Since 1 April 2009, the Belgian Business Continuity Act (WCO/LCE) has replaced the Judicial Composition Act. It offers companies experiencing temporary financial difficulties the opportunity to continue their activities or to transfer them fully or partially, thereby maintaining jobs.

Specifically, a company with WCO/LCE status is temporarily protected against its creditors. This gives them breathing space to make it through the following months and to safeguard their continued existence.

The Belgian Business Act in practice

One of the main advantages of the WCO/LCE is its low threshold. A company can rely on the WCO/LCE if:

- its continued existence is under threat;

- a realistic recovery plan or a transfer scenario would safeguard all or part of the company's economic activity and jobs;

- it can continue to operate during the period of protection, provided it can repay its current debts.

If the company meets these criteria it has two options for a solution:

- Legal procedure

The company must submit an application for legal restructuring with the commercial court. - Out-of-court procedure

The company tries to come to an amicable settlement with at least two creditors without court intervention.

Whether this will actually lead to a solution is difficult to predict. Each case is different – it all depends on the creditors and the feasibility of restructuring.

Amendment

A couple of years after the introduction of the law it was clear that it was not producing the desired outcome. There are various reasons for this:

- compared to the number of bankruptcies, the number of WCO/LCE applications remained limited;

- business continuity was only guaranteed in around 30% of cases. This figure is skewed, however, as some bankruptcies only concern non-profitable activities; the healthy business activities were rescued under the WCO/LCE. Often, the cause of failure is late application or an unrealistic recovery plan;

- this procedure sometimes lead to abuse, such as applying reduced prices for the sale of assets or unsavoury commercial practices during the period of protection;

- a significant snowball effect, where customers or suppliers of companies with WCO/LCE status ran into difficulties themselves.

For this reason the WCO/LCE was amended by act of 27 May 2013 which came into force on 1 August 2013. The amended act removes grey areas and better informs creditors, thus increasing the chance of success of legal restructuring.

15.02.2016

Which procedures are allowed under the Belgian Business Act?

The Belgian Business Act (WCO/LCE) covers a particularly wide spectrum. We will discuss the different options and their pros and cons in further detail.

The legal procedure

In this case the company starts a legal procedure so that the court can facilitate a smooth rescue and recovery process.

How does this work in practice?

The company must submit an application for legal restructuring with the commercial court. It must also provide a clear picture of its financial situation based on its balance sheet, annual accounts and accounting.

- If the court approves the application, the company is protected against its creditors for a maximum of 6 months (this can be extended to 18 months under certain conditions). Specifically, this means that:

- the company temporarily does not have to pay its current creditors, although it is free to decide to do so nevertheless – on condition that continuity demands this;

- its movable property or land and buildings cannot be attached;

- it is not possible to declare the company bankrupt, dissolve it or liquidate it.

- If the court rejects the application, the company has 8 days in which to lodge an appeal. It remains protected against its creditors until the decision on appeal.

Useful information: the protection against creditors is already effective at the time the court reviews the application.

Three portals

There are three types of legal restructuring, also known as 'portals':

Amicable settlement

The company can try to come to an amicable settlement with at least two creditors under the court's supervision.

Advantages

- The managing director or owner retains power of decision, as the court only fulfils a supervisory and monitoring role.

- The court can impose 'moderate payment terms' on the creditors if they show little flexibility, thus forcing them to grant the company deferred payment terms.

Disadvantages

- Whether a settlement can be reached depends on the goodwill of the creditors.

- The company only enjoys legal protection, not economic protection. By publishing its WCO/LCE status in the Belgian Official Gazette, the company risks reputation damage or a (permanent) breach of confidence with its customers and suppliers.

- The company must notify its employees of the procedure, which may lead to unrest.

Collective composition

A company that opts for this procedure will try to come to a composition with all its creditors under the court's supervision. This is done on the basis of a recovery plan and an arrangement for outstanding debts that can be partially cancelled.

Since the amendment of the WCO/LCE each creditor must, in principle, be paid at least 15% of their outstanding debt through the recovery plan.

Once a majority of creditors has voted in favour of the composition and the court has approved this, it becomes binding on all parties – and therefore also on any non-preferential creditors who did not vote on the recovery plan and debt rescheduling.

Advantages

- The managing director or owner retains the power of decision and control over the company.

- The company has five years in which to complete the recovery plan.

- Even if it concerns a collective composition, it is possible to come to individual arrangements with each creditor or group of creditors.

- Creditors who are difficult to convince may be obliged to respect the composition through a vote – on condition of course that there is a majority.

Disadvantages

- The result of this type of vote is sometimes difficult to predict, especially if not all creditors turn up.

- The company only enjoys legal protection, not economic protection. By publishing its WCO/LCE status in the Belgian Official Gazette, the company risks reputation damage or a (permanent) breach of confidence with its customers and suppliers.

- The company must notify its employees of the procedure, which may lead to unrest.

Transfer of activities

This option is intended to protect the company's viable activities and to apply for liquidation or bankruptcy for the remaining activities. This can be done optionally at the request of the company, but also mandatorily, for instance if the conditions for bankruptcy are met or if the creditors and/or the court do not approve the recovery plan.

Specifically the company will, under the court's supervision, try to reach a composition for full or partial transfer of its activities. Once a bidder has been found, the court will decide if the bid and the arrangement for creditors is fair and acceptable.

Advantage

- The company can rescue all or part of its activities without having to go bankrupt first.

Disadvantage

- A legal representative must supervise the transfer, which means that the managing director or owner no longer has (sole) power of decision.

How much does the legal procedure cost?

Because the WCO/LCE procedure has to remain as accessible as possible, the legal costs are limited. Since 2013, however, the applicant must pay a fee of EUR 1,000. There are also some other minor costs, such as publication in the Belgian Official Gazette. In some cases there are also administrative costs, e.g. sending registered letters.

There are, however, indirect costs as well in that the company has to spend a lot of commercial time on preparing and implementing the procedure, or has to call in external advisers. Restructuring can also require a substantial budget.

The out-of-court procedure

The company can try to come to an amicable settlement with at least two creditors without having to involve the court.

The parties involved decide mutually and freely how to make the company financially sound again. The composition is only binding on the creditors who have taken part in the negotiations.

Advantages

- The company itself chooses the creditors with which it wishes to negotiate.

- The composition is not published, only filed with the court registry. The risk of reputation damage is therefore much smaller than with a legal procedure.

- No court costs.

- No court intervention.

- This is attractive for creditors, as a legal procedure or failure entails the risk of having their claims frozen or remitted.

Disadvantage

- The negotiating creditors have full control of the process. The court cannot oblige them to grant a postponement of payment or waive part of their claims.

How much does the out-of-court procedure cost?

Obviously there are no court costs as no legal procedure will be started. However, the negotiations require a substantial time investment on the part of the company, and sometimes external advisers must be paid.

Depending on what is agreed on with the creditors, the restructuring phase can incur significant costs, especially if it concerns a thorough restructuring.

15.02.2016

The Belgian Business Act: FAQ

What impact and practical consequences does the WCO/LCE status of a customer or supplier have on your activities? 14 practical questions and answers.

Although the Belgian Business Act (WCO/LCE) is expressly intended to support economic activity, it can come as a shock when one of your customers or suppliers applies for WCO/LCE status. But is this justified? We will deal with this in greater detail in the FAQs listed below.

The basics

- How do I know if a company with which I do business has applied for WCO/LCE status?

- I am a creditor in a WCO/LCE procedure. Should I engage a lawyer?

- Do I have a say in the recovery plan of a company with WCO/LCE status?

- How can my vote influence the recovery plan or debt settlement?

- What will the bank do if a corporate customer applies for WCO/LCE status?

- Are there alternatives to the WCO/LCE?

- Where can I find further information and support?

You are a supplier and your customer applies for WCO/LCE status

- Can I terminate a long-term contract with my customer if they apply for WCO/LCE status during the term of the contract?

- Supplying to a customer with WCO/LCE status entails certain risks. Can I ask for payment in cash to hedge the risk?

- Can I repossess goods not yet paid for but already delivered to my customer?

- Does my credit insurance also cover claims on companies with WCO/LCE status?

- Can I record receivables on a customer with WCO/LCE status as a tax deductible depreciation?

You are a customer and your supplier applies for WCO/LCE status

- Should my supplier continue to supply to me, even if they have applied for WCO/LCE?

- Is it advisable to continue to do business with this supplier during the WCO/LCE procedure?

How do I know if a company I do business with has applied for WCO/LCE status?

A company with WCO/LCE status is not legally obliged to notify its customers or suppliers who are not creditors of the WCO/LCE application, although it may voluntarily do so.

Its duty of information to suppliers who are creditors depends on the selected WCO/LCE procedure:

- in the case of a legal procedure the company must, in principle, notify all its creditors;

- in the case of an out-of-court procedure the company itself chooses with whom it will negotiate, and therefore whom it will notify.

Each WCO/LCE application conducted according to this procedure automatically appears in the appendices to the Belgian Official Gazette. Shortly after publication the Central Company Register also lists this information.

In some cases the media will also report on the WCO/LCE procedure or the news may spread locally.

I am a creditor in a WCO/LCE procedure. Should I engage a lawyer?

This depends on a number of factors, such as other ongoing procedures or the outstanding amount. If the company with WCO/LCE status only owes you a small amount, you should of course assess whether calling in a lawyer will not be more expensive.

Your status as a creditor is more important, especially if the company opts for a collective composition with a recovery plan. A distinction is made in this procedure between:

preferential creditors

These are, for example, creditors who have a retention of title clause in their general or special terms and conditions – in most cases suppliers – or parties like banks or other financing institutions that have a mortgage, try charge on business assets or a simple pledge.

Their preferential status means that these creditors can never be obliged to allow more than 24 (or, exceptionally, 36) months' deferred payment terms, unless they agree to a deferral of this period.

In order to enforce your rights, it is essential that your status as a preferential creditor is recognised. This may require the intervention of a lawyer.

This is usually a responsive measure after you have been formally notified of your status as a creditor in a WCO/LCE procedure – for instance if it appears that the amount of your claim is incorrect or that some debts are not recognised as preferential.

However, you can also take pro-active measures, for instance by notifying the company with WCO/LCE status about your claims on the company and which of these are preferential. This allows the company to take this into account when preparing the recovery plan.

non-preferential creditors

If you do not have a preferential status as a creditor and the limitations on deferred payment terms do not apply to you, it may be less advantageous to engage a lawyer. In this case you will have to await the decision of the preferential creditors, who are usually in the majority.

Do I have a say in the recovery plan of a company with WCO/LCE status?

In principle, as a creditor you have no say in the elaboration of the recovery plan. The company with WCO/LCE status takes care of this, usually with the help of external advisers. In the amended Act, which came into force on 1 August 2013, the intervention of an accountant or bookkeeper is in fact mandatory.

The company applying for WCO/LCE status has a lot of freedom when preparing the plan. It must, nevertheless, abide by a number of rules and deadlines, such as the maximum postponement of payment for preferential creditors (see question 2) and, since amendment of the act, repayment of at least 15% of each creditor's claim.

Moreover, the company has to come to a composition with as many parties as possible; else the chance of the plan being approved remains small. As a creditor, you can try to influence the recovery plan to a certain degree, for instance by imposing a number of conditions on your approval of the plan.

Once the creditors have approved the recovery plan and the court has approved their decision, it becomes final. You can contest it if it constitutes 'unfair treatment', for instance if a creditor with a similar claim is able to recover a much larger part of their claim than you without a clearly demonstrable or objective reason. If the recovery plan is not complied with, the court may be petitioned to terminate it prematurely.

How can my vote influence the recovery plan or debt settlement?

The vote is conducted through a double majority system. First it is established which creditors have voted – creditors who have not voted obviously cannot influence the decision.

If a majority of the creditors present vote in favour of the recovery plan or the composition, the weight of their claims is then established: the majority that voted in favour must represent at least half of the outstanding debts.

In brief: the higher your claim, the greater your say.

What will the bank do if a corporate customer applies for WCO/LCE status?

It is in the bank's interest to help safeguard the continuity of the company, as the bank is usually one of the main creditors. Moreover the WCO/LCE is, in itself, not a legal reason for terminating an existing contract.

The bank therefore does not automatically freeze the accounts of the company or cancel its credit facilities, except if the procedure is abused or if the risks can no longer be justified. Payments can therefore continue as usual, which benefits the company's normal operations and chances of survival.

The bank places the company in a special 'regime' where it is carefully monitored. Because the WCO/LCE procedure freezes the company's current debts, the bank's possibilities to actively seek a solution are limited (see question 6).

Are there alternatives to the WCO/LCE?

In most cases there are, but on condition that a company in difficulty raises the alarm in a timely manner and communicates transparently on its financial situation. Often a company's financial health at the start of the procedure has already been considerably affected, which means that the period of protection is, effectively, only a postponement of bankruptcy.

It is therefore essential for a company whose financial position is worsening to notify its main creditors, and the sooner this is done, the greater the chance of a positive outcome. After all, creditors have no interest in a potential bankruptcy and will therefore seek an adequate and balanced solution together with the company.

If the creditor is a bank, it can deploy experts specialised in assisting companies facing difficulties, regardless of the branch of industry. These teams have a wealth of experience in problem analysis and financial restructuring. By involving them in the process from the start, things can be prevented from taking a turn for the worse.

Another advantage of a bilateral composition with the bank, or other creditors, is discretion. Often, reputation damage as a result of the WCO/LCE procedure – and the associated economic damage – can be the final blow for a company which was, essentially, still viable.

As with the WCO/LCE, success depends on the recovery plan. Not only should the company present a realistic business or restructuring plan, it should also commit fully to this plan. Experience shows that a balanced approach by shareholders and the bank working together considerably increases the chances of a successful turnaround!

In some cases, such as when a company's product or service has reached the end of its life or the market for it has disappeared, there will of course be little the experts can do. This will also be the case where the management or shareholders no longer wish to invest any further money or effort, or no longer believe in the company's survival.

Where can I find additional information and support?

Depending on the Region where your company operates, you can contact several organisations:

- Flanders: Enterprise Flanders – Tussenstap (for non-profit organisation)

- Brussels: Centrum voor Ondernemingen in Moeilijkheden (Centre for companies in difficulty)

- Walloon region: Centre pour Entreprises en difficulté

Also, please do not hesitate to contact your relationship manager.

Can I terminate a long-term contract with my customer if they apply for WCO/LCE status during the term of the contract?

During the WCO/LCE period, existing contracts will continue to apply so that the company can continue its activities, which means you remain bound to your contractual obligations: if a customer who has applied for WCO/LCE asks you to supply, you must in principle comply.

There is nothing to stop you from requesting cash payment for transactions that take place during the period of protection. After all, the protection only applies to existing debts on starting the procedure and not to 'new' debts, even if they arise from existing contracts.

Besides your obligations, your contractual rights also remain intact. If your customer fails to pay for a new delivery and thus fails to meet its obligations – which is not very promising for the company's chances of survival – you can terminate the contract.

Supplying to a customer with WCO/LCE status entails certain risks. Am I protected against these risks?

The best way to hedge risks is to help ensure that your customer completes the WCO/LCE procedure successfully and can restart. It is therefore important to find the right balance between continuity, i.e. continuing to supply goods or services so that your customer can continue business, and risk management.

A good form of protection is to adapt your payment terms, for instance by demanding payment in cash (see question 8).

Is your customer unable to pay in cash but you want to give it a chance to survive by enabling it to continue to supply? In that case the legislator offers additional protection for your claims that arise after the WCO/LCE procedure has started. These are given the special status of 'estate debts'; should the company become bankrupt, these debts have precedence over other, non-preferential creditors. This increases the chance that you can recuperate all or part of these debts.

It is therefore important to keep track of the unpaid claims that arose before the WCO/LCE procedure was started and those that arose subsequently.

Can I repossess goods not yet paid for but already delivered to my customer?

That depends on the time when the goods were delivered and when the debt arose. Claims that already existed when the WCO/LCE procedure started are subject to the suspension and therefore frozen. In that case it will be difficult, legally, to recuperate the goods. During the period of protection the WCO/LCE does not allow executory or conservatory attachment, nor is it possible to exercise a retention of property clause.

This arrangement does not apply to new claims – they have to be paid. If the customer then fails to pay you can attach the goods or exercise your rights in another way, in accordance with the contract or the general terms and conditions.

In practice, however, the answer is less straightforward: the nature of the supplied goods, the time you demand them and the consequences for the customer determine what is possible. The golden rule is that you and your customer try to come to an agreement about the goods as long as it is 'reasonable' and does not further jeopardise the company's continuity.

It is best to consult a lawyer or have a bailiff accompany you when visiting a customer to come an amicable settlement. If the customer does not agree to return the goods, the bailiff can establish this.

Does my credit insurance also cover claims on companies with WCO/LCE status?

Usually – there may be differences for each policy or insurance company – the credit insurer considers WCO/LCE as a form of insolvency. In that case you receive the outstanding receivable within the agreed term after the due date of the invoice and within the predetermined credit limits.

The exact intervention depends on the type of credit insurance:

- 'Pure' credit insurance

Depending on the policy, your outstanding invoices with a debtor are covered for between 60 to 90%, within the limit established for this debtor. If the invoice is not paid or partially cancelled, the credit insurer will pay the covered percentage of the amount. - Risk cover as part of a factoring solution

With this formula your unpaid invoices with a debtor who has applied for WCO/LCE will be covered for 100%, again within the limit established for this debtor. The factoring company will immediately pay you the amount owed.

This arrangement, however, only applies for a collective composition or a transfer of activities within the legal procedure. With amicable settlements or individual arrangements with creditors, there is no immediate payment. Only when the debtor is still in default 90 days after the due date of the invoice will the factoring company pay you the owed amount.

Can I record receivables on a customer with WCO/LCE status as a tax deductible depreciation?

If it is uncertain whether a receivable or part of it will be paid on the due date, you can record it as a depreciation.

The general principle is: a recorded depreciation is only tax-deductible if it is certain that the receivable cannot be collected. As long as it has not been established definitively that the receivable cannot be collected, such depreciation is only tax-deductible under very specific and restrictive conditions (see Section 48, first subsection of the Income Tax Code and Section 22 ff. of the Royal Decree implementing this Code)

- The WCO/LCE does provide for an easing of tax deductibility for your receivables on customers that have had the court approve a collective composition through the legal procedure or have come to an amicable settlement. Depreciations on such receivables should be accepted for tax purposes:

- for at least the amount of the reduction of debt, as agreed during the legal procedure;

- until full implementation of the recovery plan or composition, after which the depreciation becomes final (unless otherwise agreed).

- If you come to an amicable settlement through the out-of-court procedure, your receivables will be subject to the general principle and not qualify for tax deductibility.

Should my supplier continue to supply, even if they have applied for WCO/LCE?

Yes, that is precisely the objective of the WCO/LCE: to give the company the opportunity to continue its activities. During the period of protection they will, in principle, continue to produce and supply.

Furthermore, the WCO/LCE does not release your supplier from liability. Your supplier is therefore expected to supply the same quality within the due dates. If the supplier defaults on these obligations you can hold them liable and terminate the contract on account of non-fulfilment of obligations, even if your supplier only wishes to supply for payment in cash.

Is it advisable to continue to do business with this supplier during the WCO/LCE procedure?

Your supplier's WCO/LCE status is, in principle, not a reason to terminate the contract. If the general conditions of sale and the contract you have concluded with the supplier allow for this, you can adapt the payment arrangement.

There is always the possibility that the WCO/LCE procedure will fail, therefore it is certainly advisable to investigate other options. That is not always easy, obviously, as much depends on the interest of the supplied goods or services for your activities. It will probably be easier for you to find other suppliers for basic products than for rare commodities, high-tech (semi-) products or a very specific service.

If there are no immediate alternatives available it is crucial that your supplier's WCO/LCE procedure succeeds. In that case you should seek a healthy balance between continuity, i.e. continuing to purchase goods or services so that your supplier can continue business, and risk management.

10.06.2024

Electronic invoicing between companies to become mandatory

The bill to introduce this obligation in Belgium has been submitted to the Federal Parliament. If the draft bill is approved, B2B e-invoicing will become mandatory from 1 January 2026. Our experts explain why Belgium wants to introduce these new rules, what the implications are for your company and how we can better support you.

“The bill is consistent with international developments and initiatives at the European level,” says Nicolas De Vijlder, Head of Beyond Banking at BNP Paribas Fortis. "Europe's ambition is a harmonised digital standard. Structured e-invoicing between companies will also reduce the administrative burden of invoicing, enabling companies to work more efficiently and increase their competitiveness. The automation of VAT declarations will also help governments prevent tax fraud and adjust economic policies based on more qualitative data.”

Evolution rather than a revolution

“The new legislation is an evolution rather than a revolution,” adds Erik Breugelmans, Deputy Managing Director at BNP Paribas Factoring Northern Europe. "Digitalisation is becoming pervasive at all levels of society, as we have seen with the increase in electronic payments, as well as the additional obligations in recent years regarding electronic invoicing to the government. In this sense, the bill for mandatory electronic invoicing between companies is a logical next step. Our bank is happy to contribute to this process, although we do not intend to offer the same services as accounting software or fintechs. However, we are happy to help our customers with payments and financing."

The impact on businesses

“Customers need to be aware that the new regulations will have an impact on their internal and external processes,” continues Erik Breugelmans. "The majority of Belgian companies mainly serve an international market, which means that the introduction of electronic invoicing will be more complex for them than for companies operating in the domestic market. As the legislation will be introduced in one go, they need to start preparing now."

“The new rules will affect a company’s accounting department as well as its IT department,” emphasises Nicolas De Vijlder. "The procedural requirements are key, otherwise the automated process will not work. However, one of the main benefits of advanced automation is that everything can be done faster and more efficiently. The time between sending an invoice and paying it will be shorter and cash flows more predictable. In addition, it will also reduce the risk of error and fraud, as all transactions will pass through a secure channel."

Ready to offer you even more and better support

“Thanks to the far-reaching digitisation resulting from the new regulations, we will be able to further optimise payments,” concludes Erik Breugelmans. "As a bank, we need to finance our customers’ receivables as quickly and efficiently as possible, so that they have easier access to their working capital. In addition, because we have already gone through an entire process in terms of large-scale automation, we will be able to adapt quickly to the new rules. We can also draw on the expertise of the BNP Paribas Group, which is currently developing an e-invoicing solution for large companies."

Want to know more?

Listen to the episode on B2B e-invoicing :

08.03.2024

Has your company also locked in its energy prices?

The price of energy has experienced both high highs and low lows in recent years. This yo-yo behaviour is a worry to many entrepreneurs. Once again, BNP Paribas Fortis is here to offer you stability.

Controlling the price of energy: it’s an issue that’s almost impossible to avoid, or one that has been a recurring concern in your company over the past few years? We come from a time when energy prices were very volatile, with both high highs and low lows. These fluctuations have worried many entrepreneurs and, in some cases, caused huge additional costs. There is, however, a less well-known way for entrepreneurs to carry out risk management in this area. BNP Paribas Fortis is here to advise you.

Pendulum movement

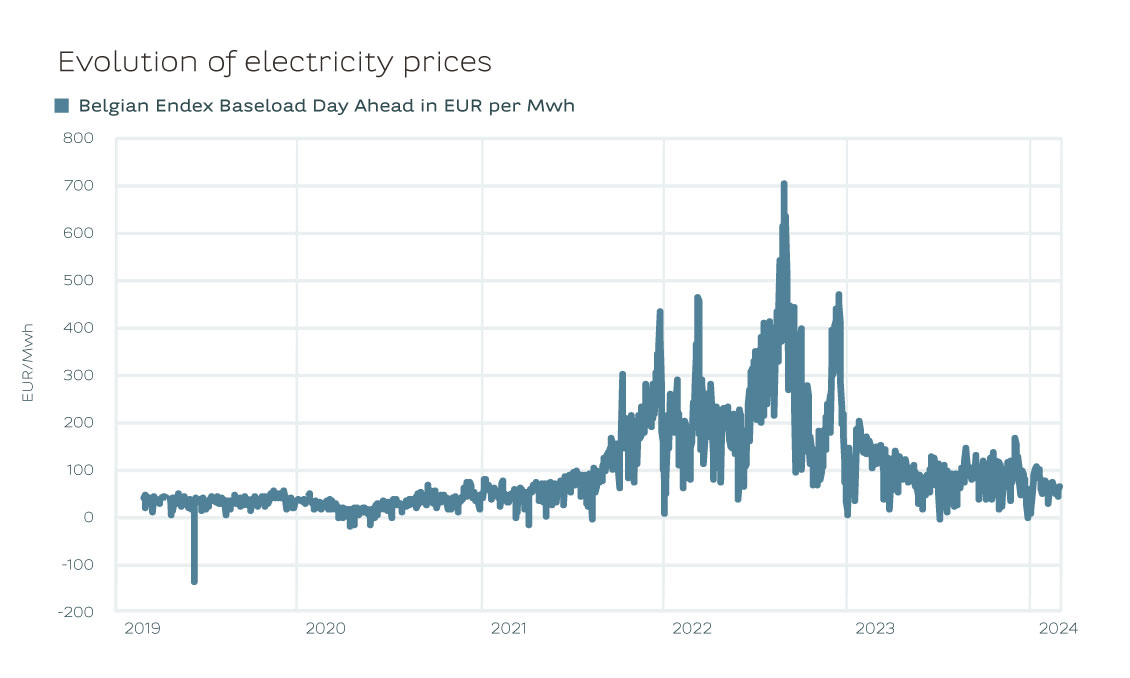

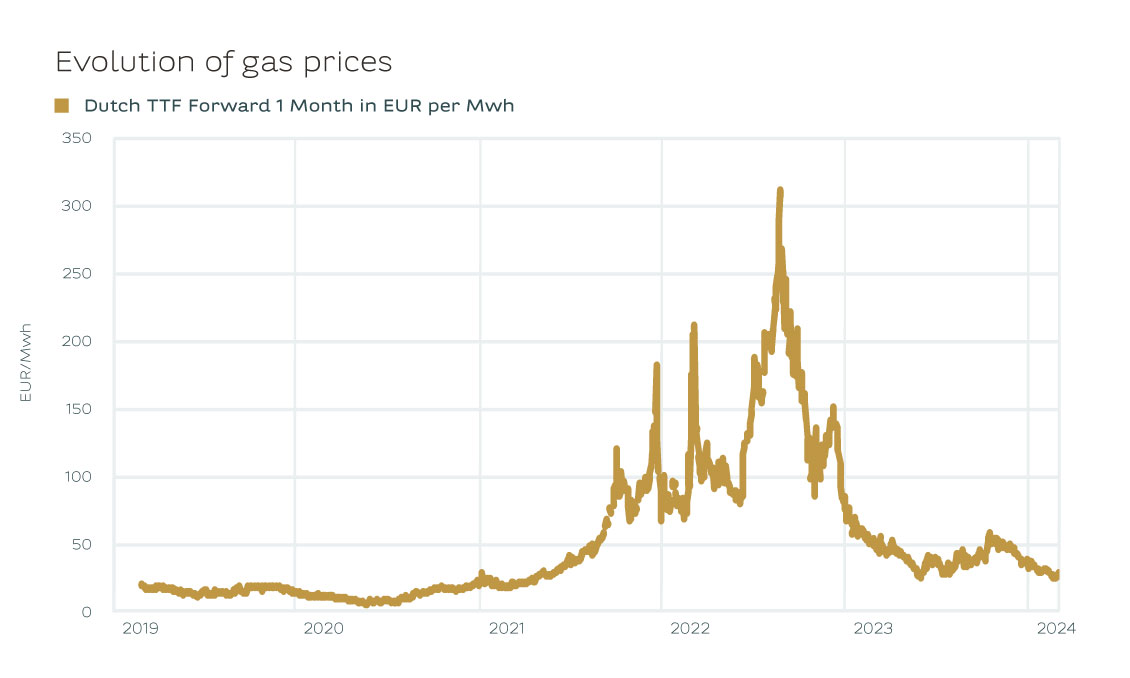

Energy prices have been on a volatile ride in recent years. After the invasion of Ukraine, they rose to unprecedented levels. Gas prices rose to EUR 300 per MWh, while in previous years they had been around EUR 10-15 per MWh. Electricity prices rose to over EUR 600 per MWh. In previous years, the price was barely EUR 50 per MWh.

Crisis management

"As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.)."

Mattias Demets, Commodity Derivatives Sales at BNP Paribas Fortis

The energy crisis of 2022 sent shock waves through the economy. Especially in energy-intensive sectors such as metallurgy or chemicals, it became clear how much affordable energy was crucial to the survival of many companies. Those that were self-sufficient in their energy needs weathered the storm better than others. The energy crisis also highlighted the importance of risk management. Companies wanted, as the legislator put it, to act like "prudent and reasonable persons" - the former "good householder principle". They fixed their energy prices and came out of the crisis virtually unscathed. While others could only hope that energy prices would come down again.

'Never waste a good crisis' is a regularly heard truism. For this energy crisis, we can use this expression once again. It’s fascinating to see companies now taking charge of their own energy supply. The rise of PPAs – Power Purchase Agreements – is particularly remarkable. A PPA is an electricity purchase agreement between a power producer and a customer.

Risk management

Companies are also making great strides in risk management. In the past, it was often up to management to lock in energy prices. They saw it as an additional responsibility to negotiate with energy suppliers. But since the energy crisis, we have seen companies become much more professional. Managing energy prices is today a job in itself. Companies are increasingly thinking about the right strategy to manage their energy costs so that their energy prices come down. How and when they lock in energy prices has become more of an informed decision than ever before, allowing them to protect their margins in the event of rising prices.

As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.). A financial swap may seem a bit complex at first, but it’s actually not such an intricate transaction. Of course, other structures are also available, depending on your needs.

This is where the “prudent and reasonable person” returns to assess what lies ahead. After all, whether you’re looking for smart investment opportunities or advice on ways to control your energy costs, it ultimately boils down to two sides of the same coin. BNP Paribas Fortis not only thinks about investing with you as an entrepreneur, but also about ways to help you smartly and safely manage important expenses such as energy costs.

Permanent drop?

Regardless of how companies choose to fix their energy prices, the current market context is very interesting at the moment. Industry in Europe is going through tough times. Nevertheless, the economy is experiencing a soft landing – a slowdown, without a real recession. This is currently leading to lower gas and electricity prices. We have also had a mild and windy autumn and winter. As a result, energy producers have generated a historically high amount of electricity from renewable sources in recent months.

And there’s nothing to suggest that prices won't continue to fall. Europe is importing more LNG from the United States than ever before. Indeed, both the price of US gas and the cost of transporting it have fallen dramatically in recent months. However, elections are coming up in more than 65% of the developed world, and the geopolitical situation (Ukraine, Israel, Taiwan) could again cause volatility.

Prudence

Gas and electricity prices have not been this low for two years and the market is currently stable. But the 2022 energy crisis has shown that we must always be on our guard. Locking in your energy price is not only the most cost-effective tactic, but it will also protect you, as a business owner in times of increasing volatility.

For more information, please contact your relationship manager.