As an employer, you have the option of paying your staff a bonus in the form of warrants. Not being subject to social security contributions, it is a financially advantageous way for your company to reward good performance.

Specifics

A warrant has the same economic characteristics as an option. An option is a financial derivative consisting of a transferable contract that grants the holder the right, though not the obligation, to purchase or sell a given amount of a specific asset at a predetermined price (the exercise price) on the contract maturity date. This is how it works:

- As the employer, you buy warrants from the issuer.

- You award these warrants to your employees as a bonus.

- Your employees now have three possibilities:

- to sell their warrants as of the next day for their stockmarket value, bearing in mind the risk of a very limited market (of one night only);

- to keep their warrants and sell them at a later date, but before the expiry date (ten years later);

- or to exercise their warrants and to convert them into shares in the underlying investment fund at the exercise price specified in the contract.

Risks

Legal / social risk

- Risk of social penalties if the employer does not respect the conditions.

Counterparty risk

- The holder of the warrants has counterparty risk on BNP Paribas (rating Moody’s Aa3 / S&P A+ / Fitch AA- on 1 July 2024).

- The employer has counterparty risk on BNP Paribas between the purchase of the warrants and allocation to the employees.

- The employees have counterparty risk on BNP Paribas between reception of the warrants and sale of the warrants.

- If the process is done via a third party, there is also counterparty risk on the third party for the holder of the warrants.

Market risk

- There is no market risk for the employer, but the employee is exposed to at least a one night risk. If the employee decides to keep his warrants longer, his exposure to market risk increases.

- There is also a leverage effect, as price movements of the underlying fund will lead to an enhanced price movement on the warrant.

Technical / operational risk

- Employees are not required to have BNP Paribas Fortis securities accounts. As such, warrants can be transferred to securities accounts at other banks. BNP Paribas Fortis has no control over these banks and as such, there may be a risk that warrants are not timely delivered onto the individual accounts.

Advantages

- Financially attractive:

- For your business: warrants you offer to your employees are not subject to social security payments, from either the employer (around 28%) or the employee (13.07%). What's more, the warrants are taxdeductible for your company;

- For the employees: the employee pays professional withholding tax (as with a cash bonus) on the value of the warrants offered, but this tax is final and there is therefore no additional tax in the case of an increase in value at the time of sale of the warrants.

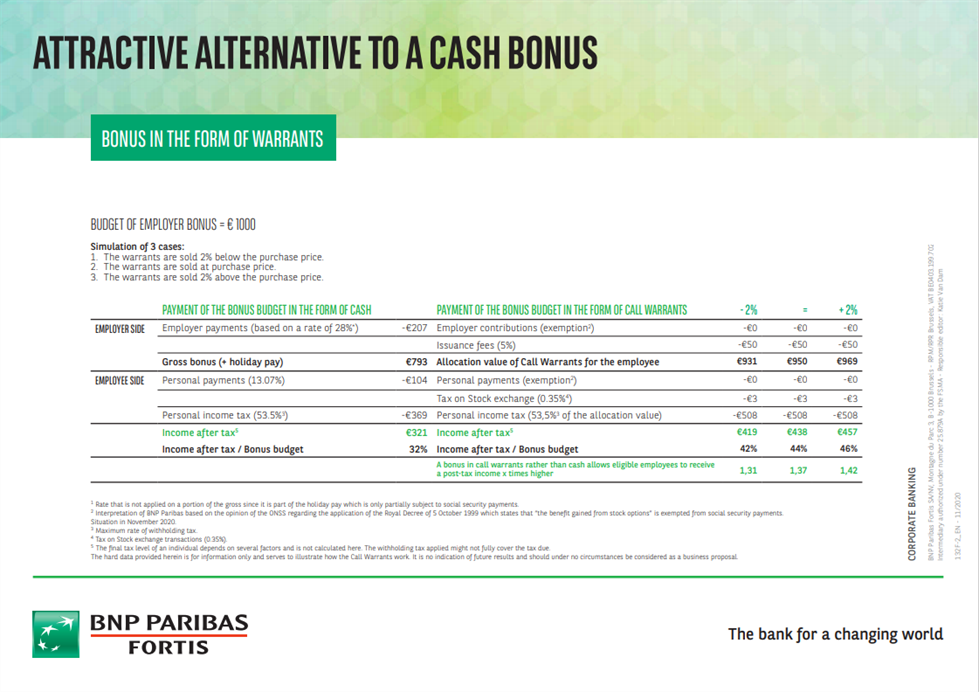

- Efficiency: for the same budget, your employees benefit from a potentially greater sum than if they had been granted a cash bonus and you have the chance to reduce your costs (thanks to the exemption from employer social security payments).

- Risk management: the final warrant parameters are set the night before the allocation to recipients, after the close of the market. When the market opens, recipients have the opportunity to resell their warrants, thus limiting their exposure to the market to one night only.

- Flexibility: you decide the amount you want to give each employee on an individual basis. They then use the warrants how they choose.

- Simplicity: there are different modes of implementation, including ones that allow the employees to manage the entire procedure via a digital platform.

Good to know

Bonuses granted in the form of warrants are regulated by the Law on Stock Options of 1999, which specifies that a bonus of this nature is, subject to certain conditions, exempt from social security payments. The interpretation of these conditions depends on each specific situation. Before adopting this bonus system, therefore, it is very important to analyse your company from a legal, social and tax points of view.

A numerical example :

Find out more

Call your Relationship Manager to discuss the details. Not a customer yet? Contact us.