Although entrepreneurs are familiar with the term working capital, all too often they fail to use its full potential. This is a mistake, because targeted management of their working capital needs can bring huge advantages, both financially and at an organisational level.

How a business approaches that in practice is obviously closely linked to its own specific situation and the sector in which it operates. Below is a number of general rules of thumb:

1. Analyse your business processes

A logical first step is a thorough analysis of your working capital needs, based on the cash conversion cycle. The idea is to clearly identify the following business processes:

- management of your customer payments

How long does it take before your invoices are paid? Why do some invoices remain outstanding? How aware are you of your customers' financial situations? - management of your supplier payments

What payment terms are you getting? Do you get a discount if you pay quickly? Do you use advance financing? - management of your production and stock

How far can you deplete stocks without jeopardising production? Can you shorten the production time in order to reduce the amount of work in progress? Do you work according to the Just-in-Time system or have you decided to go for Economic Order Quantity?

You will then find out where there is room for improvement and how you can shorten the cash conversion cycle. The idea is to reduce your working capital needs and, by doing so – by dealing more frugally with the available capital – increase the return from your general management.

2. Collect faster and better

Adequate monitoring of your accounts receivable is crucial. Relatively small, obvious interventions can sometimes produce a surprisingly big benefit. Here are some tips:

- Monitor the quality of your invoices. A good invoice will quote a correct amount, a payment due date and will be received promptly by your customers.

- Invoice smaller amounts on a regular basis and avoid summary invoices where possible.

- Actively follow up outstanding invoices and find out why they remain unpaid. Is it down to the customer's financial situation or are there other factors to consider? Disagreement over the amount charged or problems with the delivery or sale often cause delays or result in non-payment. By aligning your accounts and services more efficiently, you end up with a win-win situation: satisfied customers and fewer disputed invoices.

- Solutions such as factoring or direct debit are a particularly profitable route to take. These lead to swifter collection without putting pressure on your customers or tightening up your payment terms, which is always delicate in a commercial relationship.

A clear picture

Without an overview of your accounts at home and abroad and of your incoming and outgoing payments, management of your working capital is virtually impossible. So, you need clear, immediately available information and reporting. Different solutions for electronic banking, reporting arrangements with your financial partners and efficient operation of your accounts and bookkeeping will help you considerably here.

Another profitable route is the centralisation of your cash and cash equivalents, which will dramatically simplify both the management and monitoring of these. Often this also offers numerous options in terms of fiscal optimisation.

3. Make optimum use of your supplier credit

Making sure your invoices are paid systematically in order to build up your number of days' supplier credit seems a painless and effective intervention, but it is the least you should do. After all, there is a good chance that the supplier will pass on the charge for the longer payment term in the price you pay for subsequent deliveries. There are a number of better alternatives:

- See whether or not it would benefit you to pay more quickly – in many cases early payment carries an attractive discount.

- Choose solutions that let you pay later without the other party being affected. For example, by relying on lines of credit or working via reverse factoring, whereby the supplier receives an advance on your payments from the bank.

- Negotiate with your supplier for an extension to your payment terms.

Ensure you have adequate protection

Being able to get hold of your funds quickly is just one aspect of optimum management of your working capital. Another is the assurance that your customers will actually pay, while at the same time your business must project confidence to (potential) trade partners. To that end, you can call on the various forms of documentary credit. By engaging credit insurers, you are also hedging the risk of the other party defaulting on payment.

Another important factor, certainly as far as international transactions are concerned, is the exchange rate risk. Although you may know when you are going to get paid, the exact amount depends on the exchange rate at the time of payment. Because the difference between a good and a less favourable exchange rate can have a big effect on your margin, you are better off hedging yourself against possible exchange rate fluctuations.

4. Get maximum performance from your stocks

The financial impact of your inventory control should not be underestimated. Just think about invoices that are outstanding after a faulty or late delivery, or holding on to too much stock of slow-selling products. The advantage of the latter is that you can always deliver promptly, but it does freeze a major part of your working capital. A few guidelines:

- Check your stocks and prices regularly, preferably using a package like Enterprise Resource Planning (ERP) or a web-based application with direct link to your opposite parties.

- A warehouse management system will allow you to retain a good overview of your quick and slow-selling products, so you can adjust your stock accordingly.

- Keep your finger on the pulse of the market so that you can correctly assess demand, and thus avoid stock surpluses or deficits.

- You can also choose a radically different course and outsource your stock management to a logistics service provider.

- Use stock financing to keep cash and cash equivalents available for other purposes.

- Hedge yourself against price fluctuations on the raw materials markets, to protect your margin.

An exercise in balance

Optimising your working capital needs is therefore a continual exercise in balance between your accounts receivable, accounts payable and inventory control. It is a stiff challenge, but essential if you are to increase your financial might and steal the march on your competitors. Get your working capital to perform!

12.09.2018

Working capital: far more than just an accounting term

Working capital, also known as net operating capital, presents a picture of the operational liquidity of a business. But there is more to it than meets the eye.

The success of a business actually depends to a significant extent on how it deals with its working capital needs.

The difference between working capital and working capital needs

Within the financial analysis, working capital is just one of the indicators that present a picture of the operational liquidity of a business. It not only affects general management, but also the access to bank credit or the valuation of the business, for example. This is calculated as follows:

Equity capital and other resources in the long term - fixed assets

This allows you to see whether sufficient long-term funds are available to finance the production chain. Where there is a positive result that is indeed the case, whereas with a negative result it is actually the production chain that must safeguard the long-term financing.

It is therefore useful to calculate the working capital needs as well:

Current assets (excluding cash) - current liabilities (excluding financial liabilities)

The result shows the amount the business needs in order to finance its production chain, and may be both positive and negative:

- where working capital needs are positive, the commercial debts no longer cover the short-term assets (excluding the financial). In that case, a business can rely on its working capital. If this is insufficient, it will need additional financing for its operational cycle in the short term;

- where working capital needs are negative, a business can meet its short-term liabilities without any problem. Nevertheless, it is advisable to reduce working capital needs (further).

In short, working capital presents a picture of the operational liquidity of a business, whereas working capital needs represent the amount the business needs in order to finance its production chain.

In other words, it boils down to limiting working capital needs as far as possible, thus increasing liquidity. This is crucial, especially in times of economic or financial difficulty. After all, customers tend to pay later then, while your stocks are increasing and your suppliers are imposing stricter payment terms. As a result, more and more working capital gets 'frozen' in your operating cycle, precisely when circumstances make it more difficult to attract additional financing.

Conclusion

Optimising working capital is not only a question of long-term considerations. In the short term, too, the business can release cash that is not being used optimally, or is being used unnecessarily, more specifically in the purchasing, production and sales processes within the operating cycle.

The working capital and the working capital needs must, above all, be geared effectively to each other. The working capital needs must be structurally less than the working capital itself, preferably with an extra buffer. However, there is no mathematical truth regarding the amount of working capital and working capital needs. Sector, activity and business model can affect this, for example.

18.01.2016

The cash conversion cycle reviewed

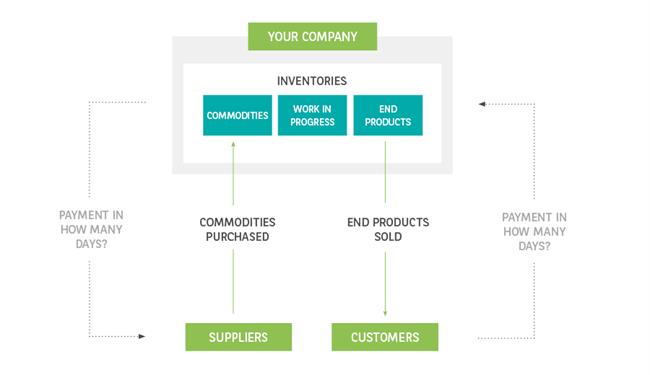

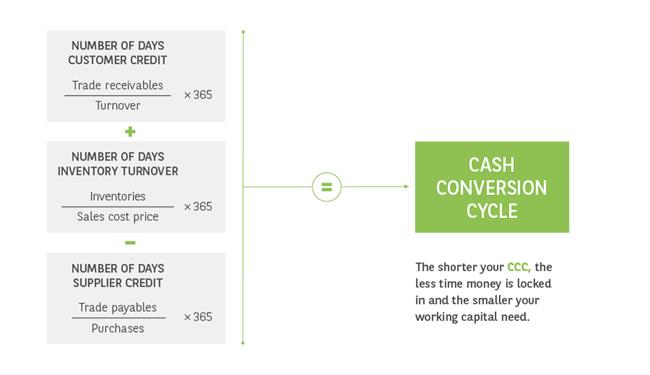

A good barometer of how great the demands of your operating cycle are on your working capital is the 'cash conversion cycle'. This is expressed in number of days and shows how long money is tied up in your business's purchasing, production and sales processes.

The calculation of the cash conversion cycle is based on:

- the number of days' customer credit (DSO – Days Sales Outstanding):

the average number of days that your business must wait for payment after a product or service is delivered. - the number of days' stock rotation (DIO – Days Inventory Outstanding):

the average number of days that your business needs to convert stock into a sale. - the number of days' supplier credit (DPO – Days Payable Outstanding):

the average number of days that your business needs to pay suppliers.

The shorter the cycle, the less capital is held in the business process, which allows you to meet your short-term liabilities and expand your activities.

Simplified presentation of the cash conversion cycle

07.11.2024

BNP Paribas Fortis Factor: the oxygen to your growth story

Factoring is playing an increasingly important role in promoting the growth of Belgian and international companies. BNP Paribas Fortis Factor provides the oxygen to their growth story.

You want your business to grow and thrive, and so all the help and guidance you can get are more than welcome. The reason is clear: support brings extra energy to your entrepreneurial spirit and essential resources to fuel your innovative growth plans.

BNP Paribas Fortis Factor, a subsidiary of BNP Paribas Fortis, offers a service designed precisely for that: to relieve stress and motivate, to promote and nurture your growth. In this interview, Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, and Audrey Bourguet, Working Capital Advisor at BNP Paribas Fortis Corporate Banking, come together to discuss one key topic: Factoring and the positive role it can play for Belgian businesses and their international branches.

Explaining factoring succinctly, however, is a challenge. Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, clarifies: “To start with, factoring is a means, not an end. It’s a tool for business owners or CFOs to optimise working capital. Every financial manager, in any company, will at some point ask the same question: ‘Who do I need to pay, when, and how can I pay them with the resources I have?’ Simply put, factoring enables businesses to pay suppliers without waiting for customer payments to come in. We finance invoices by converting them into directly available cash for the business.”

This process actively alleviates concerns and reduces stress factors, allowing entrepreneurs to focus on what they do best – running their business. Ramaekers adds, “We like to say ‘giving oxygen to growth stories.’ But I certainly see the value in the term ‘relieving stress’ here. By giving an entrepreneur or CFO the freedom to focus on core activities and by taking on a key part of the financial management, we create extra time and opportunities. And they also have less to worry about."

Positive shift

According to Ramaekers, the traditionally negative perception of factoring is a thing of the past: “Factoring was once seen by many business leaders as a ‘lender of last-resort’ – a way to borrow money from the bank by using assets, receivables, or customer invoices. In other words, a company’s last resort. Fortunately, those days are long behind us. We’ve evolved towards a very open attitude to factoring, allowing our division to grow into a true service provider. Our clients’ primary need remains short-term financing. Today, one in five invoices in our country is paid through factoring. Factoring is now a substantial market, representing more than one hundred billion euros per year. BNP Paribas Fortis Factor manages 41 per cent of this market, accounting for EUR 55 billion at the end of 2023.

Growth

From the bank’s perspective, factoring also represents a significant growth story. Audrey Bourguet, Working Capital Advisor at Transaction Banking for BNP Paribas Fortis, explains: “Today, factoring is the financial product that nicely aligns with the rising turnover of our companies. It provides a practical solution for working capital and is part of a suite of Transaction Banking services. In addition to Factor, this also includes Global Trade Solutions, Cash Management, Fixed Income, and Working Capital Advisory. All these services share a common goal: provide the best possible solution for our clients’ financial needs and be there for them in all situations where they can benefit from our support.”

Factoring, from the bank’s standpoint, represents an increasingly strong and positive story, unlinked from its past connotations. Bourguet adds, “You can see this in how we truly integrate factoring within our bank and the group, and in how we offer this service to businesses across all sectors and sizes. We work with a wide range of companies in the Belgian economy. As a result, we have seen that it is precisely those companies that succeed in optimising the funding of their working capital by making use of our factoring services, among other things. This reinforces our belief that it is a very positive story: we’re talking about a form of financing that seamlessly adapts to the growth of any business, large or small.”

Natural evolution

Factoring is available to small, medium-sized, and large companies alike. Ramaekers says, “We aim to provide a solution that supports businesses throughout their entire lifecycle – we’re genuinely unique in the market in this regard. This means that we are there for start-ups, SMEs, multinationals, and every type of business in between. We are the only bank on the market to have a digital solution for small businesses in the form of Easy2Cash. This digitalisation makes it a very cost-effective option with highly competitive margins, but also a reliable, particularly fast and up-to-date link with our customers and their accounting, using a digital yet personal approach. Although Easy2Cash is digital, it includes a dedicated contact person, making the solution both personal and accessible. For start-ups, for example, it’s often challenging to secure credit. For these modest, short-term credit needs, we provide a solution in consultation with the BNP Paribas Fortis banker, enabling them to keep growing without being hindered by their expanding requirements for financing, automation, accounting, etc. Factoring gives them additional resources to meet these needs.”

Ramaekers notes that the steady growth of young companies also demands an adaptation of financial services: “It’s a natural evolution that benefits both partners. If your business grows, we grow with you – it’s that simple. During all those specific growth moments – when entrepreneurs start considering additional staff or potential exports – factoring grows with them. And we do this together with the bank; the group behind this story plays as a team. And let’s not forget, we’re here even if more challenging times come. We’re well aware that a company’s journey is not always easy. It’s at those moments that the value of our expertise and the support we provide really stands out.”

When a company grows into a large enterprise with the profile of a multinational, the importance of factoring further increases. Ramaekers says, "More than 65% of the really large companies in Belgium, with a turnover of more than EUR 1 billion, use factoring services. And half of them are our customers. Factoring often provides additional economies of scale for large enterprises. For example, we can finance receivables that have no impact on a company’s debt ratio. By combining invoice pre-financing with credit insurance, companies can avoid having debt on their balance sheet, with the approval of the company auditor. It’s a technical matter, but it is this combination of various financial elements that makes factoring efficient, high-performing and valuable for many companies.”

Economic fabric

The two agree on the value of factoring in supporting the economic fabric. Bourguet explains, “Part of this supportive role is due to the fact that factoring is a completely transparent financial service – you can only finance what is effectively there.” Ramaekers adds, “Absolutely. Plus, factoring sits right in the middle of the value chain, embedded in the economic fabric. We work alongside our clients, their customers (debtors), the bank, and so on. This makes us a key figure in this chain. We coordinate and facilitate. And for this we need to have our feet firmly planted on economic ground, often for the benefit of all our customers. When we succeed in, for example, reducing the payment terms of invoices for a business, it has a positive ripple effect not only for that company but for the economic process as a whole. This is why I am convinced that we play a broad role in the economic ecosystem – often broader than is generally perceived.”

Opportunities and fair guidance are also crucial in this financial field. Ramaekers says, “At Factor, we engage in transparent discussions with the bank and our clients to find the best solution for their needs. This means we identify opportunities and often suggest them, but also act as an honest, proactive sounding board. It’s about dialogue, analysis, and constructive critique.” Bourguet concurs: “I completely agree. With a service like factoring, we are deeply involved in our clients’ economic activity – the entrepreneurs who rely on us. So, we take a broad view of every case, looking beyond just a banking product or a single solution. This is what makes BNP Paribas Fortis’s approach so strong: we operate as a team, consisting of specialists from both Factor and the bank. This group of experts from different, well-coordinated entities provides entrepreneurs and companies with a comprehensive approach, even for complex cases. These are the moments when we truly rely on our internal expertise: years of experience; colleagues with solid knowledge; reliable economic data applicable to numerous scenarios. This combination enables us not only to guide companies in the right direction but also to provide financial support that is fair, safe, and sound.”

Future

Just like the bank itself, BNP Paribas Fortis Factor frequently considers its strategic direction for the future. As a provider of forward-thinking services, it’s essential to adopt a future-oriented approach to financial services. Ramaekers notes, “Earlier, I mentioned our digital solution, Easy2Cash. I think we can be quite proud of this because it is a glimpse into the future – today. Beyond that, our services are evolving very organically towards the future: we’re constantly striving to make them accessible to an ever-wider group of clients across the economic landscape. Additionally, we’re very focused on sustainability.”

Bourguet adds, “This last aspect is a natural extension of what we do at the bank every day. Our commitment to sustainability extends seamlessly to factoring: we encourage and motivate our clients to join us on this sustainable path.”

The two teams also collaborate closely in developing new services. Ramaekers explains, “We see a significant evolution in the commercial sector, with many online stores offering deferred payment options, such as a 30-day extension. This practice is also increasingly common in the B2B market. Factoring can innovate in this area, so we see it as part of the future we’re actively developing. From a European perspective, there are other innovations too: e-invoicing, for example, is soon to become the standard for all businesses. This presents both a challenge and an opportunity in terms of services and advisory, which we’re shaping together with the bank.”

The two partners have also developed new services. Ramaekers: "We have observed a remarkable evolution in the commercial sector, where many online stores offer payment delays of 30 days, for example. This practice is also increasingly common in the B2B market. Factoring can offer an innovative solution, so this is part of the future that we are currently developing. On the European level, there are also new features: e-invoicing will soon become the norm for all companies. This presents both a challenge and an opportunity in terms of services and advice, which we are developing together with the bank."

Bourguet concludes, “It’s clear that this is a story of synergy, one where we work together seamlessly. This isn’t just rewarding for us but also for our clients. We’re rooted in the heart of the economic marketplace, yet we’re also focused on creating platforms and products that will lead the way and shape the future of this market.”

More information: https://factor.bnpparibasfortis.be/

10.06.2024

Electronic invoicing between companies to become mandatory

The bill to introduce this obligation in Belgium has been submitted to the Federal Parliament. If the draft bill is approved, B2B e-invoicing will become mandatory from 1 January 2026. Our experts explain why Belgium wants to introduce these new rules, what the implications are for your company and how we can better support you.

“The bill is consistent with international developments and initiatives at the European level,” says Nicolas De Vijlder, Head of Beyond Banking at BNP Paribas Fortis. "Europe's ambition is a harmonised digital standard. Structured e-invoicing between companies will also reduce the administrative burden of invoicing, enabling companies to work more efficiently and increase their competitiveness. The automation of VAT declarations will also help governments prevent tax fraud and adjust economic policies based on more qualitative data.”

Evolution rather than a revolution

“The new legislation is an evolution rather than a revolution,” adds Erik Breugelmans, Deputy Managing Director at BNP Paribas Factoring Northern Europe. "Digitalisation is becoming pervasive at all levels of society, as we have seen with the increase in electronic payments, as well as the additional obligations in recent years regarding electronic invoicing to the government. In this sense, the bill for mandatory electronic invoicing between companies is a logical next step. Our bank is happy to contribute to this process, although we do not intend to offer the same services as accounting software or fintechs. However, we are happy to help our customers with payments and financing."

The impact on businesses

“Customers need to be aware that the new regulations will have an impact on their internal and external processes,” continues Erik Breugelmans. "The majority of Belgian companies mainly serve an international market, which means that the introduction of electronic invoicing will be more complex for them than for companies operating in the domestic market. As the legislation will be introduced in one go, they need to start preparing now."

“The new rules will affect a company’s accounting department as well as its IT department,” emphasises Nicolas De Vijlder. "The procedural requirements are key, otherwise the automated process will not work. However, one of the main benefits of advanced automation is that everything can be done faster and more efficiently. The time between sending an invoice and paying it will be shorter and cash flows more predictable. In addition, it will also reduce the risk of error and fraud, as all transactions will pass through a secure channel."

Ready to offer you even more and better support

“Thanks to the far-reaching digitisation resulting from the new regulations, we will be able to further optimise payments,” concludes Erik Breugelmans. "As a bank, we need to finance our customers’ receivables as quickly and efficiently as possible, so that they have easier access to their working capital. In addition, because we have already gone through an entire process in terms of large-scale automation, we will be able to adapt quickly to the new rules. We can also draw on the expertise of the BNP Paribas Group, which is currently developing an e-invoicing solution for large companies."

Want to know more?

Listen to the episode on B2B e-invoicing :