TEST

Test heMaJuscuLeader 5

- Test number bullet 1

- Test number bullet 2

- Test number bullet 3

- Test simple bullet first column

- Test simple bullet second column

- Test simple bullet third column

- Test simple bullet second column

Test header 2

Test header 3

Test header 4

Test heMaJuscuLeader 5

Test header 6

JIJ bent belangrijkste schakel om levens te redden, niet alleen een AED-toestel https://t.co/QEX224lFNk #reanimeren #defibrilleren pic.twitter.com/eKNDb7yHMI

— RodeKruis-Vlaanderen (@RodeKruisVL) 26 octobre 2017

Test header 1

Test header 2

Test header 3

Test header 4

Test header 5

Test header 6

Post emensos insuperabilis expeditionis eventus languentibus partium animis, quas periculorum varietas fregerat et laborum, nondum tubarum cessante clangore vel milite locato per stationes hibernas, fortunae saevientis procellae tempestates alias rebus infudere communibus per multa illa et dira facinora Caesaris Galli, qui ex squalore imo miseriarum in aetatis adultae primitiis ad principale culmen insperato saltu provectus ultra terminos potestatis delatae procurrens asperitate nimia cuncta foedabat. propinquitate enim regiae stirpis gentilitateque etiam tum Constantini nominis efferebatur in fastus, si plus valuisset, ausurus hostilia in auctorem suae felicitatis, ut videbatur.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Duis a nisl vitae sapien tristique finibus. Sed malesuada eleifend vulputate. Sed rhoncus sed risus in efficitur. Cras commodo, arcu quis viverra blandit, lacus justo condimentum dolor, sit amet finibus velit elit eget dolor. Sed dapibus metus urna, sit amet tristique est consectetur in. Cras est leo, viverra eget sodales vitae, ullamcorper id neque. In id nulla dapibus, dapibus arcu ut, lacinia mauris. Vestibulum porta tempus elementum. Maecenas in elit a quam gravida commodo. Pellentesque maximus augue eu nisi tincidunt, ac blandit tellus pulvinar. Duis vel volutpat massa, non molestie erat. Sed interdum vel est a feugiat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.1.0

1.0Duis a nisl vitae sapien tristique finibus. Sed malesuada eleifend vulputate. Sed rhoncus sed risus in efficitur. Cras commodo, arcu quis viverra blandit, lacus justo condimentum dolor, sit amet finibus velit elit eget dolor. Sed dapibus metus urna, sit amet tristique est consectetur in. Cras est leo, viverra eget sodales vitae, ullamcorper id neque. In id nulla dapibus, dapibus arcu ut, lacinia mauris. Vestibulum porta tempus elementum. Maecenas in elit a quam gravida commodo. Pellentesque maximus augue eu nisi tincidunt, ac blandit tellus pulvinar. Duis vel volutpat massa, non molestie erat. Sed interdum vel est a feugiat.

- Test simple bullet first column

- Test simple bullet second column

- Test simple bullet third column

- Test simple bullet second column

Lorem ipsum dolor sit amet, cPnsectetur adipiPcing elit.2.0

2.0Duis a nisl vitae sapien tristique finibus. Sed malesuada eleifend vulputate. Sed rhoncus sed risus in efficitur. Cras commodo, arcu quis viverra blandit, lacus justo condimentum dolor, sit amet finibus velit elit eget dolor. Sed dapibus metus urna, sit amet tristique est consectetur in. Cras est leo, viverra eget sodales vitae, ullamcorper id neque. In id nulla dapibus, dapibus arcu ut, lacinia mauris. Vestibulum porta tempus elementum. Maecenas in elit a quam gravida commodo. Pellentesque maximus augue eu nisi tincidunt, ac blandit tellus pulvinar. Duis vel volutpat massa, non molestie erat. Sed interdum vel est a feugiat.

2.1Sed maximum est in amicitia parem esse inferiori. Saepe enim excellentiae quaedam sunt, qualis erat Scipionis in nostro, ut ita dicam, grege. Numquam se ille Philo, numquam Rupilio, numquam Mummio anteposuit, numquam inferioris ordinis amicis, Q. vero Maximum fratrem, egregium virum omnino, sibi nequaquam parem, quod is anteibat aetate, tamquam superiorem colebat suosque omnes per se posse esse ampliores volebat.

Quare hoc quidem praeceptum, cuiuscumque est, ad tollendam amicitiam valet; illud potius praecipiendum fuit, ut eam diligentiam adhiberemus in amicitiis comparandis, ut ne quando amare inciperemus eum, quem aliquando odisse possemus. Quin etiam si minus felices in diligendo fuissemus, ferendum id Scipio potius quam inimicitiarum tempus cogitandum putabat.

Haec et huius modi quaedam innumerabilia ultrix facinorum impiorum bonorumque praemiatrix aliquotiens operatur Adrastia atque utinam semper quam vocabulo duplici etiam Nemesim appellamus: ius quoddam sublime numinis efficacis, humanarum mentium opinione lunari circulo superpositum, vel ut definiunt alii, substantialis tutela generali potentia partilibus praesidens fatis, quam theologi veteres fingentes Iustitiae filiam ex abdita quadam aeternitate tradunt omnia despectare terrena.

Quare talis improborum consensio non modo excusatione amicitiae tegenda non est sed potius supplicio omni vindicanda est, ut ne quis concessum putet amicum vel bellum patriae inferentem sequi; quod quidem, ut res ire coepit, haud scio an aliquando futurum sit. Mihi autem non minori curae est, qualis res publica post mortem meam futura, quam qualis hodie sit.

slider4

slider5

05.04.2017

International payments: go with the processing flow

What goes on behind the scenes when an international payment is made? We reveal all and demonstrate the various processing stages.

Better understanding results in fewer errors. Here you will find an animated film explaining the basics of international payments.

Let's look at the four steps in the processing of an international payment

1. The customer sends the payment order to the bank

The payment order is sent to the bank via an online banking system (e-banking) or a bulk upload system, in other words a file containing a large number of payments.

- Banks have their own internal e-banking systems (such as Easy Banking Business at BNP Paribas Fortis), but there are also systems that can communicate with multiple banks, such as SWIFTNet and Isabel.

- A limited number of corporates and public institutions can send large volumes of payments to the bank directly from their own ERP systems via bulk upload (sometimes referred to as 'host-to-host').

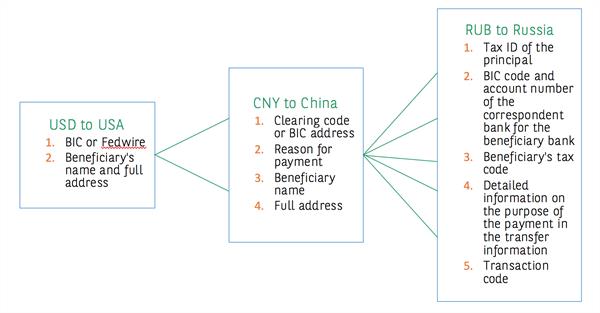

Remember to provide all the necessary information in the payment request. For transactions outside the SEPA zone, specific rules often apply. A few typical examples:

Not sure what you're doing? Check the Currency Guide here for information on all currencies.

2. The bank validates the input and sets the payment in motion

The bank performs the necessary compliance checks. The bank has an obligation to carry out a number of checks, for example in order to prevent payments being sent to countries under embargo or to people/entities subject to financial sanctions. The EU, the US, the UN and individual countries have such embargo lists.

3. The bank chooses the appropriate routing for executing the payment

For payments in EUR in the SEPA zone, agreed clearing systems are used. Elsewhere in the world, there is no system that is able to connect with any bank in any currency. That makes things complicated, as your banker must find correspondent bankers to ensure the money is received by the final beneficiary. Banks usually have one or several correspondents in each country for the currencies they allow payments in. Matching them with one another for every payment is no small feat. When that has been done, the money can subsequently pass through each of those banks. Your bank will determine the optimal routing on the basis of a number of criteria. These are the main ones:

- 'In-house'

For payments between accounts held with the same bank. This is an accounting movement, whereby the money does not leave the bank. - 'Clearing

The daily transaction volumes between banks are enormous. They are processed in clearing systems. These systems process payments on a 'net basis': all incoming and outgoing payments are listed per bank, and then the net amount to be paid or received ('settled') is calculated for each bank in question. This process takes place multiple times a day. This is called 'net settlement'. Depending on the clearing system, there is usually a focus on either large, relatively urgent amounts or greater numbers of smaller, less urgent transactions. - ‘Correspondent banking’

The actual settlement can only take place in the country to which the currency belongs, i.e. via a local clearing system. Often, one of the two banks involved is not connected to the clearing system of the third country. In this case, direct routing to this system is not possible.

The solution? A 'correspondent bank' that does have access to the local clearing system. Many banks have a worldwide network of such correspondent banks. They hold accounts with them (called 'nostro' accounts) via which they can route payments. The correspondent bankers then settle the amounts so that the beneficiary bank receives the money and can pay the final beneficiary.

4. The customer receives the details of the payment

The entire process concludes with reporting: the customer sees all credit and debit information on their bank statements.

Watch out for 'restricted' currencies

Only convertible currencies can be used to make international payments. Some currencies are 'restricted': this means that in accordance with local legislation, these currencies are not permitted to leave the country. As such, it is not possible to open an account in Belgium in this currency or to use it to make international payments.

An example of a 'restricted' currency is the BRL, the Brazilian real. Banks have a workaround for this problem. They conclude an agreement with a correspondent who does have access to the currency. They send the equivalent value in EUR or USD, convert the amount into the local currency in the country (in this case BRL), and forward that amount to the beneficiary.

What is SWIFT?

To ensure routing is successful, banks communicate with one another via the SWIFT network (Society for Worldwide Financial Communication). SWIFT is owned by financial organisations worldwide. There is a specific standard for each form of communication, for example MT 101, MT 202, etc. In the case of SWIFT, a specific address is also required: the BIC (Bank Identification Code).

16.05.2016

Online payments: customers are truly king

With the arrival of the smartphone, tablet, smartwatch, etc., consumers already have a direct link with their bank in their pockets or even on their wrists. It is therefore essential for banks to facilitate ‘digital’ payment transactions in order to remain the trusted partner in this field. They need to do so without compromising on cost price and security.

Banks are facing competition from other players in the field, such as Google, PayPal, Apple, etc. . Even though, each of them seems to have different reasons for getting a piece of the payment transactions market.

Today we see that each bank has one or more apps to interact with its customers as seamless as possible. All banks seem to be well aware that the rules are changing when it comes to payments transactions. For example, online shopping and payments are not bound to any opening hours. Moreover, Belgians are becoming more and more demanding. Not only do they decide where and when to buy, they also want to decide how to pay. A significant number of online transactions are thus done at home on the tablet while other members of the household enjoy their favourite soap or series. We also see quick response (QR) codes popping up everywhere to make ‘shopping’ easier and more mobile.

It is obvious that both e-commerce and m-commerce are growing exponentially and that even goods and services that traditionally were harder to sell on the internet, now have found their way online to the consumer. The public sector being no exception in this regard. Briefly put, the market is changing and traditional payment methods by which your organisation pays or is getting paid are coming under pressure.

Looking for an equilibrium

It is more than likely that a number of payment solutions will fall into oblivion over time thanks to smartphones. Meanwhile, computers, payment terminals, credit cards and cash still shape today's payment landscape. A bank is therefore obliged to keep alternating between two ideas:

- improving its existing range of payment options

- gradually expanding its e-banking and m-banking

Choices. That is what it is all about. And these choices need to be made based on the digital payment landscape of today and of tomorrow.

16.05.2016

Digitised reporting coming soon

Large organisations and companies are already one step ahead with e-banking and have mostly already integrated their accounting.

In larger organisations, banking details are requested automatically and processed in the accounting department. In the case of a smaller company, accountants are increasingly taking over this task. These can be obtained from their customers through various channels in order to process digitally.

Peter Pollaert (Head of Cash Management BNP Paribas Fortis):

“Banks must also respond to this with their new e-banking applications. Previously, there was a bilateral relationship between the bank and organisation, both at the level of transactions and reporting. In the future, other parties, such as the accounting firm, will make this a triangular relationship.”

Where does Belgium stand in that domain?

It seems to be doing well. The great benefit is that bank reporting in our country is standardised, via the well-known CODA-protocol. CODA (Coded Statement of Account) is an electronic file that contains the data of account statements and their attachments. Each transaction is assigned a unique code, which an accounting program can use to accurately identify and record the transaction.

“Thanks to that common protocol, nearly all accounting software packages used in Belgium can upload CODA”, says Peter Pollaert. “A foreign online accounting firm may therefore venture into the Belgian market. The firm just asks for a channel to receive CODAs securely, efficiently and electronically and to finalise the accounting of companies online.

More than just CODAs are needed for this purpose: banks must also be prepared and have the necessary technical capabilities to establish a link with the accounting package provider. This can be done the old way, by which a company gives its bank the instruction to send the CODAs to the accountant. But it can also be done completely digitally, with mandate holders and digital signatures.”

16.05.2014

E-commerce and m-commerce: a smoother system ahead

Even though there is significant interest in e-commerce and m-commerce, making payments is often perceived as cumbersome or as insecure.

E-commerce considerably increases ease of use. You can calmly consult information about services (training, holiday camp for children, etc.) and then pay for them straight away. The trend shows no signs of stopping, yet Belgium is not leading the way here. In our country, for example, only 2-3% of the total retail turnover is made with electronic sales. The figure in our neighbouring countries is already 8-9%. Gunter Uytterhoeven (Head of Marketing BNP Paribas Fortis):

“One of the reasons for lagging behind is that Belgium still does not have a good payment solution for electronic transactions. Many people perceive online payments to be complex, cumbersome and not adequately secure. Almost one-quarter of all transactions are interrupted at the time payment must be made.”

The most common way of online payment is the credit card, which is being used increasingly with the card reader and PIN. The payment requires several actions. A system that is making considerable progress is the virtual wallet or e-wallet. The customer opens a wallet on a website to which an amount can be transferred or on which payment is made by credit card. The advantage is that you do not have to release any personal details on the internet. The disadvantage is that you can only use this system in affiliated web shops. A well-known example is PayPal. The customer only needs to provide his bank account or credit card details once and can pay after that with an e-mail address and password. This also requires a number of actions that can form an obstacle for many e-shoppers.

M-commerce (buying and paying via mobile devices such as smartphones and tablets) is still in its infancy. Apps are very popular, but they are not yet used very frequently for mobile trade. Paying in the app often does not work, merchants have problems identifying customers, and there are still doubts about security and privacy.

However, there is a solution in sight to make both e-commerce and m-commerce work more smoothly and securely. BNP Paribas Fortis is currently working on a new system together with other Belgian banks and major telecom players: Sixdots.

Sixdots: smooth and secure online and mobile payments

Sixdots is a system designed to make both payment cards and card readers superfluous. These are to be replaced by a secret code that is typed into the smartphone. Online mobile payments will be smooth and secure. The system is aimed at the Belgian market and will be launched in 2015.

- Sixdots refers to the six-figure PIN, which together with several other elements is designed to ensure the security of the system. Sixdots will be an open platform that is accessible for all organisations/companies and their customers/consumers: the app can be used by anyone with a smartphone, a payment card at a Belgian bank and a mobile data subscription with a Belgian telecom operator.

- Sixdots offers attractive benefits to vendors, both for e-commerce and ‘in-app’ commerce. Sixdots can be seamlessly integrated into the organisation's own app. You pay a small fee for each transaction.

- Using Sixdots is free and convenient for the payer. Payers no longer have to leave behind their card details during the payment process and the card reader also becomes superfluous. All that they need to pay for goods or services is a smartphone.

Gunter Uytterhoeven: “For commercial organisations, more is possible than just shopping and paying. The entire retail process can be combined in Sixdots, including loyalty cards and discount vouchers. Discount vouchers would then automatically appear on customers' smartphones, for example, when they are at the shop rack height of the relevant product. The till will also recognise the customer's smartphone and automatically deduct the discount vouchers from the bill. The current buzz word for this in the retail world is ‘fidgetal’, the combination of finger and digital. The aim of this is the convergence of the physical and e-commerce world, using the smartphone as the ideal binding agent. These types of applications will also prove their usefulness in the public and social profit sectors.”