Promotional communication

Warning

Investment in a tax shelter involves certain risks, including the fact that the tax benefit is obtained immediately but is not definitive, and only becomes permanent providing that a number of conditions are met. Before investing you are invited to read the Prospectus, and in particular to be aware of all the risks relating to this financial operation (see below). To benefit from this product, a company needs to generate a sufficient increase in taxable profits relative to the intended amount of the subscription, and must account for this as required by law; we therefore strongly advise you to consult your accountant or a financial or tax adviser.

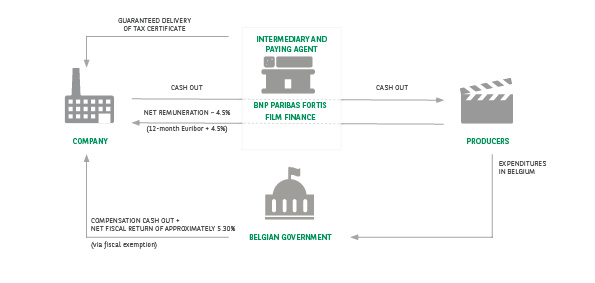

The tax shelter is a unique product that enables profit-making companies to invest in audiovisual and stage productions in order to earn a potentially attractive return on their investment.

A tax shelter subscription via BNP Paribas Fortis Film Finance, a subsidiary of BNP Paribas Fortis, is governed by the Belgian regulations on audiovisual and stage productions as defined under Articles 194ter and 194ter/1 of the Income Tax Code.

How does it work?

- You can subscribe at any time to invest in the next audiovisual or stage productions or video game that will be selected by BNP Paribas Fortis Film Finance. You will be notified once BNP Paribas Fortis Film Finance has selected one or more productions to be financed by you, and the subscription amount will be debited from your account.

- A tax shelter subscription represents a payment without reimbursement. The intention is to fund a producer’s audiovisual or stage project. In return for this payment:

- the producer undertakes to

- pay a return after 18 months;

- meet its obligations, so that the investor is entitled to the tax advantage within the legal timescale of 4 years;

- if the tax shelter conditions are met, the investor may offset 421% of the payment for tax purposes, resulting in a benefit of 105.25% of the subscription.

- On the amount paid, taking into account all benefits, you should obtain a potential total net income of 12,83% after 18 months (this return applies until December 2025 and varies every 6 months depending on the Euribor).

- You can invest from EUR 15,000 now. The maximum amount is EUR 237,000. Per financial year, the law allows a tax deduction limited to:

- half of the increase in taxed profits for that financial year;

- an absolute limit of EUR 1,000,000.

- You will not be charged any fees, at any time, other than the amount of your subscription.

Risks

The risk factors set out below are described in the prospectus (pp. 9 to 11 and 13 to 21), which is available here (not available in English). Approval by the FSMA should not be viewed as a favourable opinion on the product.

Certain conditions depend on you: it is essential, for instance, that your business has sufficient taxable profits in relation to the intended investment and that it recognises the investment in the manner required by law.

- The gain and the tax benefit described here apply to businesses subject to 25% tax rate. The investor’s return could, however, be lower or even negative (in theory as low as -15,80% if the investor is taxed at a rate of 20%). The remuneration may vary depending on the date and duration of the investment in the financial product.

- The Euribor 12m average, which will be used to calculate the interest rate, is the average of the Euribor 12 months rate on the last day of each month of the calendar half-year prior to the date of payment. If the Euribor 12m rate is negative, the applicable interest rate is less than 4.50%.

- Any complaint about our investment products or services should be sent by post to BNP Paribas Fortis SA – Complaints Department – Montagne du Parc 3, 1000 Brussels or by email to gestiondesplaintes@bnpparibasfortis.com or klachtenbeheer@bnpparibasfortis.com. If you are not happy with the proposed solution, you can send your complaint by post to Ombudsfin – Financial Services Mediation Service – North Gate II, Blvd du Roi Albert II 8 (Bte 2), 1000 Brussels or by email to ombudsman@ombudsfin.be.

If you have any doubts about these risk factors or the adequacy of this investment in relation to your financial situation, we strongly advise you to consult your accountant or a financial or tax adviser.

If the tax benefit is to be definitively secured, it is necessary moreover that the producer scrupulously observes the provisions of the tax shelter legislation: i.e. he presents you with a tax certificate in the four years following your investment.

BNP Paribas Fortis Film Finance guarantees that the producer will provide you with the relevant tax certificate. We have also put in place the necessary procedures and checks to guarantee that the projects are actually achieved and generate the required spending in Belgium. If not, or if a financed project does not receive its tax certificate for another reason, BNP Paribas Fortis Film Finance guarantees that you will be indemnified.

Apart from the risks specific to tax shelter, the same risks apply as to any other investment. For the sake of transparency, we have set out the relevant ones below:

- The risks associated with the producers and their operational (ability to shoot the films,…) and financial capacity (ability to pay the intended interest).

- The risks associated with the issuer and its financial capacity or competitiveness. In this case: the risk that the issuer will be unable to pay the amounts due to the investors, or to meet the obligations associated with the offered guarantees, as well as the risk that the issuer will no longer be able to find attractive audio-visual and stage productions.

- Risks associated with the offer and the issuer's capacity to execute it properly. In this case, the risk that the offer will be unsuccessful, which could prevent it being finalised, if it is impossible to select a package of audio-visual and stage productions that meets the minimum conditions.

- Sector-specific risks. This relates in particular to risks that could impact the finalisation of a film. And more generally, if the Belgian audio-visual and stage productions are developing unfavourably, it might prove difficult to find productions that satisfy the issuer’s selection criteria.

- Miscellaneous risks, such as the possibility of legislative changes, making it less attractive to invest in tax shelter.

Advantages

- The highest return permitted by law (subject to the risks referred to above):

- In the year of the subscription you can offset 421% of your contribution for tax purposes. This means that the tax benefit will fully finance your contribution and that you also obtain a potential net tax yield of 5.25% on the amount subscribed.

- After 18 months you benefit from an additional payment based on an annual rate of 4.5% + Euribor 12m average.

- The overall net income after 18 months is therefore 12,83% (return applicable until December 2025). It is fixed at the time the investment is made.

- With the necessary degree of security:

- When you sign an agreement with a producer through BNP Paribas Fortis Film Finance, a BNP Paribas Fortis subsidiary, you benefit in full from the advantages offered by the tax shelter legislation.

- BNP Paribas Fortis Film Finance guarantees that you will receive the required tax certification within the legally established limits or that you are indemnified for all the consequences of an inadequate or missing certificate.

- A tax shelter subscription can be combined perfectly with advance tax payments.

- Extras: you can also enjoy additional benefits: such as invitations to performances or previews, and DVDs.

Useful link(s)

- Prospectus (NL / FR)

- Summary prospectus ( NL / FR)

- Art.194 of CIR ( NL / FR)

- Presentation ( NL / FR / EN)

Find out more

![]()

Call your Relationship Manager to discuss the details. Not a customer yet? Contact us.