A quiet groan or a deep sigh in the finance department? Probably yet another international payment gone south. What exactly can go wrong?

Making payments is never easy, but international payments can sometimes be a real pain. Payments in euros and in the SEPA zone usually go off without a hitch.

However, many companies regularly experience problems when making payments to countries outside the SEPA zone. What's more, finding a solution is often tedious and time-consuming. There is also an impression that international payments are shrouded in secrecy. The amount enters the system, and eventually comes out the other side. But the lead times, costs and payment dates used are often not clear enough or difficult to predict.

This impression held by companies is partially correct, explains Wim Grosemans (Head of Product Management International Payments at the BNP Paribas Cash Management Competence Center).

'SWIFT data shows us that almost 1 in 200 international payments get stuck somewhere along the line. These little hitches are then discussed and investigated by the banks. This can result in frozen payments, queries, uncertainties and rectifications, among other things. The consequences for businesses vary. For instance, unexpected costs may be skimmed off along the way, meaning that the amount received by the beneficiary is lower than intended. Other problems include payments that arrive later than expected or that are even sent back.'

So what is the reason behind these errors? There are in fact several. In Europe, we are lucky enough to have SEPA harmonisation: for payments in euros, all you need to provide is the IBAN and the name of the beneficiary. Outside the SEPA zone, it is still a real jungle of currencies and specifications. In addition, you have to respect the laws and regulations of the country in which the payment is executed, the country that is the final destination of the funds and any potential stopover countries.

Alwin Vande Loock (Senior Product Manager International Payments at the BNP Paribas Cash Management Competence Center) sums up a few of the potential stumbling blocks.

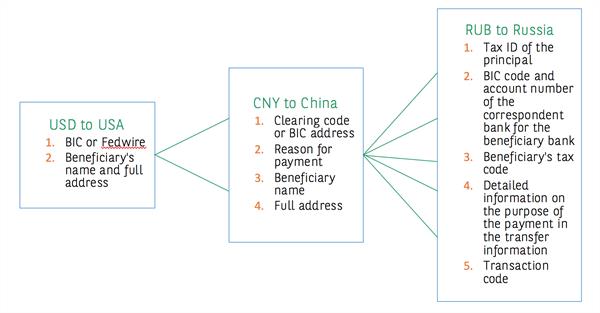

'Sometimes, certain requirements have to be met in order to be able to route the payment through the local clearing system, for example the CNAPS code for payments in yuan in China or the Fedwire code for payments in American dollars. Another problem is that not all countries use the IBAN account format. For instance: when making payments to Mexico, you have to use the CLABE format. In many countries, account numbers don't even have a set structure and there is no check digit like we have here: if you enter one incorrect digit you're already in trouble, and you don't even receive a warning. Sometimes, you also have to provide very specific information about the beneficiary, such as the tax code for payments in Russian roubles to Russia. There are many steps at which things can go wrong, usually those that are still performed manually.'

Another aspect you need to bear in mind is compliance. For legal and ethical reasons, banks must be (and want to be) 100% sure that funds are not of suspicious origin or destination, and that they are not in breach of embargos and financial sanctions. A number of countries are regarded as high-risk in that respect. During compliance checks, all transactions are passed through several filters upon reaching each intermediate banker and each clearing system. This means, for example, that payments with only an invoice number and missing a detailed description risk getting caught up in those filters for longer. The same also applies to payments where the beneficiary information is incomplete, for instance.

Do you have any problems?

Contact your relationship manager or contact person at Cash Management. Or get in touch with the help desk.

Easy Banking business

Tel. + 32 2 565 05 00

E-mail: PC banking Business Help Desk // ebb.support@bnpparibasfortis.com

Isabel

Tel. +32 2 565 28 34

E-mail: Isabel Customer Support // hdisabel@bnpparibasfortis.com

Top 3 errors in international payments

-

The IBAN format is not used in countries where this is mandatory.

-

The clearing code is not provided, is in the wrong format or is not entered in the correct field. The clearing code is used in many countries that don't use the IBAN format (Fedwire for the US, CNAPS for China, BSB for New Zealand etc.).

-

The purpose of the payment is not described clearly enough. Only providing an invoice number or using unclear abbreviations can result in queries from one of the banks concerned as well as delays, especially in countries under embargo.

24.04.2017

Everything you ever wanted to know about international payments

From Albania to Zambia: the BNP Paribas Currency Guide contains everything you ever wanted to know (and more) about international payments in 132 currencies.

At 420 pages long, it's quite a hefty tome to keep on your desk. Fortunately, the BNP Paribas Currency Guide is also available online. For the most recent version, click here. The guide is produced by the Cash Management Competence Center. As the head of Product Management Cash Management at BNP Paribas Fortis, Jo Germeys is very familiar with the concerns of Belgian entrepreneurs and organisations. Which is why they find this guide a useful tool.

'We try and keep our customers informed about changes in legislation or the banking world. However, companies often have so much to think about that the message doesn't always stick. This is usually not a major problem, but it does increase the risk of errors, delays and extra costs. That is why the Currency Guide is an excellent tool.'

In the past, an abridged version of this guide was available for the most common currencies, but the latest version is exhaustive, listing every currency and its associated regulations in alphabetical order. A two-page overview of each currency is provided. First of all, this overview contains clear currency guidelines. For example, that for payments in Canadian dollars you have to give not only an invoice number but also a clear description, in English, of the type of payment; for example, 'payment of travel expenses'. In addition to this standard information, the guide also explains that the IBAN format is not used in Canada. In this case, it is mandatory that you provide a full address and a nine-digit CC code. The first four digits represent the routing number, and the last five the transit number of the bank. Subsequently, there is also an explanation of how the payment must be formatted.

Alwin Vande Loock (Senior Product Manager International Payments at the BNP Paribas Cash Management Competence Center):

'Most businesses only work with a few currencies, so it's not too hard to read up on those currencies in detail and make the necessary adjustments. ERP packages are often set up in such a way that you enter the same details for all countries, and that doesn't always work.'

The five golden rules of international payments

- Write everything in full

Don't use initials or abbreviations in the name or address of the beneficiary. - Provide complete information

Clearly state the purpose of your payment. You can do this by way of a description written in English, a code indicating the reason for the payment or a combination of the two. An invoice number alone is not sufficient. - Use (or don't use) the IBAN format

Use the IBAN format where necessary. This is the case for example when making payments in Albanian lek (ALL) or in Swiss francs (CHF). In Australia, the IBAN format is not in use. There, you have to indicate the BSB (Bank State Branch) code and the BIC (Bank Identification Code). - Use English (and the Latin alphabet)

Write any information in English using the Latin alphabet. Don't use the beneficiary's language or your own language. - Mind the decimals

The majority of currencies accept two decimal places (numbers after the decimal point). There are some exceptions: the Chilean peso (CLP) and the Indonesian rupiah (IDR), for example, do not use decimal places.

20.04.2017

Cost price and lead time of international payments

Who pays what when you make an international payment? And when will the money be available in the beneficiary's account? The latter depends on the cut-off time.

The principal and the beneficiary decide between themselves how the costs of an international payment are to be divided. This can be done in three ways:

1. OUR

The principal pays all of the costs, including those charged by the correspondent bank and the beneficiary's bank.

2. SHA ('shared')

The costs are shared. The principal pays the costs charged by their own bank, and the beneficiary pays the costs charged by the other bank(s). Within the EEA, the 'shared' option is in principle the only one applied in accordance with the PSD (Payment Services Directive).

3. BEN ('beneficiary')

The beneficiary pays all the costs, including the costs charged by the principal's bank.

Another tricky question is the duration: when will the money be available in the beneficiary's account? This depends on the cut-off time. This is the latest time at which your bank can guarantee that the funds will be credited to the correspondent banker of the beneficiary's bank on the agreed date. Remember: this does not necessarily mean that the beneficiary will receive the money on that payment date.

Alwin Vande Loock (Senior Product Manager International Payments at the BNP Paribas Cash Management Competence Center):

'The cut-off time depends on the payment method and the currency. For an urgent international payment in EUR, the cut-off time is 4:00 pm Belgian time. In principle, a beneficiary in Europe should receive the funds on the same day. An Asian beneficiary would probably receive them the following day.'

05.04.2017

International payments: go with the processing flow

What goes on behind the scenes when an international payment is made? We reveal all and demonstrate the various processing stages.

Better understanding results in fewer errors. Here you will find an animated film explaining the basics of international payments.

Let's look at the four steps in the processing of an international payment

1. The customer sends the payment order to the bank

The payment order is sent to the bank via an online banking system (e-banking) or a bulk upload system, in other words a file containing a large number of payments.

- Banks have their own internal e-banking systems (such as Easy Banking Business at BNP Paribas Fortis), but there are also systems that can communicate with multiple banks, such as SWIFTNet and Isabel.

- A limited number of corporates and public institutions can send large volumes of payments to the bank directly from their own ERP systems via bulk upload (sometimes referred to as 'host-to-host').

Remember to provide all the necessary information in the payment request. For transactions outside the SEPA zone, specific rules often apply. A few typical examples:

Not sure what you're doing? Check the Currency Guide here for information on all currencies.

2. The bank validates the input and sets the payment in motion

The bank performs the necessary compliance checks. The bank has an obligation to carry out a number of checks, for example in order to prevent payments being sent to countries under embargo or to people/entities subject to financial sanctions. The EU, the US, the UN and individual countries have such embargo lists.

3. The bank chooses the appropriate routing for executing the payment

For payments in EUR in the SEPA zone, agreed clearing systems are used. Elsewhere in the world, there is no system that is able to connect with any bank in any currency. That makes things complicated, as your banker must find correspondent bankers to ensure the money is received by the final beneficiary. Banks usually have one or several correspondents in each country for the currencies they allow payments in. Matching them with one another for every payment is no small feat. When that has been done, the money can subsequently pass through each of those banks. Your bank will determine the optimal routing on the basis of a number of criteria. These are the main ones:

- 'In-house'

For payments between accounts held with the same bank. This is an accounting movement, whereby the money does not leave the bank. - 'Clearing

The daily transaction volumes between banks are enormous. They are processed in clearing systems. These systems process payments on a 'net basis': all incoming and outgoing payments are listed per bank, and then the net amount to be paid or received ('settled') is calculated for each bank in question. This process takes place multiple times a day. This is called 'net settlement'. Depending on the clearing system, there is usually a focus on either large, relatively urgent amounts or greater numbers of smaller, less urgent transactions. - ‘Correspondent banking’

The actual settlement can only take place in the country to which the currency belongs, i.e. via a local clearing system. Often, one of the two banks involved is not connected to the clearing system of the third country. In this case, direct routing to this system is not possible.

The solution? A 'correspondent bank' that does have access to the local clearing system. Many banks have a worldwide network of such correspondent banks. They hold accounts with them (called 'nostro' accounts) via which they can route payments. The correspondent bankers then settle the amounts so that the beneficiary bank receives the money and can pay the final beneficiary.

4. The customer receives the details of the payment

The entire process concludes with reporting: the customer sees all credit and debit information on their bank statements.

Watch out for 'restricted' currencies

Only convertible currencies can be used to make international payments. Some currencies are 'restricted': this means that in accordance with local legislation, these currencies are not permitted to leave the country. As such, it is not possible to open an account in Belgium in this currency or to use it to make international payments.

An example of a 'restricted' currency is the BRL, the Brazilian real. Banks have a workaround for this problem. They conclude an agreement with a correspondent who does have access to the currency. They send the equivalent value in EUR or USD, convert the amount into the local currency in the country (in this case BRL), and forward that amount to the beneficiary.

What is SWIFT?

To ensure routing is successful, banks communicate with one another via the SWIFT network (Society for Worldwide Financial Communication). SWIFT is owned by financial organisations worldwide. There is a specific standard for each form of communication, for example MT 101, MT 202, etc. In the case of SWIFT, a specific address is also required: the BIC (Bank Identification Code).

07.11.2024

BNP Paribas Fortis Factor: the oxygen to your growth story

Factoring is playing an increasingly important role in promoting the growth of Belgian and international companies. BNP Paribas Fortis Factor provides the oxygen to their growth story.

You want your business to grow and thrive, and so all the help and guidance you can get are more than welcome. The reason is clear: support brings extra energy to your entrepreneurial spirit and essential resources to fuel your innovative growth plans.

BNP Paribas Fortis Factor, a subsidiary of BNP Paribas Fortis, offers a service designed precisely for that: to relieve stress and motivate, to promote and nurture your growth. In this interview, Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, and Audrey Bourguet, Working Capital Advisor at BNP Paribas Fortis Corporate Banking, come together to discuss one key topic: Factoring and the positive role it can play for Belgian businesses and their international branches.

Explaining factoring succinctly, however, is a challenge. Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, clarifies: “To start with, factoring is a means, not an end. It’s a tool for business owners or CFOs to optimise working capital. Every financial manager, in any company, will at some point ask the same question: ‘Who do I need to pay, when, and how can I pay them with the resources I have?’ Simply put, factoring enables businesses to pay suppliers without waiting for customer payments to come in. We finance invoices by converting them into directly available cash for the business.”

This process actively alleviates concerns and reduces stress factors, allowing entrepreneurs to focus on what they do best – running their business. Ramaekers adds, “We like to say ‘giving oxygen to growth stories.’ But I certainly see the value in the term ‘relieving stress’ here. By giving an entrepreneur or CFO the freedom to focus on core activities and by taking on a key part of the financial management, we create extra time and opportunities. And they also have less to worry about."

Positive shift

According to Ramaekers, the traditionally negative perception of factoring is a thing of the past: “Factoring was once seen by many business leaders as a ‘lender of last-resort’ – a way to borrow money from the bank by using assets, receivables, or customer invoices. In other words, a company’s last resort. Fortunately, those days are long behind us. We’ve evolved towards a very open attitude to factoring, allowing our division to grow into a true service provider. Our clients’ primary need remains short-term financing. Today, one in five invoices in our country is paid through factoring. Factoring is now a substantial market, representing more than one hundred billion euros per year. BNP Paribas Fortis Factor manages 41 per cent of this market, accounting for EUR 55 billion at the end of 2023.

Growth

From the bank’s perspective, factoring also represents a significant growth story. Audrey Bourguet, Working Capital Advisor at Transaction Banking for BNP Paribas Fortis, explains: “Today, factoring is the financial product that nicely aligns with the rising turnover of our companies. It provides a practical solution for working capital and is part of a suite of Transaction Banking services. In addition to Factor, this also includes Global Trade Solutions, Cash Management, Fixed Income, and Working Capital Advisory. All these services share a common goal: provide the best possible solution for our clients’ financial needs and be there for them in all situations where they can benefit from our support.”

Factoring, from the bank’s standpoint, represents an increasingly strong and positive story, unlinked from its past connotations. Bourguet adds, “You can see this in how we truly integrate factoring within our bank and the group, and in how we offer this service to businesses across all sectors and sizes. We work with a wide range of companies in the Belgian economy. As a result, we have seen that it is precisely those companies that succeed in optimising the funding of their working capital by making use of our factoring services, among other things. This reinforces our belief that it is a very positive story: we’re talking about a form of financing that seamlessly adapts to the growth of any business, large or small.”

Natural evolution

Factoring is available to small, medium-sized, and large companies alike. Ramaekers says, “We aim to provide a solution that supports businesses throughout their entire lifecycle – we’re genuinely unique in the market in this regard. This means that we are there for start-ups, SMEs, multinationals, and every type of business in between. We are the only bank on the market to have a digital solution for small businesses in the form of Easy2Cash. This digitalisation makes it a very cost-effective option with highly competitive margins, but also a reliable, particularly fast and up-to-date link with our customers and their accounting, using a digital yet personal approach. Although Easy2Cash is digital, it includes a dedicated contact person, making the solution both personal and accessible. For start-ups, for example, it’s often challenging to secure credit. For these modest, short-term credit needs, we provide a solution in consultation with the BNP Paribas Fortis banker, enabling them to keep growing without being hindered by their expanding requirements for financing, automation, accounting, etc. Factoring gives them additional resources to meet these needs.”

Ramaekers notes that the steady growth of young companies also demands an adaptation of financial services: “It’s a natural evolution that benefits both partners. If your business grows, we grow with you – it’s that simple. During all those specific growth moments – when entrepreneurs start considering additional staff or potential exports – factoring grows with them. And we do this together with the bank; the group behind this story plays as a team. And let’s not forget, we’re here even if more challenging times come. We’re well aware that a company’s journey is not always easy. It’s at those moments that the value of our expertise and the support we provide really stands out.”

When a company grows into a large enterprise with the profile of a multinational, the importance of factoring further increases. Ramaekers says, "More than 65% of the really large companies in Belgium, with a turnover of more than EUR 1 billion, use factoring services. And half of them are our customers. Factoring often provides additional economies of scale for large enterprises. For example, we can finance receivables that have no impact on a company’s debt ratio. By combining invoice pre-financing with credit insurance, companies can avoid having debt on their balance sheet, with the approval of the company auditor. It’s a technical matter, but it is this combination of various financial elements that makes factoring efficient, high-performing and valuable for many companies.”

Economic fabric

The two agree on the value of factoring in supporting the economic fabric. Bourguet explains, “Part of this supportive role is due to the fact that factoring is a completely transparent financial service – you can only finance what is effectively there.” Ramaekers adds, “Absolutely. Plus, factoring sits right in the middle of the value chain, embedded in the economic fabric. We work alongside our clients, their customers (debtors), the bank, and so on. This makes us a key figure in this chain. We coordinate and facilitate. And for this we need to have our feet firmly planted on economic ground, often for the benefit of all our customers. When we succeed in, for example, reducing the payment terms of invoices for a business, it has a positive ripple effect not only for that company but for the economic process as a whole. This is why I am convinced that we play a broad role in the economic ecosystem – often broader than is generally perceived.”

Opportunities and fair guidance are also crucial in this financial field. Ramaekers says, “At Factor, we engage in transparent discussions with the bank and our clients to find the best solution for their needs. This means we identify opportunities and often suggest them, but also act as an honest, proactive sounding board. It’s about dialogue, analysis, and constructive critique.” Bourguet concurs: “I completely agree. With a service like factoring, we are deeply involved in our clients’ economic activity – the entrepreneurs who rely on us. So, we take a broad view of every case, looking beyond just a banking product or a single solution. This is what makes BNP Paribas Fortis’s approach so strong: we operate as a team, consisting of specialists from both Factor and the bank. This group of experts from different, well-coordinated entities provides entrepreneurs and companies with a comprehensive approach, even for complex cases. These are the moments when we truly rely on our internal expertise: years of experience; colleagues with solid knowledge; reliable economic data applicable to numerous scenarios. This combination enables us not only to guide companies in the right direction but also to provide financial support that is fair, safe, and sound.”

Future

Just like the bank itself, BNP Paribas Fortis Factor frequently considers its strategic direction for the future. As a provider of forward-thinking services, it’s essential to adopt a future-oriented approach to financial services. Ramaekers notes, “Earlier, I mentioned our digital solution, Easy2Cash. I think we can be quite proud of this because it is a glimpse into the future – today. Beyond that, our services are evolving very organically towards the future: we’re constantly striving to make them accessible to an ever-wider group of clients across the economic landscape. Additionally, we’re very focused on sustainability.”

Bourguet adds, “This last aspect is a natural extension of what we do at the bank every day. Our commitment to sustainability extends seamlessly to factoring: we encourage and motivate our clients to join us on this sustainable path.”

The two teams also collaborate closely in developing new services. Ramaekers explains, “We see a significant evolution in the commercial sector, with many online stores offering deferred payment options, such as a 30-day extension. This practice is also increasingly common in the B2B market. Factoring can innovate in this area, so we see it as part of the future we’re actively developing. From a European perspective, there are other innovations too: e-invoicing, for example, is soon to become the standard for all businesses. This presents both a challenge and an opportunity in terms of services and advisory, which we’re shaping together with the bank.”

The two partners have also developed new services. Ramaekers: "We have observed a remarkable evolution in the commercial sector, where many online stores offer payment delays of 30 days, for example. This practice is also increasingly common in the B2B market. Factoring can offer an innovative solution, so this is part of the future that we are currently developing. On the European level, there are also new features: e-invoicing will soon become the norm for all companies. This presents both a challenge and an opportunity in terms of services and advice, which we are developing together with the bank."

Bourguet concludes, “It’s clear that this is a story of synergy, one where we work together seamlessly. This isn’t just rewarding for us but also for our clients. We’re rooted in the heart of the economic marketplace, yet we’re also focused on creating platforms and products that will lead the way and shape the future of this market.”

More information: https://factor.bnpparibasfortis.be/