Digital wallets have been around for some time, but now look likely to become the default virtual payment method of the future. And with good reason, since they offer much more than mobile transactions.

What is a "digital wallet"? As the name implies, this is a wallet used via digital means such as a smartphone, tablet or computer (it can also be called a "mobile wallet"). It is a digital application allowing users to collate all their financial information in one place, from all their bank details and credit and debit card information to loyalty schemes, promotional offers, tickets, personal details and more. It is a genuine wallet with a big bonus – it also offers connectivity and services, anytime and anywhere. And digital wallets have many more benefits besides: they enable faster, contactless payments and easier deposits, and let users keep on top of their spending and manage their day-to-day budgets, etc. And while their popularity is growing thanks to the progress of technology and increasing take-up by both consumers and retailers, the market is still buoyant too.

From PayPal to Apple Pay

The digital revolution is ripping up the payment method rulebook, both in relation to how consumers themselves make payments and the facilities offered by retailers. Digital wallets are certainly part of the pattern in this respect, as one of the tools of the present and the future. Yet the idea is not a new one. In the 1980s, David Chaum had already created DigiCash, a precursor to virtual payment methods. Then in 1998, PayPal emerged as a solution for buyers on eBay, allowing them to simplify the payment process by storing their credit card. This was the first sign of the digital wallet revolution... but despite the launch of Google Wallet in 2011, the next decisive step forward in the process was not until 2014 and the arrival of Apple Pay, closely followed by a series of competitors (Samsung Pay, Android Pay, Visa Checkout, etc.). Even though it wasn’t the runaway success experts predicted, use of digital wallets is continuing to grow.

Creating added value around the transaction

A digital wallet is more than just a means of making payments. Akin to a "digital Swiss Army knife", it allows its owner to centralise all their financial information (and perhaps more) without carrying everything around in their pocket. The result is easier purchases and greater security in comparison with more conventional payment methods, especially through the use of data encryption. But there are also advantages for retailers: these include transaction processes which are faster, more flexible and accessible, which in turn improve the flow of customer in-store journeys and increase conversion rates for online purchases. But that's not all. Digital wallets provide more methods of communication, more targeted and effective customer loyalty incentives, stronger customer relationships, advanced reporting tools and more. A set of benefits which each take their place in a secure ecosystem.

Millennials are in the know

If digital wallets are becoming the norm, it is because every day, mobile payments are gaining ground on the path towards an ever more cashless world. The number of payments made by smartphone has skyrocketed in recent years. According to the German statistics body Statista, mobile transactions have risen from 5.5 million in 2009 to 64 million in 2016 in Europe alone, a rise driven by usage among younger generations in particular. It is estimated that almost 8 in 10 European millennials (digital natives born between 1980 and 2000) use their mobile phones to make financial transactions and manage their savings. Mobility, practicality, immediacy, connectivity, added value and real-time operations are the demands of these consumers, and the digital wallet is riding the crest of the wave in order to become a crucial tool in the lives of these generations. It still remains that in a forever changing world, the payment market is not yet fully mature; dozens of innovative digital solutions, all with their own ecosystems and benefits, continue to abound. The ultimate app is still in the making...

16.12.2024

The digital divide persists

“It's not just the elderly who lack digital skills, young people and workers are also affected,” says Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chair of DigitAll.

Despite the acceleration in digitalisation, many people are being left behind. In Belgium, 40% of the population between the ages of 16 and 74 are at risk of digital exclusion. Although older people are often seen as the most vulnerable group, younger people are also struggling in the digital age. Among young people aged between 16 and 24, almost a third lack basic digital skills, with a peak of 52% among those with a low educational attainment.

Figures that are surprising to say the least, considering young people grow up surrounded by digital tools.

"People often assume that young people are digital natives because they are adept at using social media. But making a TikTok video or scrolling through your Instagram feed doesn't necessarily mean you know how to carry out online banking transactions or complete an application form.

Does poverty play a significant role in the digital divide?

"Absolutely. For 25% of people living in poverty, a smartphone is their only digital device. Although they provide a basic form of access, smartphones are often inadequate for important tasks such as preparing a CV or filing a tax return. Without a computer or a stable internet connection, many digital opportunities remain out of reach for those who don't have access to these tools.

What are the other reasons for this digital divide?

"People often lack the necessary basic digital skills because they never learned them. They may not know how to use a search engine, attach a file to an e-mail, or download an app. Without this knowledge, the digital world becomes inaccessible. Furthermore, there is also the issue of digital stress. Many people worry about making mistakes, being hacked, or their privacy. Some people deliberately choose not to use digital services even though they have the skills. Technology instils a sense of distrust and unrest in them, creating a significant barrier.”

How can companies help close this gap?

"Companies can play a key role on several levels. In addition to being a social problem, digital exclusion is also an economic challenge. Today, less digitally adept individuals are both customers and potential employees. Being aware of this as a company is the most important first step. But it’s also essential to provide support to your staff. For example, employees at the municipal parks and greenery service in Ghent received training on how to file their tax returns online. These kinds of initiatives give people practical skills and confidence. In addition, companies need to do a digital check. To measure is to know. Just because someone uses a laptop daily, it doesn’t mean they have digital skills."

What does BNP Paribas Fortis do specifically to promote digital inclusion?

"We have launched several initiatives. In 2020, we established DigitAll, a platform for sharing knowledge and best practices around digital inclusion. Today, we bring together more than 130 organisations. DigitAll has developed a range of tools, including a checklist that companies can use to test how accessible their apps and websites are. A simple interface can make the difference between joining or dropping out for people who are less digitally adept. Since 2021, the bank has also supported a chair at the VUB that investigates the link between digital inclusion and human rights."

How important are tools in bridging the digital divide?

"User-friendly tools are a must. We have partnered with Emporia, a manufacturer of user-friendly smartphones for the less digitally adept. We pre-install our app for customers who buy one of their smartphones."

We mentioned digital stress earlier. How can you mitigate this?

"With awareness campaigns. We want our customers to use our tools with confidence. The bank also takes its less digitally adept customers into account. Thanks to our partnership with bpost, all our customers can go to their local post office for all basic banking transactions."

Do companies stand to benefit from promoting digital inclusion?

"They do. Digital inclusion requires a sustained effort from all stakeholders, including governments and educational institutions. No one should be left behind. Companies that act now can contribute to a more inclusive society while also securing their own future in an increasingly digital world.”

“Without key digital skills, many digital opportunities remain out of reach.”

“A simple interface can make the difference between joining or dropping out for people who are less digitally adept.”

“Limited digital skills remain an obstacle to closing the digital divide.”

Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chairman of DigitAll

10.06.2024

Electronic invoicing between companies to become mandatory

The bill to introduce this obligation in Belgium has been submitted to the Federal Parliament. If the draft bill is approved, B2B e-invoicing will become mandatory from 1 January 2026. Our experts explain why Belgium wants to introduce these new rules, what the implications are for your company and how we can better support you.

“The bill is consistent with international developments and initiatives at the European level,” says Nicolas De Vijlder, Head of Beyond Banking at BNP Paribas Fortis. "Europe's ambition is a harmonised digital standard. Structured e-invoicing between companies will also reduce the administrative burden of invoicing, enabling companies to work more efficiently and increase their competitiveness. The automation of VAT declarations will also help governments prevent tax fraud and adjust economic policies based on more qualitative data.”

Evolution rather than a revolution

“The new legislation is an evolution rather than a revolution,” adds Erik Breugelmans, Deputy Managing Director at BNP Paribas Factoring Northern Europe. "Digitalisation is becoming pervasive at all levels of society, as we have seen with the increase in electronic payments, as well as the additional obligations in recent years regarding electronic invoicing to the government. In this sense, the bill for mandatory electronic invoicing between companies is a logical next step. Our bank is happy to contribute to this process, although we do not intend to offer the same services as accounting software or fintechs. However, we are happy to help our customers with payments and financing."

The impact on businesses

“Customers need to be aware that the new regulations will have an impact on their internal and external processes,” continues Erik Breugelmans. "The majority of Belgian companies mainly serve an international market, which means that the introduction of electronic invoicing will be more complex for them than for companies operating in the domestic market. As the legislation will be introduced in one go, they need to start preparing now."

“The new rules will affect a company’s accounting department as well as its IT department,” emphasises Nicolas De Vijlder. "The procedural requirements are key, otherwise the automated process will not work. However, one of the main benefits of advanced automation is that everything can be done faster and more efficiently. The time between sending an invoice and paying it will be shorter and cash flows more predictable. In addition, it will also reduce the risk of error and fraud, as all transactions will pass through a secure channel."

Ready to offer you even more and better support

“Thanks to the far-reaching digitisation resulting from the new regulations, we will be able to further optimise payments,” concludes Erik Breugelmans. "As a bank, we need to finance our customers’ receivables as quickly and efficiently as possible, so that they have easier access to their working capital. In addition, because we have already gone through an entire process in terms of large-scale automation, we will be able to adapt quickly to the new rules. We can also draw on the expertise of the BNP Paribas Group, which is currently developing an e-invoicing solution for large companies."

Want to know more?

Listen to the episode on B2B e-invoicing :

06.09.2023

New mobility: driven by technology

Can technology drive the transition towards more sustainable mobility for businesses? See what Philippe Kahn, Mobility Solutions Expert, has to say on the matter.

Now more than ever, businesses need to rethink mobility so that it forms part of the sustainable transition that needs to take place in our societies. Since 1 July 2023, the regulation meaning that company vehicles with combustion engines will no longer be longer tax-deductible by 2026 has started to have an impact. At the same time, Belgium’s Federal Mobility Budget and its recent developments are making this (r)evolution much more concrete and practical. And one thing is for sure: technology – and especially apps – have a key role to play. Philippe Kahn, Mobility Solutions Expert at Arval BNP Paribas Group, explains why.

1 July 2023: a key date

“In the few weeks that have passed since the pivotal date of 1 July 2023, we have already seen a change in the needs expressed by our corporate customers,” says Kahn. "Some of them had already taken practical steps towards sustainable transition. But nowadays, more and more of them also have to address the specific questions and concerns of their employees. How will I be able to use an electric car when I live in a city and have no charging stations available? Do I want to search for a reliable place to charge every day? And am I ready to fundamentally rethink how I get around? Providing a satisfactory answer to these questions is inevitably a priority for employers. As well as the end-to-end management of company electric vehicles – including the question of charging them – more and more companies are starting to rethink their overall mobility policy, analysing all existing alternatives, particularly multimodal solutions. And that’s great news, because it’s essential for their future. So I think the demand for such solutions is only going to grow. Technology, and apps in particular, are key tools for a smooth transition".

Anticipating change to serve companies better

Whereas this issue is only just emerging for many companies, it has been a priority for Arval BNP Paribas Fortis and Philippe Kahn for years. "For more than five years now, we have been anticipating the changes that are now taking place, ensuring that our vision of mobility and expertise go far beyond leasing. We now have an entire department that deals with these matters exclusively. This enables us to meet and even anticipate the needs of companies that have no experience of these issues, and who sometimes feel a little lost when it comes to this revolution in travel.”

A simpler, smoother experience thanks to technology

But why and how is technology playing an important role in this transition to more sustainable business travel? "It’s making the experience of new mobility easier and smoother for its users. And that's where the latest developments in the market are heading," says Kahn. "In fact, that's also what our new Mobility Arval App now offers our corporate customers. It makes it easier for employers to manage the mobility budget established by the federal authorities. This budget, its three pillars and recent developments are crucial factors when a company is rethinking its mobility. But at the same time, it involves some regulatory complexity. That’s why, five years ago, we started developing a whole range of technological tools to help companies deal with these matters. For example, we make it simple for our customers to manage the combination of an electric car and bicycle within this mobility budget. In this spirit of innovation, and aiming to improve the user experience, our app integrates all facets of new business mobility, which are all accessible from a smartphone. Use of public transport, shared mobility, taxis, and even parking – even though this is not one of the pillars of the mobility budget – everything is in one place. The app also makes it easier to manage transactions: low-value mobility transactions, such as buying a bus ticket, are automatically captured and validated, so manual checks are no longer needed. Similarly, there is no longer any need to advance money to employees or reimburse them for anything, and no need for them to keep and present tickets or any other proof of purchase. In short, our app translates the entire mobility budget, which can be pretty complex, into a user-friendly tool where all the important components are taken into account: car, bicycle, scooter, multimodal solutions, public transport, shared mobility, etc."

Technology as a strategy accelerator

Arval Belgium’s innovations perfectly illustrate why technology is an important accelerator when implementing new mobility strategies. And it goes without saying that what exists today will evolve very quickly, leading to an ever-richer user experience. As Philippe Kahn says, "there are a lot of innovative tools out there already. But one of the challenges, linked to the complexity of the situation in Belgium, is to bring together all the players involved under the same umbrella, so that the result of this collaborative work can be found in a single 'magic' app. The solutions that exist today in Belgium are often local in scope. This is a limitation that doesn’t exist in the Netherlands, for example, thanks to their OV card. Belgium’s urban planning realities are also a challenge: outside the major urban centres, it’s less easy to set up mobility hubs in which all modes of travel are accessible."

One thing is certain: for companies, the transition to new forms of mobility is well underway. And the new Arval Belgium app is a valuable tool for those companies. “This technological innovation now makes it possible to mitigate the regulatory complexity for employers, and to make multimodal transport a very fluid experience for employees,” concludes Kahn.

Arval Belgium SA, Ikaroslaan 99, 1930 Zaventem – Registered with the Brussels trade register – Belgian VAT number 0436.781.102. Company with an ancillary insurance brokage business, registered with the Belgian Financial Services and Markets Authority (FSMA) under number 047238 A. Subject to acceptance of your request.

Arval Belgium SA is a subsidiary of BNP Paribas Fortis S.A.

20.12.2021

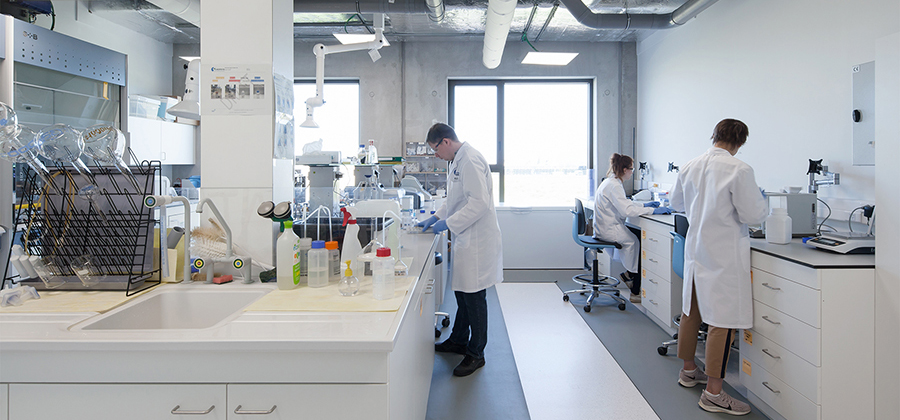

Building a sustainable chemical industry together

As a bank, we promote sustainable entrepreneurship and innovation. Together with BlueChem, the first incubator for sustainable chemistry in Europe, we are taking some important steps in the chemical industry.

In December 2021, BNP Paribas Fortis extended its exclusive partnership with BlueChem for a further three years. A logical step after the successful cooperation over the past years.

BlueChem is the first independent incubator in Europe to focus specifically on innovation and entrepreneurship in sustainable chemistry. It provides legal, administrative and financial support to promising Belgian and international start-ups and ambitious growth companies. BlueChem recently invested in a brand-new building on the Blue Gate site, the new climate-neutral business park in Antwerp. The incubator provides start-ups, SMEs, large companies, research centres and knowledge institutions with fully-equipped and freely-configurable labs, individual offices and flexible workplaces. Tenants include a company that splits CO2 molecules into useful chemicals, a company that develops protein sources for meat substitutes, and a company that extracts chemicals from polluted industrial waste water.

Didier Beauvois, Head of BNP Paribas Fortis Corporate Banking: “We are very proud to be a partner of BlueChem, which, like our bank, feels very strongly about sustainable development and open innovation, which is why we chose to immediately extend our partnership with BlueChem by a further three years. Our aim with these kinds of initiatives is to help companies and industries meet the conditions set out in the European Green Deal, the European Commission’s initiative to make the European Union climate neutral by 2050.”

Sustainable partnership

As a leading bank in Belgium, we believe in taking our responsibility and contributing to the sustainable development of our society, now and in the future. A promise we can continue to deliver thanks to our partnership with BlueChem.

Our primary role within this unique partnership is to share our expertise. The bank has a centre of expertise, the Sustainable Business Competence Centre, which closely monitors innovative, sustainable developments, using this knowledge to support companies in their sustainability transition. We also have a wealth of experience, through our Innovation Hubs, in fine-tuning business plans for start-ups that want to evolve into scale-ups. Making our network available is a second crucial role. We connect with potential clients and investors and identify synergies between start-ups and large companies. Contacts that also offer added value for our Corporate Banking clients.

Barbara Veranneman, Chairman BlueChem NV and Director International Affairs essenscia: “BlueChem partly owes its success to strong strategic partnerships, such as with BNP Paribas Fortis, among others. Our sustainable chemistry incubator is thus able to provide the right facilities in the right place, in addition to specialised, custom services. This access to high-level expertise is definitely an asset, offering start-ups and scale-ups optimal support so they can focus on their core business: bringing sustainable innovations to market."

Why the chemical industry?

The chemical industry is a major contributor to our country’s economy. Antwerp is home to Europe’s largest and the world’s second-largest integrated chemical cluster. We can have a major impact by providing optimal support to start-ups and scale-ups throughout Flanders in terms of innovation and sustainability.

We don't always realise that developments in the chemicals industry impact every aspect of our daily lives: virtually every technological product contains plastics, smartphones are jam-packed with chemical elements, the biodegradable packaging of the products on supermarket shelves, research into new batteries, recycling that involves a great deal of development, etc.

A good example is Triple Helix, an innovative growth company that was one of the first to move to BlueChem and which received support from the bank from the outset. The company is preparing the construction of its ‘SurePure’ recycling plant for polyurethane foam and PET shells, which will be converted into new raw materials, for new applications. Polyurethane is used in mattresses, car seats, insulation panels, etc. But this is just the first step. True to the motto ‘Molecules as a service’, Triple Helix is already planning similar initiatives with glass, stone and wood . Considering waste as a resource creates a huge growth market.

Steven Peleman, Managing Partner Triple Helix Group: “What makes BNP Paribas Fortis such a valuable partner is that it can bring the right parties to the table, essentially becoming a lever on the pathway to a more sustainable industry. It’s not just the financial aspect. The bank also looks for strategic partners, helps us to strengthen our credibility, and brings in potential investors. A bank that looks beyond purely financial considerations can create tremendous added value for us.”

Sustainability and innovation in the chemical Industry

Innovation in chemistry is the key to overcoming our planet's sustainability challenges. The chemicals industry develops crucial innovations and products to successfully address climate change, even though it is not traditionally considered a 'greener’ industry. There are several opportunities: better recycling techniques to extract sustainable metals from waste, biodegradable plastics, the replacement of certain substances in existing materials, or the greening of a chemical production process. Moreover, innovation is not an easy feat in the chemical industry. It takes a lot of time, guts and money to scale up from a lab setting to industrial-scale production.

European Green deal

All these efforts to increase sustainability are part of an EU-wide initiative. The European Green Deal is a set of policy initiatives by the European Commission to make the European Union climate neutral by 2050. It proposes to achieve this by drastically reducing CO2 emissions and by immediately absorbing or offsetting any remaining carbon emissions in Europe by 2050, for example by planting forests or with new technology. This would make Europe the first climate-neutral continent in the world. An ambition that we, as a bank, are more than happy to lend our support! And what about you as a company?

Would you like to know more about how we promote sustainability and open innovation or do you require support for your transition to a more sustainable business model? Discuss this with your relationship manager or the experts of our Sustainable Business Competence Centre.