On-balance and off-balance financial leasing are alternative forms of medium-term investments that allow you to finance the acquisition of vehicles, computer equipment and industrial equipment (*).

How does it work?

-

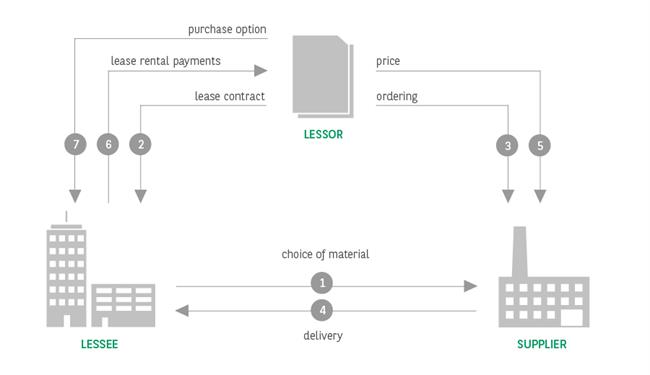

You choose the equipment and the supplier, and negotiate the purchase price.

-

After accepting the file, we send you the agreement for signature.

-

Once the agreement is signed, we place the order with the supplier.

-

The equipment is delivered.

-

After you have received and accepted the equipment, ES Finance pays the invoice directly to the supplier.

-

You start to pay the lease rentals.

-

At the end of the lease agreement, you can choose to exercise the purchase option at a predetermined price.

Advantages

- 100% financing of your investment.

- Prefinancing of the VAT, which is spread over the entire term of the agreement.

- Free choice of equipment and supplier: any type of equipment can be financed with this type of leasing: rolling equipment (cars, trailers, trucks, etc.), machine tools, construction equipment, IT equipment, etc. and with the supplier of your choice.

- Free choice between on-balance and off-balance formulas. The two formulas are distinguished mainly by the accounting treatment which is determined by the height of the purchase option.

- Simple and reduced administrative formalities: you only have to make the lease payments, nothing else. You can pay by direct debit, so you don’t have to worry about it anymore.

- Purchase option at the end of the agreement.

- Positive impact on your working capital.

Good to know

- This a pure financial solution. You are free to choose the insurance cover and the maintenance strategy of the equipment. Of course, the material must be used with due care and attention and covered by an insurance.

- Your lease rentals are fixed contractually and depend on:

- the net price of the investment,

- the lease term,

- the purchase option.

- The term of the lease agreement must be aligned with the economic life of the goods (24 to 60 months and in some specific cases up to 84 months).

- In Belgium, financial leasing is governed by the legal framework of equipment lease, regulated by the Royal Decree of 10 November 1967.

Useful link(s)

(*) Financial leasing is a product of ES Finance, a specialized subsidiary of the BNP Paribas group.