Solution

Real Estate leasing is a commonly used method for long-term financing of your commercial building.

The basic principle is that BNP Paribas Leasing Solutions, at your request and according to your instructions, buys or commissions the construction and then makes it available for you against payment of a periodic rental. This operation can be on- or off-balance. (*).

How does it work?

- You plan your project in complete freedom: the construction of a new building or the purchase of an existing building. You enquire the permits and certificates.

- Based on this project, and considering your requirements, together we work out

the most optimal structure of the lease contract. Of course, the property rights on the plot are taken into account.

Depending on the structure chosen and/or your preferences, the land can be financed in different ways: by your own equity, via an investment loan provided by BNP Paribas Leasing Solutions or by integrating it into the Real Estate leasing.

- After approval by the Credit Committee, we complete the necessary documents: private and notarial deed(s).

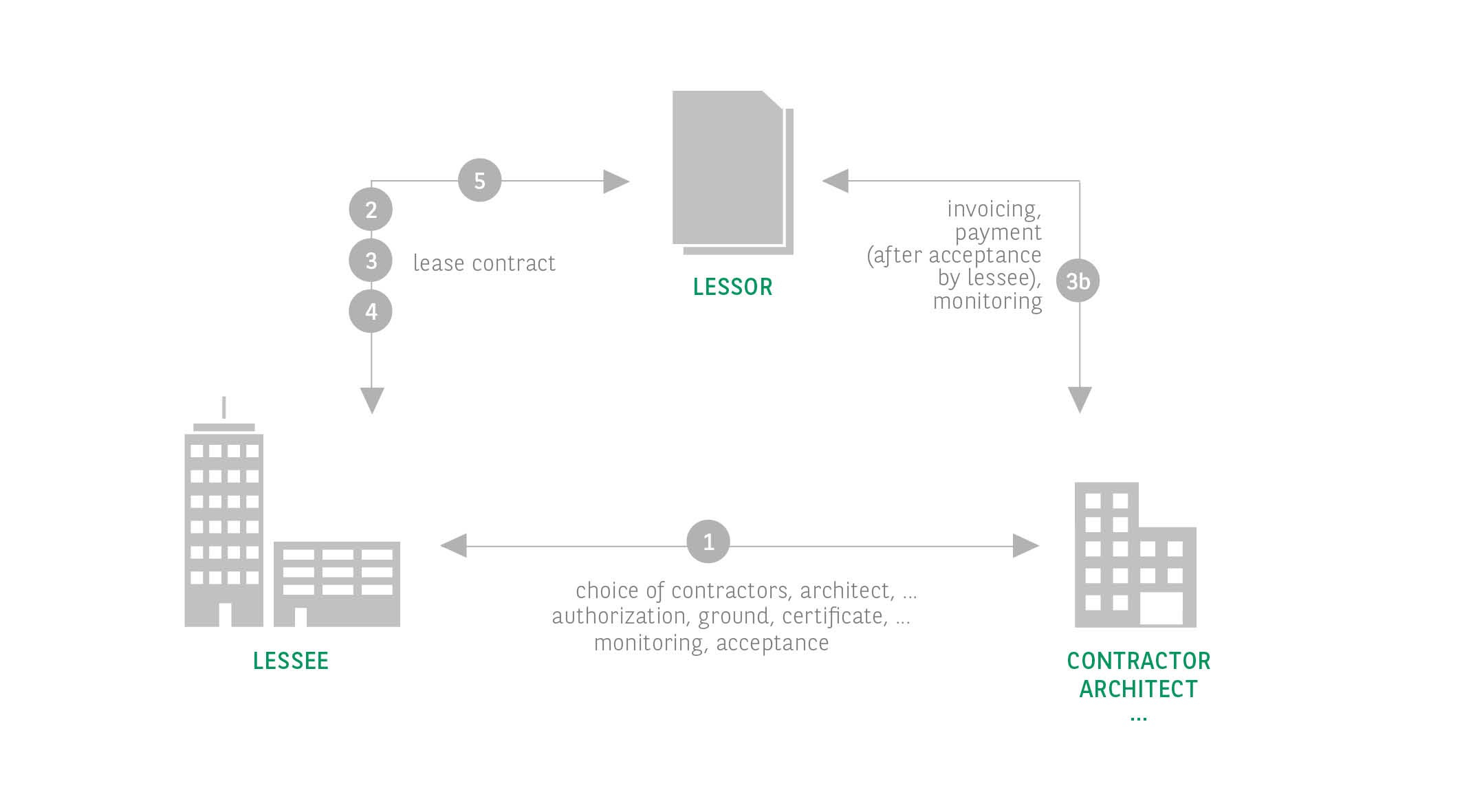

During the construction of a new commercial building :- After signature, you will receive a mandate to conclude, on our behalf, the contracts with the architect and the contractor(s). The choice of architect and contractor(s) is also entirely free.

- During the construction phase, BNP Paribas Leasing Solutions pays the invoices, of course after your agreement (see point 3b in the diagram below).

- After the act of purchase or the entry of service of the new building, reimbursements begin, and the building is made available.

BNP Paribas Leasing Solutions remains the owner of the property throughout the duration of the Real Estate leasing. Of course, you have the full right to use the property.

- At the end of the Real Estate leasing, you can acquire the building for a predetermined amount, or you can extend the rental of the contract.

Advantages

- Real Estate leasing aims for maximum financing of your investment.

- Real Estate leasing can be on-balance or off-balance. In case of off-balance, you book the rentals in Profit and Loss account and your balance sheet ratios are not weighed down.

- Real Estate leasing generally requires less additional collaterals, which means, among other, that you have considerably less mortgage costs.

- Real Estate leasing is a tailor-made financing structure, according to your requirements.

- Real Estate leasing offers an interesting form of pre-financing: you only pay interests on the amounts paid by BNP Paribas Leasing Solutions.

- Real Estate leasing prefinances the VAT during the construction phase. The VAT on new constructions is recoverable in case of professional use.

- Real Estate leasing is a fixed-term contract whereby you benefit from a predefined purchase option and an extension option at the end of the contract.

Good to know

- Real Estate leasing is available under the form of financial (on-balance formula) or operational (off-balance formula) leasing.

- The contract cannot be early terminated, and its duration is generally between 15 and 20 years.

- The rent:

- is determined contractually;

- depends on the capital invested by BNP Paribas Leasing Solutions;

- can be fixed or variable depending on the evolution of the interest rates (monthly, quarterly or semi-annual review).

- Insurance, property tax, maintenance and repair costs are your responsibility.

- Real Estate leasing only concerns the purchase or construction of buildings. And therefore, cannot be used to finance the purchase of land only.

- BNP Paribas Leasing Solutions has a team of experts to work out with you the most optimal structure for your Real Estate leasing, according to your requirements.

Useful link(s)

(*) Real Estate Leasing is proposed by ES Finance, subsidiary of BNP Paribas Fortis.