Car sharing is a cost-efficient solution for your company, even while social distancing is in place. Our online booking system also ensures optimum occupancy.

It's easy to ensure hygiene, too, because your smartphone doubles up as a car key and there are guidelines in place for disinfecting the car after use. The driving administration for each user allows us to track who has driven the car if someone is infected or falls ill.

What is car sharing?

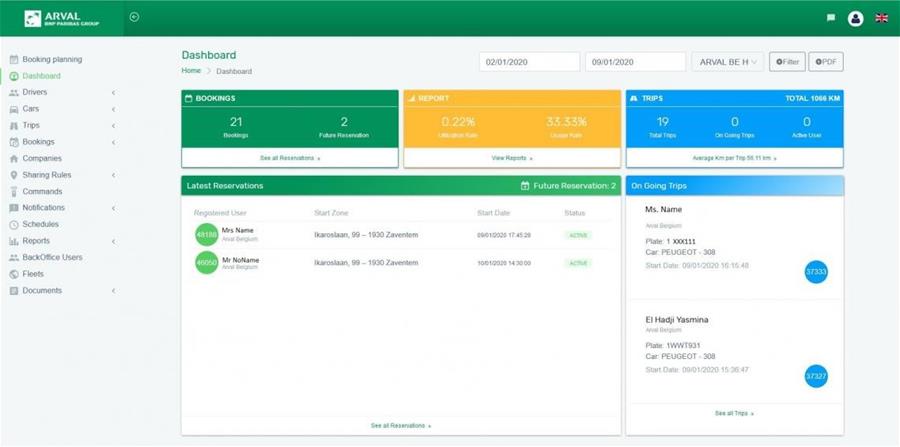

Car sharing adds a new dimension to the concept of carpooling. You can manage corporate car sharing using a smart online platform and an innovative app. There's no need to hand over keys, as users open, start and lock cars using the Car Sharing app. Car sharing is a great example of smart sharing and flexible, sustainable mobility. As the employer, you can make cars available and decide which employees can use them.

Car sharing adds a new dimension to the concept of carpooling. You can manage corporate car sharing using a smart online platform and an innovative app. There's no need to hand over keys, as users open, start and lock cars using the Car Sharing app. Car sharing is a great example of smart sharing and flexible, sustainable mobility. As the employer, you can make cars available and decide which employees can use them.

How does car sharing work?

Book online

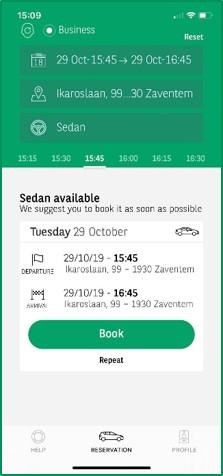

Car sharing lets you book a car anywhere, any time. We've developed an intuitive online booking system and a free Car Sharing app for Android and iOS. It takes seconds to book a car, whether you're at the computer or on your smartphone.

You open, start and lock the car using the app. Picking up and dropping off keys is a thing of the past. No smartphone? no problem – we'll give you a chip card.

No more paperwork

The app also makes sure that all data is carefully recorded and kept. Mileage and fuel consumption are automatically recorded after each trip, while users can report any damage quickly and accurately using the app.

Operational leasing is offered by Arval Belgium SA/NV, with the intervention of BNP Paribas Fortis SA/NV – Montagne du Parc/Warandeberg 3, B-1000 Brussels, Brussels Register of Companies VAT BE0403.199.702.

Promotion only available from Thursday 21 January up to and including Wednesday 31 March 2021 and is only available to professional clients (self-employed, liberal professionals and SMEs) of BNP Paribas Fortis and Fintro.

The information provided here does not constitute an offer. An offer is made only after your file has been accepted and is always subject to Arval Belgium SA/NV's General Terms and Conditions.

02.05.2022

Opt for a more sustainable mobility offer thanks to bicycle leasing

Sustainability isn't a hype – it's a must. The transition is also in full swing in terms of mobility. With bicycle leasing, you offer your employees a high-quality bicycle package and choose a more sustainable mobility offer. And it's tax efficient.

Cycling to work is popular

Not only our way of working has become hybrid; so too has the way we travel to work. More and more people are seeing the benefits of cycling to work, whether or not electric. An e-bike or speed pedelec is no longer just a gadget. Thanks to these, you can now comfortably cycle longer distances. So, bicycles are certainly part of a sustainable mobility policy. Bicycle leasing allows you to offer your employees a healthy and sporty option that reduces your organisation’s carbon footprint.

How does bicycle leasing work?

Bicycle leasing is much more than just financing bicycles. Maintenance, repairs, breakdown service and insurance are all included in the package. With Bike Lease, our mobility partner Arval offers an operational, full-service solution for 36 months. With over 120 brands and all types of bicycles, the range is extensive: city bikes, sports bikes, e-bikes, speed pedelecs, mountain bikes, folding bikes, etc. Your employees choose the bicycle that suits them best. An annual maintenance budget is provided for maintenance and repair by professionals. Bike Lease also includes indemnity for accidents, theft and vandalism of the bicycle with a fixed excess based on the value of the lease bike. And finally, a 24/7 breakdown service is provided within 45 minutes, anywhere in Belgium.

Good for everyone

Including bicycles in your mobility offer offers both your company and your employees many advantages.

- Tax-efficient

The leasing costs are deductible for your company if your employees use their bikes to commute. By using this bike to commute, they avoid a taxable benefit in kind.

- Healthy

Cycling makes healthier and fitter employees who suffer less from stress. And your company benefits from this as well.

- Affordable

A bicycle is a cheaper alternative or complement to a company car for short to medium-distance trips. You save on fuel, maintenance and parking costs. It also allows you to offer mobility to a wider target group.

- Flexible

Once your employees have chosen a type of bicycle, they decide for themselves when they pedal to work. Through all kinds of weather, when the sun is shining or when there are too many traffic jams and a bicycle is the perfect alternative to a car. They can also enjoy their bikes in their free time.

- Sustainable

A bicycle has of course a low ecological footprint and fits perfectly in a sustainable mobility policy. By offering your employees a bicycle, your company emits less CO2 and your organisation becomes more socially responsible.

Operational leasing is offered by Arval Belgium SA/NV, with the intervention of BNP Paribas Fortis SA/NV – Montagne du Parc/Warandeberg 3, B-1000 Brussels, Brussels Register of Companies VAT BE0403.199.702.

The information provided here does not constitute an offer. An offer is made only after your file has been accepted and is always subject to Arval Belgium SA/NV's General Terms and Conditions.

20.12.2024

Mobility in 2025: Arval’s view

Laurent Mélignon, Corporate Sales Director of Arval, the market leader in full-service car leasing and new mobility solutions, looks ahead to 2025. What does the future hold for the industry and mobility?

Arval is part of the Commercial, Personal Banking & Services division of the BNP Paribas Group. As the market leader, it plays a key role in offering full-service car leasing and new mobility solutions. Laurent Mélignon, Corporate Sales Director of Arval, is thus ideally placed to share his thoughts on what's in store for Arval in 2025.

Arval is the market leader in a sector in flux: how companies and private individuals see and approach mobility has changed significantly. Mélignon sees several reasons for this: "In our country, taxation is the primary driver of many change processes. This taxation is linked to wage costs: many companies see company cars as a tax-friendly alternative for maximising the remuneration they want to pay their staff. Employees, meanwhile, see company cars as a way to be compensated with tangible benefits, without the tax authorities targeting them. In the coming year, the tax framework will continue to evolve in line with this social evolution. The federal mobility budget and the bicycle allowance, for example, or options such as the cafeteria plan or the flex income plan: these are just some of the ways in which companies can use their salary package to motivate their workers."

But Arval's Corporate Sales Director sees even more drivers of change for mobility. Mélignon: "Our entire mobility culture is also changing, a trend that is set to continue in 2025. The younger generation is much less attached to the status that company cars have been associated with for so many years. They are just as happy to hop on a bicycle, take the bus or use car sharing, depending on the company's location, of course. Finally, there are also several macroeconomic factors driving this change. These include the growing traffic crisis many cities are facing, as well as the increasing awareness of people and economic players regarding the energy transition. We are all gradually seeing the need for change and alternative mobility choices. This has been clear for quite some time."

Flexible complexity

The mobility mix will only become stronger in the future. Mélignon: "That is a big part of our mission: to be and remain a one-stop shop, offering companies the opportunity to think in terms of flexible remuneration. A new employee, for example, someone who is single and without a family, has different mobility needs than their colleague, who is married with two children and has their own home in the countryside or in the city. Now that this need is becoming stronger and more established, Arval is the ideal partner to provide companies with knowledge about mobility and take the burden off their hands. We enable employers to offer flexibility by taking care of the complexity associated with it."

Positive mindset

Mélignon expects the transition to electric mobility to continue in 2025: "When I look at corporate customers, I see that 80% of all new orders are electric. This is quite different from the private market, where we barely reach 20%. The electrification of the Belgian fleet is therefore mainly driven by companies. I see that the government has recently made some announcements and initiatives to slightly adjust and refine the federal mobility budget. In the coming months, more and more people may thus give up their company cars and opt for this adjusted budget instead. Arval can also be of service there, with a positive mindset and a lot of know-how, in our role as a 'full mobility provider'."

Tipping point

According to Mélignon, the shift to electric mobility, which the market has been anticipating for so long, will also have consequences for companies. Mélignon: "We expect to see many more affordable models in 2025. Electric vehicles will no longer be just for the lucky few. This benefits the private market, but it also gives companies more opportunities. In addition, I expect the price of cars with combustion engines to rise. We often receive this feedback from manufacturers. As a result of the Corporate Average Fuel Economy (CAFE) standards, which regulate their CO2 emissions, they will soon have to pay huge fines if they fail to meet these standards. It is therefore in their interest to steer the market towards electric cars. They will also adjust their production capacity accordingly: 'made to order' instead of holding large stocks will become the industry standard from next year."

The road ahead

On a final note, Arval expects the market to open up to smaller and medium-sized enterprises and individual clients in the near future. Mélignon: "We believe that the change in the market will mean that many companies, which currently still favour purchasing company cars or financial leasing, will switch to operational leasing. They will outsource the risk related to, for example, residual value to us. And that is where we can make a difference as the market leader: we see this as a scenario for the near future, for which we are already preparing."

16.12.2024

The digital divide persists

“It's not just the elderly who lack digital skills, young people and workers are also affected,” says Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chair of DigitAll.

Despite the acceleration in digitalisation, many people are being left behind. In Belgium, 40% of the population between the ages of 16 and 74 are at risk of digital exclusion. Although older people are often seen as the most vulnerable group, younger people are also struggling in the digital age. Among young people aged between 16 and 24, almost a third lack basic digital skills, with a peak of 52% among those with a low educational attainment.

Figures that are surprising to say the least, considering young people grow up surrounded by digital tools.

"People often assume that young people are digital natives because they are adept at using social media. But making a TikTok video or scrolling through your Instagram feed doesn't necessarily mean you know how to carry out online banking transactions or complete an application form.

Does poverty play a significant role in the digital divide?

"Absolutely. For 25% of people living in poverty, a smartphone is their only digital device. Although they provide a basic form of access, smartphones are often inadequate for important tasks such as preparing a CV or filing a tax return. Without a computer or a stable internet connection, many digital opportunities remain out of reach for those who don't have access to these tools.

What are the other reasons for this digital divide?

"People often lack the necessary basic digital skills because they never learned them. They may not know how to use a search engine, attach a file to an e-mail, or download an app. Without this knowledge, the digital world becomes inaccessible. Furthermore, there is also the issue of digital stress. Many people worry about making mistakes, being hacked, or their privacy. Some people deliberately choose not to use digital services even though they have the skills. Technology instils a sense of distrust and unrest in them, creating a significant barrier.”

How can companies help close this gap?

"Companies can play a key role on several levels. In addition to being a social problem, digital exclusion is also an economic challenge. Today, less digitally adept individuals are both customers and potential employees. Being aware of this as a company is the most important first step. But it’s also essential to provide support to your staff. For example, employees at the municipal parks and greenery service in Ghent received training on how to file their tax returns online. These kinds of initiatives give people practical skills and confidence. In addition, companies need to do a digital check. To measure is to know. Just because someone uses a laptop daily, it doesn’t mean they have digital skills."

What does BNP Paribas Fortis do specifically to promote digital inclusion?

"We have launched several initiatives. In 2020, we established DigitAll, a platform for sharing knowledge and best practices around digital inclusion. Today, we bring together more than 130 organisations. DigitAll has developed a range of tools, including a checklist that companies can use to test how accessible their apps and websites are. A simple interface can make the difference between joining or dropping out for people who are less digitally adept. Since 2021, the bank has also supported a chair at the VUB that investigates the link between digital inclusion and human rights."

How important are tools in bridging the digital divide?

"User-friendly tools are a must. We have partnered with Emporia, a manufacturer of user-friendly smartphones for the less digitally adept. We pre-install our app for customers who buy one of their smartphones."

We mentioned digital stress earlier. How can you mitigate this?

"With awareness campaigns. We want our customers to use our tools with confidence. The bank also takes its less digitally adept customers into account. Thanks to our partnership with bpost, all our customers can go to their local post office for all basic banking transactions."

Do companies stand to benefit from promoting digital inclusion?

"They do. Digital inclusion requires a sustained effort from all stakeholders, including governments and educational institutions. No one should be left behind. Companies that act now can contribute to a more inclusive society while also securing their own future in an increasingly digital world.”

“Without key digital skills, many digital opportunities remain out of reach.”

“A simple interface can make the difference between joining or dropping out for people who are less digitally adept.”

“Limited digital skills remain an obstacle to closing the digital divide.”

Linde Verheyden, Director Public Affairs at BNP Paribas Fortis and Chairman of DigitAll

09.12.2024

Managing business uncertainty with BNP Paribas Fortis

Every entrepreneur will tell you that financial markets are unpredictable, entailing inherent risks. We provide tailored solutions to protect your business as you navigate these volatile markets.

Whether you’re a small or large business, operating domestically or internationally, one thing is certain: if you enter a market and do your utmost to grow your business, sooner or later there inevitably will come a time when you expose yourself to risks. Frédéric Raxhon, Head of FI Midcap Sales, BNP Paribas Fortis Transaction Banking, is our go-to expert. Here, he explains how BNP Paribas Fortis helps customers manage this uncertainty.

Raxhon knows how market volatility can impact the daily operations of small, medium and large enterprises. Thanks to his experience of working as a banker in corporate finance, shares and derivatives, and advising holding and listed companies, he understands how the market works like no other.

Raxhon: "We are keenly aware that price uncertainty, in the form of volatility on the financial markets, can have a serious impact on the operations and profitability of businesses. That’s why we constantly monitor the markets and their volatility: if prices fluctuate sharply, our customers run the risk of buying high and selling low. The past few years are a good example of what can happen, with a sudden rise in interest rates, an energy crisis with very volatile prices, and a sharp rise in inflation. We will continue to see volatility in these markets, due to geopolitical tensions and ongoing wars. However, elections can also cause volatility, as they often cause a change in economic policy. President-elect Donald Trump has already said that he will hike tariffs on goods coming from outside the U.S., which will have an impact on global growth and inflation. The transition to a more sustainable society because of the energy transition, however positive this may be, is also a source of uncertainty. Companies will be required to make significant investments, and it is not yet clear which technologies will prevail.

All of these factors show that companies need guidance in the form of a tailor-made solution to ensure that volatile markets minimise the impact on their operations so that they can focus on their core business."

Solution-oriented

The solution to this volatility comes from a partner who is a market leader when it comes to safeguarding national and international business.

Raxhon: "At BNP Paribas Fortis, this often means managing the risks of companies that have a number of straightforward wishes: they want to conduct business on a daily basis without unnecessary complications; buy at a stable price where possible; pay wages in a stable environment; sell to customers with a profitable, stable margin, and so on. If they experience market uncertainty in their business operations, we are there to advise them and suggest solutions in different scenarios. This can range from companies that want stability when buying or selling goods in another currency, to controlling fluctuating interest rates on current or future loans, or even creating a stable financial environment in which they can steadily pay their wages. We also hedge raw materials: companies that require large quantities of energy, metal, or wheat, for example – just a few of the commodities that are subject to price fluctuations – can rely on our expertise to turn their uncertainty into certainty. When companies are calculating their budgets for the coming years at the end of the year, assumptions about budgets and costs are a factor that future markets do not take into account. This, in turn, could lead to inconsistencies in business operations during the next financial year. We regularly suggest solutions for this, which inject trust into the entire process. We help entrepreneurs make their business more resilient to market fluctuations. Because at BNP Paribas Fortis, we are always focused on finding solutions, in any given scenario."

International intelligence

Belgian companies are increasingly expanding their horizons, which is why an international perspective is so crucial.

Raxhon: "Everything is intricately connected in the economic space. The energy crisis, for example, was not a national crisis. In Belgium, electricity prices were directly impacted by the drop in nuclear power production in France in 2022. The American elections have a direct impact on international business, with anxiety gripping investors and the markets. And I can give you many more examples.

Moreover, we expect this interdependence and volatility to continue for quite some time: there are a large number of economic and global trends that are feeding this uncertainty. And that is why it is so important that we keep up with developments in this uncertain global environment. At BNP Paribas Fortis, we rely on a global network of experts who are always on the lookout for the latest updates. Whatever happens and wherever it happens, there are always people from our bank on the ground who monitor the situation and provide us with real-time advice on how best to inform our customers. This network has proven its worth time and again, both for us and our customers."