Optimise your working capital, valorise your invoices

How can you outsource your debtor monitoring, cover yourself against non-payment and have more working capital available? Take advantage of our factoring solutions.

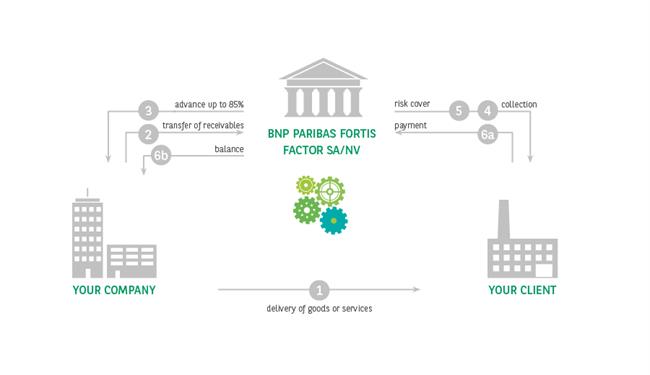

How does it work?

- You deliver your goods or services to your clients and you send your invoice.

- You transfer your receivables to us.

- If you opted for a factoring solution with risk coverage and your client fails to pay the invoice, we will cover your damage at the agreed time.

- You will immediately receive an advance of up to 85% of the invoice amount.

- We will collect the receivables.

- When we have received your client's payment, we will transfer the balance to your account.

Advantages

- You save time as you no longer have to monitor your outgoing receivables yourself.

- You improve your solvency thanks to faster debtor payments.

- You are better protected against defaulters if you opt for 100% risk coverage.

- You increase your working capital without additional security thanks to the possible advances based on your outstanding invoices.

- You get up-to-date and continuous information about your accounts receivables portfolio (invoices, credit notes, payments, disputes and so on) in our unique online tool.

- Tailor-made : Together we will map out your requirements. We will then send you a proposal with the services that offer the perfect solution for your company.

Good to know

- EXPERTS THAT SUPPORT YOU

As the European factoring market leader and working capital experts, we provide tailor-made solutions for your business regardless of your company's size. This will offer you sustainable support at every stage of your journey.

In a rapidly changing world, you will have the expert assistance you need to further optimise and digitalise your experience.

You can also count on BNP Paribas' strength and network to support you in your international expansion.

- TAILOR-MADE SOLUTIONS

Based on your company's specific needs and figures, such as turnover, number of invoices and debtors, payment terms and the actual postponement of payment, we search for a suitable solution.

If you already have a credit insurance policy that protects you against defaulters, we can provide a solution that perfectly complements any existing policies.

The rate will be tailored to your company.

The factoring products and services are offered by BNP Paribas Fortis Factor SA/NV, a subsidiary wholly owned by BNP Paribas Fortis.

Related Article