the losses have been recouped. This, of course, on the assumption that you do not need the money at the time.”

The ratio between new pension savings insurance policies and pension savings funds is currently about fifty-fifty: savings insurance has risen during the last few years at the expense of savings funds. Despite the low interest rates given by insurers (approximately 1.5%), more Belgians currently choose the peace of mind of pension savings insurance, with the crises of 2008 and 2011 apparently still fresh in their minds. Let's wait and see what the future holds.

Best pension savings fund in Belgium

BNP Paribas Investment Partners has been given the ‘Best Pension Savings Fund in Belgium’ award by De Tijd and L’Echo for the third year in a row. Bart Van Poucke manages these funds together with his team at BNP Paribas Investment Partners. How is he able to make a difference in a market in which strict legal investment restrictions apply? Here he discusses three tricks of the trade:

- “In the shares section, managers have been allowed to invest in equities in the entire European Economic Area since 2004. We still deliberately opt to maintain a large amount of Belgian equities. On average, they have fared better.

- We are legally obliged to invest a certain number of the equities in small caps and micro caps, equities of smaller companies. This market is more difficult to gauge than that of the very large enterprises, the so-called large caps. Specifically in this section, our specialists make the difference: they know these 'smaller' companies very well and are able to gauge which equities will give the best return. Their choices have often worked out well.

- Also in terms of bonds we have made different choices. Just like everyone else, we sold our interests in Greek bonds when the problems started in 2011, but we maintained our positions in the Spanish and Italian government bonds, despite the fact that they were under great pressure at the height of the debt crisis in 2011. When the pressure died down, the interest rates started to fall and fell stronger than those in the core countries. We used this to our advantage to generate greater returns.”

10.09.2020

Export plans? Make sure you talk to our experts first

To prepare your international adventure properly, ask yourself the right questions and talk to people who have done it all before: partners, customers, fellow exporters and experts.

BNP Paribas Fortis listens to the questions asked by international entrepreneurs and offers reliable advice. "A lot of exporting companies ask for our help when it's too late", Frank Haak, Head of Sales Global Trade Solutions, says.

Entrepreneurs with little export experience are often unaware of the bigger financial picture. So what do they need to take into account when they set up a budget for their export plans?

Frank Haak: "Budgeting and pricing are affected by a lot of crucial factors: working capital, currency exchange risks and currency interest, prefinancing, profit margins, insurance, import duties and other local taxes, competitor pricing and so on. We always advise customers or prospects to start from a worst-case scenario. Quite a few companies are insufficiently prepared for their first international adventure: they see an opportunity and they grab it, but quite often disappointment and a financial hangover are not far away.

Our experts have years of export experience and the BNP Paribas Group has teams around the world. This means that we can give both general and country-specific tips. Let's say a machine builder wants to design and manufacture a custom-made machine. We recommend including the machine's reuse value in the budget: can this machine still be sold if the foreign customer suddenly no longer wishes to purchase it or if export to that country becomes impossible due to a trade embargo or emergency situation?"

What type of companies can contact BNP Paribas Fortis for advice?

Frank Haak: "All types! Entrepreneurs are often hesitant to ask for advice. Sometimes they are afraid that it will cost them money. However, the right advice can save them a lot of money in the long run. For example, we recommend a letter of credit or documentary credit to anyone exporting goods to a foreign buyer for the first time. This product is combined with a confirmation by BNP Paribas Fortis to offer the exporter the certainty that it will receive payment when it presents the right documents and to assure the buyer that its goods or services will be delivered correctly."

The consequences of not seeking advice: what can an exporter do in case of non-payment without documentary credit?

Frank Haak: "If you are not receiving payment for your invoices, the counterparty's bank can be contacted in the hope that it advances the payment on the customer's behalf. However, we shouldn't be too optimistic in that respect: the chances of resolving the issue without financial losses are very slim. Once you have left your goods with customs, you usually lose all control over them. Hence the importance of good preparation: listen to and follow the advice of your bank and organisations such as Flanders Investment and Trade (FIT). It will protect you against a whole host of export risks."

BNP Paribas Fortis

- is the number one bank for imports (approx. 40% market share) and exports (approx. 25% market share) in Belgium (according to the statistics of the National Bank of Belgium): it offers advice/financing and can help you to discover new export markets through trade development;

- is proud that Belgium is one of the world's 15 largest export regions and is pleased to give exporters a leg up, for example by sponsoring the Flemish initiative ‘Leeuw van de Export’.

Source: Wereldwijs Magazine