Belgian companies are not scaling down their investment in training. But how are we faring in comparison to other countries? The answer to that question varies from one study to another.

Life-long learning and continuing training are Europe's leverage in equipping its citizens for the jobs of tomorrow. There are three European sources available for comparing efforts in the various EU countries.

- CVTS (Continuing Vocational Training Survey) = a survey conducted every five years among employers with more than ten employees in industry and the commercial services sectors

- EWCS (European Working Conditions Survey) = a socio-economic survey of people in employment

- LFS (Labour Force Survey) = a socio-economic survey of households

All three studies collect information about employees' participation in training courses, among other data.

- According to the CVTS (the last edition dates from 2010), around 52% of all employees have received a formal training.

- The most recent EWCS survey (also from 2010) concludes that the average participation rate stands at 39%.

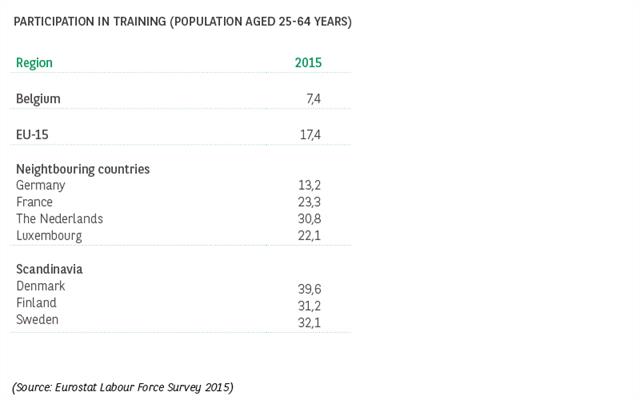

- In the LFS survey (last conducted in 2015), a figure of 7.4% is given.

The differences are huge. This is largely due to the set-up and methodology of the studies, explains Wouter Vanderbiesen (Steunpunt Werk, KULeuven).

“The CVTS is a voluntary company survey that collects information on training offers. Companies with a focus on training are probably more likely to participate in such a survey. The reference periods are different, too: one year for the CVTS and the EWCS, and one month for the LFS.”

So there is a reason behind the major differences between the three sources. A bigger problem is that comparisons with other countries produce rather erratic results, too.

- According to the CVTS, Belgium is a top performer in Europe when it comes to training, with a participation rate of 52%: the European average is 38%. Only the Czech Republic is performing better. We are also ahead of the traditionally strong contenders in the field of training, such as the Scandinavian countries.

- With a score of 39%, the EWCS study puts us at around the European average of 37%.

- The LFS score (2015) of 7.4% is rather poor in comparison to the EU15 average of 17.4% (see table below).

Wouter Vanderbiesen:”If you ask companies, like in the CVTS, our country seems to perform much better than when you survey employees, like in the EWCS or LFS. The latter two sources are the most closely aligned when it comes to their rankings of the various EU countries: countries that score highly in the LFS usually also score highly in the EWCS. So whereabouts does Belgium come in the ranking? I expect the truth is somewhere between the two extremes: around the European average.”

Training investment versus labour costs

In addition to participation in training, the Continuing Vocational Training Survey also looks at the financial investments companies make in training their employees. In 2010, these costs were equivalent to 2.4% of total labour costs. This includes not only direct costs (such as payments to training providers), but also indirect costs such as the labour costs for employees taking a training course during working hours. In Belgium, the latter accounts for almost two thirds of all investment in training. In our neighbouring countries, it's a little less. The European average is 50/50. One of the reasons for this is the high labour costs in Belgium.27.04.2017

Formation : les entreprises continuent à investir

L’économie connaît des hésitations. Ce qui n’empêche pas les entreprises belges d’investir en 2015, à nouveau près d’un milliard d’EUR en formations formelles. Avec cependant des différences entre régions, secteurs et sexes.

Économies, restructurations, licenciements, incertitude… Les temps sont durs pour l’économie belge. Pourtant, le volume des formations n’en laisse rien paraître. On y pratique le ‘business as usual’. Bisnode, expert en données et analyses (www.bisnode.be), a étudié de près les bilans sociaux de 17.000 entreprises belges qui représentent ensemble environ 1,2 million d’employés. Bisnode a ainsi pu évaluer leur niveau d’investissement en formations formelles (des cours et des stages généralement dispensés par des enseignants externes). Selon Bart Vanbaelen, business unit manager B2B de Bisnode Belgique, le résultat est plutôt satisfaisant.

« Si l’on totalise les investissements de ces 17.000 entreprises en 2015, on atteint presque le milliard d’euros dédié à la formation du personnel. Chiffre qui reste tout à fait dans la ligne de 2013 et de 2014. Au sein des entreprises qui s’engagent sur la voie du L&D (Learning and Development), plus de la moitié des employés répondent positivement à l’offre. En 2015, près de 785.000 personnes ont suivi une ou plusieurs formations. »

L’analyse révèle que ce sont les plus grandes entreprises qui ont consacré le plus de fonds à la formation. Les 191 plus grosses sociétés (des entreprises de plus de 1.000 employés) ont dépensé 43 % du total du budget, pour 39 % de personnes qui ont suivi des cours. Les entreprises dont la taille est légèrement inférieure – de 500 à 1.000 employés – ont organisé les formations les plus coûteuses.

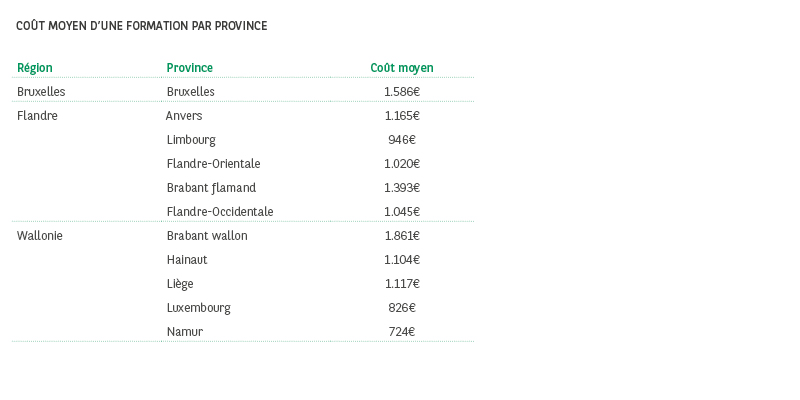

Nombre de grandes entreprises ont leur siège à Bruxelles. On s’attend donc en toute logique que ce soit la capitale qui détienne la moyenne la plus élevée en dépenses de formation, ce que confirment les chiffres. Les sociétés bruxelloises dépensent en formation une moyenne de 1.893 EUR pour un homme et de 1.173 EUR pour une femme. En Wallonie, la dépense s’élève respectivement à 1.411 EUR et 919 EUR, et en Flandre, elle est respectivement de 1.360 EUR et de 858 EUR.

Bart Vanbaelen explique :

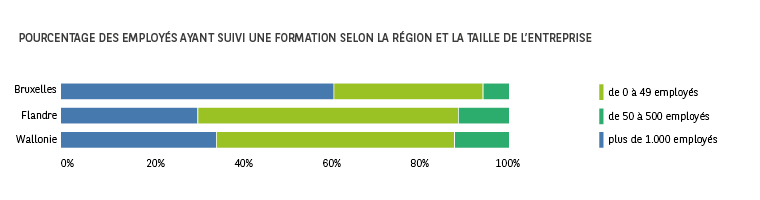

« En Wallonie, les chiffres sont un peu biaisés par le Brabant wallon, une province qui se porte économiquement très bien et compte quelques-unes des toute grandes entreprises. Le coût moyen d’une formation est encore bien plus élevé qu’à Bruxelles : 1.861 EUR, par rapport à 1.586 EUR. Dans les autres provinces wallonnes, le coût moyen est comparable à celui des provinces flamandes. Autre fait remarquable : c’est précisément à Bruxelles que les plus petites entreprises investissent le moins dans la formation. Plus de 60 % des employés ayant suivi une formation dans la capitale travaillent dans une société qui compte plus de 1.000 employés. »

(Source: Bisnode)

(Source : Bisnode)

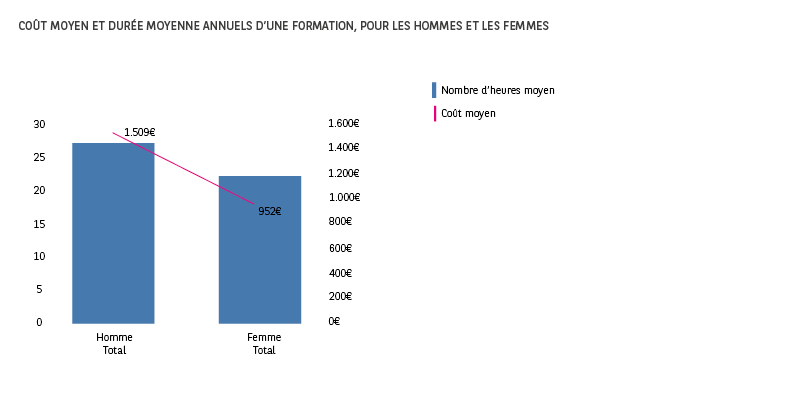

La conclusion la plus remarquable de l’étude de Bisnode porte sur la différence entre employés masculins et féminins. 68 % des femmes suivent une formation (ce qui représente une nette augmentation par rapport à 2013 et 2014), tandis que les hommes ne sont que 58 % à le faire (en léger recul). Par ailleurs, les formations suivies par les hommes sont nettement plus longues et plus chères que celles des femmes. Si les dames suivent en moyenne 22 heures de formation par année, les messieurs en suivent 27. Pour les femmes, le tarif est de 952 EUR, pour les hommes, de 1.509 EUR, ce qui représente une différence de 37 %.

Bart Vanbaelen déclare :

« Il est probable que ces écarts s’expliquent par les différences observées entre secteurs. Ceux qui permettent majoritairement aux femmes de suivre des formations sont les soins et la santé. La plupart du temps, les sociétés souhaitent proposer des formations, mais en général elles ne disposent pas de fonds suffisants pour acheter des programmes coûteux. Compte tenu du vieillissement de la population, il s’agit essentiellement de secteurs en pleine croissance, ce qui pourrait expliquer pourquoi le nombre d’heures augmente ces dernières années. Les sociétés au sein desquelles les hommes sont nombreux à se former relèvent surtout de secteurs comme le transport, la chimie, ou même le commerce. Les salaires y sont en moyenne plus élevés et les formations plus techniques. Par exemple, le secteur « fabrication de produits chimiques » consacre à la formation un budget moyen annuel de 1.880 EUR ».

(Source : Bisnode)

La conclusion générale de cette étude le souligne, malgré les conditions difficiles, les entreprises belges continuent à investir dans la formation.

Bart Vanbaelen conclut :

« Non seulement c’est un fait remarquable, mais c’est aussi nécessaire. Pour la chasse aux talents (war for talent) d’une part, car les employés plus jeunes estiment qu’il est parfaitement normal de continuer à apprendre et à se développer. Mais aussi pour la rétention des talents (care for talent). Quand une entreprise offre à ses collaborateurs l’occasion de se former, ces derniers se sentent mieux valorisés et accomplissent leur travail avec plus d’expertise et de motivation ».

09.12.2024

Managing business uncertainty with BNP Paribas Fortis

Every entrepreneur will tell you that financial markets are unpredictable, entailing inherent risks. We provide tailored solutions to protect your business as you navigate these volatile markets.

Whether you’re a small or large business, operating domestically or internationally, one thing is certain: if you enter a market and do your utmost to grow your business, sooner or later there inevitably will come a time when you expose yourself to risks. Frédéric Raxhon, Head of FI Midcap Sales, BNP Paribas Fortis Transaction Banking, is our go-to expert. Here, he explains how BNP Paribas Fortis helps customers manage this uncertainty.

Raxhon knows how market volatility can impact the daily operations of small, medium and large enterprises. Thanks to his experience of working as a banker in corporate finance, shares and derivatives, and advising holding and listed companies, he understands how the market works like no other.

Raxhon: "We are keenly aware that price uncertainty, in the form of volatility on the financial markets, can have a serious impact on the operations and profitability of businesses. That’s why we constantly monitor the markets and their volatility: if prices fluctuate sharply, our customers run the risk of buying high and selling low. The past few years are a good example of what can happen, with a sudden rise in interest rates, an energy crisis with very volatile prices, and a sharp rise in inflation. We will continue to see volatility in these markets, due to geopolitical tensions and ongoing wars. However, elections can also cause volatility, as they often cause a change in economic policy. President-elect Donald Trump has already said that he will hike tariffs on goods coming from outside the U.S., which will have an impact on global growth and inflation. The transition to a more sustainable society because of the energy transition, however positive this may be, is also a source of uncertainty. Companies will be required to make significant investments, and it is not yet clear which technologies will prevail.

All of these factors show that companies need guidance in the form of a tailor-made solution to ensure that volatile markets minimise the impact on their operations so that they can focus on their core business."

Solution-oriented

The solution to this volatility comes from a partner who is a market leader when it comes to safeguarding national and international business.

Raxhon: "At BNP Paribas Fortis, this often means managing the risks of companies that have a number of straightforward wishes: they want to conduct business on a daily basis without unnecessary complications; buy at a stable price where possible; pay wages in a stable environment; sell to customers with a profitable, stable margin, and so on. If they experience market uncertainty in their business operations, we are there to advise them and suggest solutions in different scenarios. This can range from companies that want stability when buying or selling goods in another currency, to controlling fluctuating interest rates on current or future loans, or even creating a stable financial environment in which they can steadily pay their wages. We also hedge raw materials: companies that require large quantities of energy, metal, or wheat, for example – just a few of the commodities that are subject to price fluctuations – can rely on our expertise to turn their uncertainty into certainty. When companies are calculating their budgets for the coming years at the end of the year, assumptions about budgets and costs are a factor that future markets do not take into account. This, in turn, could lead to inconsistencies in business operations during the next financial year. We regularly suggest solutions for this, which inject trust into the entire process. We help entrepreneurs make their business more resilient to market fluctuations. Because at BNP Paribas Fortis, we are always focused on finding solutions, in any given scenario."

International intelligence

Belgian companies are increasingly expanding their horizons, which is why an international perspective is so crucial.

Raxhon: "Everything is intricately connected in the economic space. The energy crisis, for example, was not a national crisis. In Belgium, electricity prices were directly impacted by the drop in nuclear power production in France in 2022. The American elections have a direct impact on international business, with anxiety gripping investors and the markets. And I can give you many more examples.

Moreover, we expect this interdependence and volatility to continue for quite some time: there are a large number of economic and global trends that are feeding this uncertainty. And that is why it is so important that we keep up with developments in this uncertain global environment. At BNP Paribas Fortis, we rely on a global network of experts who are always on the lookout for the latest updates. Whatever happens and wherever it happens, there are always people from our bank on the ground who monitor the situation and provide us with real-time advice on how best to inform our customers. This network has proven its worth time and again, both for us and our customers."

10.09.2020

Export plans? Make sure you talk to our experts first

To prepare your international adventure properly, ask yourself the right questions and talk to people who have done it all before: partners, customers, fellow exporters and experts.

BNP Paribas Fortis listens to the questions asked by international entrepreneurs and offers reliable advice. "A lot of exporting companies ask for our help when it's too late", Frank Haak, Head of Sales Global Trade Solutions, says.

Entrepreneurs with little export experience are often unaware of the bigger financial picture. So what do they need to take into account when they set up a budget for their export plans?

Frank Haak: "Budgeting and pricing are affected by a lot of crucial factors: working capital, currency exchange risks and currency interest, prefinancing, profit margins, insurance, import duties and other local taxes, competitor pricing and so on. We always advise customers or prospects to start from a worst-case scenario. Quite a few companies are insufficiently prepared for their first international adventure: they see an opportunity and they grab it, but quite often disappointment and a financial hangover are not far away.

Our experts have years of export experience and the BNP Paribas Group has teams around the world. This means that we can give both general and country-specific tips. Let's say a machine builder wants to design and manufacture a custom-made machine. We recommend including the machine's reuse value in the budget: can this machine still be sold if the foreign customer suddenly no longer wishes to purchase it or if export to that country becomes impossible due to a trade embargo or emergency situation?"

What type of companies can contact BNP Paribas Fortis for advice?

Frank Haak: "All types! Entrepreneurs are often hesitant to ask for advice. Sometimes they are afraid that it will cost them money. However, the right advice can save them a lot of money in the long run. For example, we recommend a letter of credit or documentary credit to anyone exporting goods to a foreign buyer for the first time. This product is combined with a confirmation by BNP Paribas Fortis to offer the exporter the certainty that it will receive payment when it presents the right documents and to assure the buyer that its goods or services will be delivered correctly."

The consequences of not seeking advice: what can an exporter do in case of non-payment without documentary credit?

Frank Haak: "If you are not receiving payment for your invoices, the counterparty's bank can be contacted in the hope that it advances the payment on the customer's behalf. However, we shouldn't be too optimistic in that respect: the chances of resolving the issue without financial losses are very slim. Once you have left your goods with customs, you usually lose all control over them. Hence the importance of good preparation: listen to and follow the advice of your bank and organisations such as Flanders Investment and Trade (FIT). It will protect you against a whole host of export risks."

BNP Paribas Fortis

- is the number one bank for imports (approx. 40% market share) and exports (approx. 25% market share) in Belgium (according to the statistics of the National Bank of Belgium): it offers advice/financing and can help you to discover new export markets through trade development;

- is proud that Belgium is one of the world's 15 largest export regions and is pleased to give exporters a leg up, for example by sponsoring the Flemish initiative ‘Leeuw van de Export’.

Source: Wereldwijs Magazine

01.05.2020

The conversation manager: essential and permanently online

Coordinating a company's social media strategy is a task in itself. Who will you use to handle this? And what about involved customers who suddenly get too involved?

Because of social media, the role of a traditional marketing manager is evolving more and more towards being a conversation manager: someone who facilitates consumer communication. This includes communication between customers themselves and communication between the customers and the company.

Some key tasks in the conversation manager's job description are:

- Uniting and activating ‘branded fans’, as they will recommend the brand to friends and family.

- Listening to what people are saying about your company and seeking their active contribution to your products and strategy.

- Creating content worth distributing in order to encourage discussions.

- Managing these discussions.

- Ensuring your work is very customer-oriented and customer-friendly through customer care, i.e.by responding faster and providing more than what the customer is expecting.

Some companies are big enough to hire a full-time conversation manager. In other cases another employee will take on this role part-time. A third possibility is using a specialised company.

Caroline Hombroukx, conversation manager at content marketing company Head Office:

“No matter which option you go for, communication in social media must come across as personal. There is definitely a reason why large companies such as Telenet and Belgacom have created a fictitious person to deal with their customers; Charlotte and Eva respectively. The conversation manager also has to know the company and its social media strategy very well. It may therefore be an advantage if someone in the company itself takes on that role. That person is right at the source and so can distribute information, take a quick picture and post it online, etc.

This task is not for everyone. A conversation manager must have experience with social media, have fluent communication and writing style and must be empathetic, positive and solution-oriented in his or her dealings with customers. Prior training is not a luxury, because the employee must be very aware of the company's content strategy. The audience is varied and unpredictable. You have to decide time and time again whether certain content is or is not suitable for your target group. It is also not a nine-to-five job: the online world keeps on turning even at night or at the weekend."

The advantage of hiring a conversation manager from an external company is that in principle the expertise is present. In that case the challenge is to know the company to such an extent that the customer has the impression that he or she is talking to a real employee.

Getting angry is out of the question

Traditional marketing and advertising are a one-way street. If they do not work, they are a waste of money. However, they are not likely to result in angry comments. A company venturing out on Facebook, Twitter or other social media, can be sure to receive comments and reactions. Including negative ones. Caroline Hombroukx:

“On social media the consumer is suddenly right next to you banging the table. It is important to respond well to that. Getting angry yourself is out of the question. You need to respond by showing that you understand and you are taking the question or complaint seriously. Everyone following the discussion must see that the company is providing a quick answer and is trying to find a solution. If a mistake has been made, you can acknowledge this openly and honestly. You can also show the problem as something positive: as an opportunity to improve your brand, product or service. Of course you must find a suitable solution in the end. If the person sharing the complaint becomes too negative, you have to try and divert him or her to a private channel: a private message on Facebook, a direct message on Twitter, an e-mail or a phone call."

An enthusiastic, understanding response also works well if the consumer is sharing something positive about your brand, company or service. Thanking the consumer strengthens the bond between the company and the customer. Caroline Hombroukx:

"The dialogue with the target group is an opportunity to improve your product or operations through constructive criticism. Make customers feel involved. It creates a strong relationship. If you are publishing a magazine or starting a poster campaign for instance, you can let customers choose the best layout or title from three options posted on Facebook, for example. Everything that engages customers can only strengthen their commitment."

Social media dos and don'ts

- The consumer is always right (even when this isn't the case).

- Be open, honest and friendly.

- Use a personal style.

- Respond quickly to any questions or reactions.

- Stay positive and be understanding.

- Do all you can to engage your customers.

- Come up with a free gift every now and then.

- As a brand, try to avoid political topics.