Solution

This interbank mobility service allows your customers to change banks easily and free of charge. Banks have gone to great lengths to launch this mobility service, which goes further than the European Directive on this issue.

How does it work?

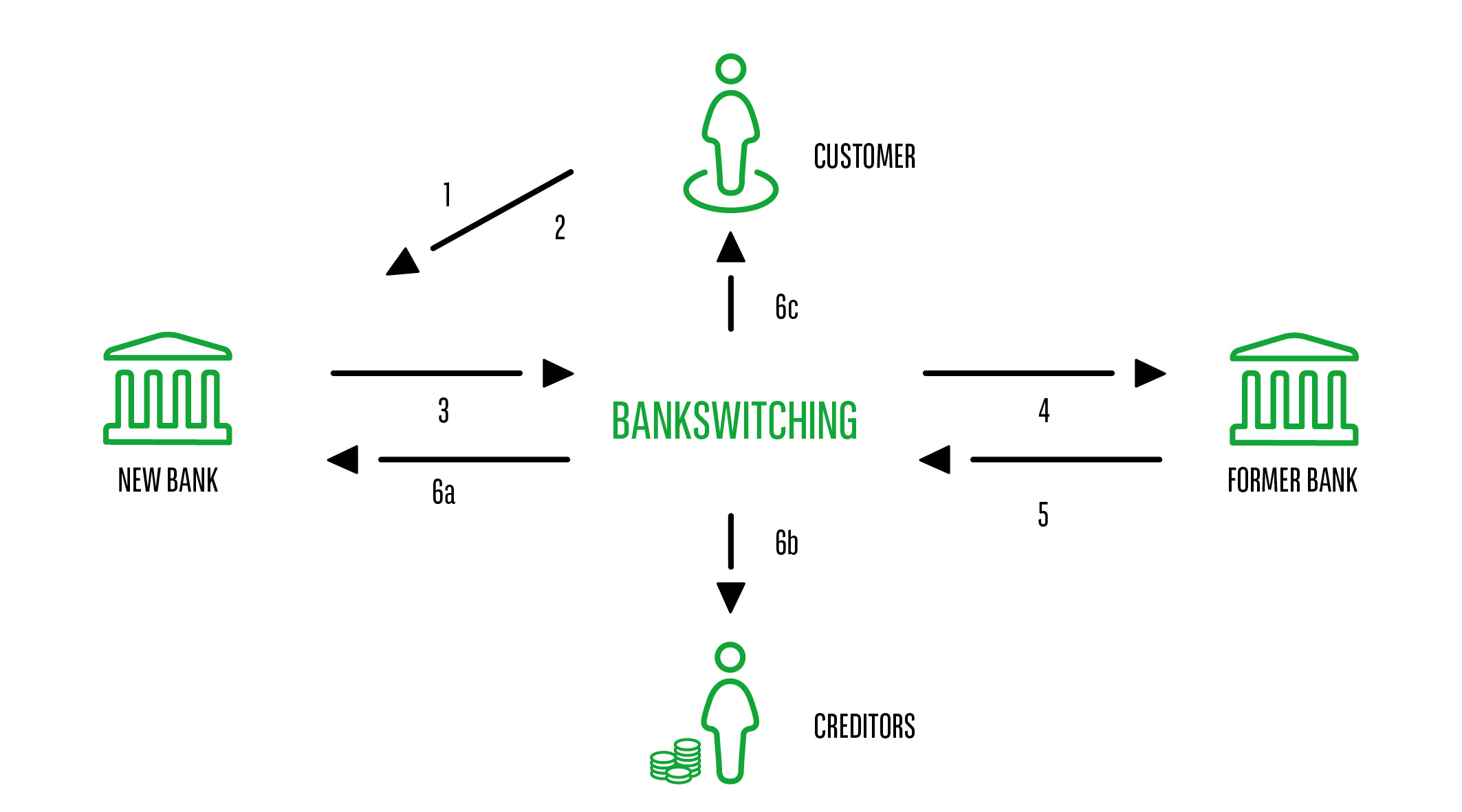

- Your customer tells their new bank that they want to use the banking mobility service.

- They sign the necessary documents.

- The new bank sends this document to the central interbank service Bankswitching.

- Bankswitching contacts the customer's previous bank.

- The previous bank sends all the information to Bankswitching.

- Bankswitching

- sends it to the new bank;

- sends a notification of change of bank to the customer's creditors. This notification includes the previous and new bank account number, the date of change of bank, the mandate references of Sepa Direct Debit (SDD) which are not blocked, the new account name (for recurring transfers) and a copy of the request signed by the customer;

- informs the customer of the information received and disclosed or, if applicable, that some creditors have not been informed (for example, due to a lack of information).

Advantages

- Changing banks is quicker.

- Only one notification per day via a single channel: Bankswitching sends all the notifications from the new banks together in a single message. A very practical process for companies that have to manage several recurring payments.

- Creditors may choose to receive notifications electronically (quicker, easier and automated) by sending a request to Bankswitching (NL-FR). Failing that, notifications are sent by post.

Good to know

- This service is only available for private customer current accounts (therefore, only SDD and B2C accounts are affected).

- From the date of change of bank, creditors are legally required to use the new account number.

- Creditors must ensure, in terms of IT, that they are able to encode the new account numbers in their payment application in time.

- If the customer prefers to inform their creditors themselves, Bankswitching will send sample letters for the customer to complete, sign and send to the creditors.