Discretion is a major advantage of the Schuldschein. The product is moreover quick, flexible and involves relatively little documentation.

Discretion is what German companies have valued about Schuldschein for centuries. Mid-cap or family companies do not always want big media headlines regarding their financial transactions. A Schuldschein is a credit facility agreement that is concluded directly between a borrower and an investor. If a company wishes to capitalise on advertising, it can. However, by means of a simple request, the deal can also be handled very discreetly.

There are other advantages to Schuldschein besides privacy:

- It is an efficient way for companies to diversify their investment base, away from the traditional partner bank.

- The Schuldschein allows a company to have recourse to the capital market without burdensome processes and conditions in relation to rating. Investors carry out their own analysis.

- The documentation involved in a Schuldschein agreement is less prescriptive than in case of a bond loan. It can therefore be simpler and more concise. Fifteen pages is not unusual, particularly for a Schuldschein with a low risk profile (e.g. an issuer from the public sector).

- A Schuldschein is also flexible: it can be tailored to simple loans or complex, structured deals. The Schuldschein can be brought into line with existing financing instruments of the company and take over the securities and covenants.

- The transaction can be organised quickly.

- No minimum volume is expected. In the stock market, that quickly amounts to EUR 500 million. In the Schuldschein market, it is around the EUR 100-150 million mark, although EUR 50 or 300 million are equally possible.

- The Schuldschein is also more flexible than the stock market. The amount may be distributed across different maturities and currencies. For example, maturities can be placed in parallel at 3, 5, 7 and 10 years. Those tranches must then be refinanced every two years, making one less dependent on current market circumstances. This provides an answer to the bullet repayment issue, which features in the stock market.

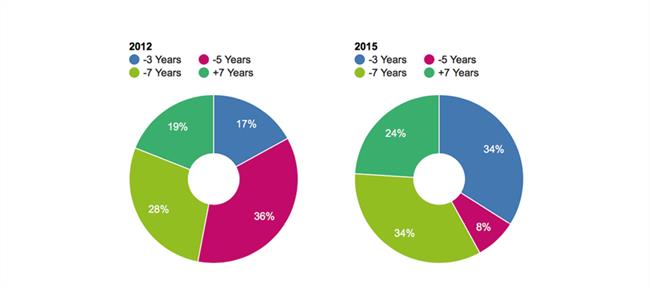

Maturities are increasing

Schuldschein maturities have been increasing over the last few years. In 2012, maturities of less than three years accounted for 17% of the market, and maturities of more than seven years for 19%. In 2015, those figures were 8% and 34% respectively. The current average is 6.6 years.

(Source: Thomson Reuters LPC)

Investors

Schuldschein investors are often insurance companies, pension funds and credit institutions, particularly savings banks and cooperative banks. What attracts them to Schuldscheine?

- The product offers spreads and maturities that are not available in the syndicated loans market.

- Because of the lower amounts, more investors can access the market.

- Investors also gain access to organisations and companies that do not operate in the bond market.

- Due to the flexibility of the Schuldschein, there is something to suit every investor's tastes. Institutional investors, for example, often choose fixed coupons with a longer maturity, while commercial banks prefer medium-term maturities and variable interest coupons.

Role of the bank

The bank is often designated by the issuer to organise the loan payments. The bank plays the role of 'arranger' in that case, explains Raoul Heßling, Schuldschein expert at BNP Paribas:

"The bank advises the customer on the structure of the Schuldschein, maturities, types of interest and the content of the documentation. We also prepare a profile of the issuer and a presentation for potential investors in conjunction with the company. We obviously also use our network to approach those investors."

08.08.2016

Schuldschein: German export for the financing market

In 2015, Germany and Austria jointly made up 85% of the Schuldschein market. But interest is growing in other European countries, including Belgium.

Schuldschein: the word sounds unmistakably German. Indeed, our eastern neighbours have had the product for decades, and there were even predecessors that proved their worth a few centuries ago. Earlier issuers were mainly the government, at all levels. The federal states (Bundesländer) and the municipalities used this instrument to finance investments, while credit institutions also used Schuldscheine in a number of ways, including in refinancing programmes.

An increasing number of companies have recently been using Schuldscheine to raise money. These have typically been German mid-cap companies that are not listed on the stock exchange. Over the last few years, larger, listed companies have also started to enter the Schuldschein market.

What exactly is a Schuldschein? A Schuldschein is a credit facility agreement, concluded directly between a debt issuer and an investor, which a bank uses to structure the transaction. The issuer issues negotiable securities that represent the claim for repayment, in exchange for an investor lending a monetary amount on a medium or long-term basis.

What are the main differences between Schuldscheine and other forms of market financing?

- Schuldschein versus classic investment credit The claims under a Schuldschein agreement are more liquid than in case of a classic investment loan. They can be circulated among different investors just like financial securities.

- Schuldschein versus syndicated loans In contrast to a syndicated loan, the creditors are not connected to each other. A majority is therefore not needed for decisions. Schuldschein versus a bond issue In contrast to a bond issue, the security is not revalued on a daily basis, so the accounting also differs.

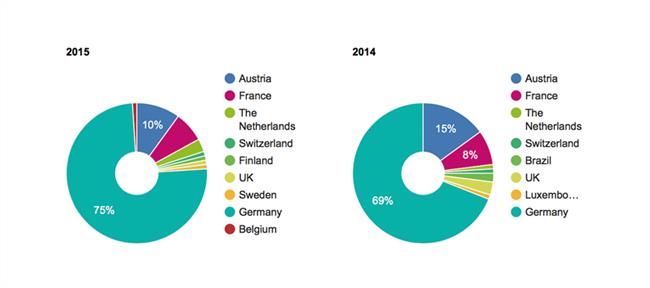

Corporate Schuldschein volume per country

(Source: Thomson Reuters LPC)

Until a few years ago, Schuldscheine did not exist outside German-speaking countries. German and Austrian companies still dominate the market today. In 2014, 69% of the volume was made up by German companies. In 2015, that figure increased to 75%. German companies issued EUR 8.3 billion of Schuldscheine in 2014, and EUR 15.2 billion in 2015. Raoul Heßling, the Schuldschein expert at BNP Paribas points out that last year's picture is somewhat inflated by a number of very large transactions:

"2015 was an exceptional year with three very large German Schuldschein transactions. These jointly represent more than one-fifth of the total issued volume. But it is entirely possible that the share of other European countries will increase more than that of Germany in the years to come. The system is already well-established in France, for instance: that country represented 8% and 7% of the market in 2014 and 2015 respectively. Over the same period, the Netherlands increased from 1% to 2%, while Belgium increased from 0% to 1%. The general trend is clear: internationalisation. Schuldschein remains a typically European story. I can see it developing into the European equivalent of private placement in the United States."

08.08.2016

Schuldschein is gaining in popularity as an alternative type of investment. Why so?

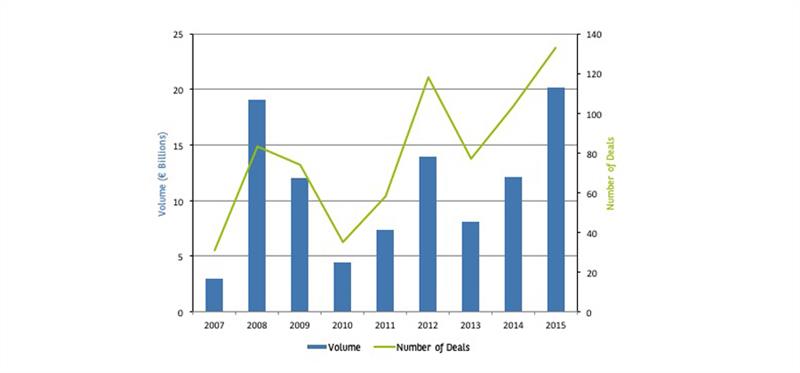

With issues of EUR 20.2 billion, 2015 was a record year for corporate Schuldscheine – an increase of 67% compared to 2014. And 2016 could be even better. Where does this success originate from?

Over the last few years, the market for 'Schuldscheindarlehen' (Schuldschein loans) to private companies has grown substantially. That growth was particularly turbulent in the wake of the financial crisis, with a few notable peaks. 2008 was such a peak year, with almost double the volume of 2007. The record of 2008 fell last year, with a volume of EUR 20.2 billion. And 2016 has also been quick out of the starting blocks. Raoul Heßling, Schuldschein expert at BNP Paribas:

"We are expecting a volume of more than EUR 5 billion in the first quarter, with a good mix of large and small companies, both in Germany and abroad. If the trend continues, 2016 will surpass 2015."

Annual Corporate Schuldschein Volume and Deal Flow

(Source: Thomson Reuters LPC)

The main reason for those record years is the volatility of the bond market. At that level, 2008 was a difficult year, with much economic nervousness and the bankruptcy of Lehman Brothers. Raoul Heßling:

"The Schuldschein market is very stable and is well-shielded from that sort of volatility. The system is normally used by mid-cap companies that are not listed on the stock exchange. Due to the difficult circumstances in 2008, during which the bond market practically stalled for a period, some companies noted that Schuldscheine could be a good alternative. I am referring to names such as BMW, Daimler, Siemens and Deutsche Telekom. As a result, the volume soared to around EUR 19 billion in 2008."

The worst loss was suffered in 2009. The bond market picked up again and Schuldscheine returned to their normal volume and users. From 2010 to 2014, the volume fluctuated around the normal EUR 10 billion and users were mainly mid-cap companies. And then came the peak of 2015. Raoul Heßling:

"With more than EUR 20 billion, that was a new record year. I see various reasons for this. Firstly, the Schuldschein has become better known as a financing tool, among both issuers and investors. Secondly, there was more merger and acquisition activity over the past year. Quite a number of companies have discovered that Schuldscheine are an efficient way to raise money. Thirdly, the bond market returned to being volatile in the second half of the year and listed companies gravitated towards the Schuldschein market again. ZF Friedrichshafen, a global player in the automobile sector, entered into a record deal of EUR 2.2 billion, for instance, while Daimler and Mann+Hummer each entered into transactions of EUR 1.1 billion."

Meanwhile, 2016 looks to be on course to match or surpass 2015. Is this becoming the new norm for Schuldscheine? Raoul Heßling remains cautious: "I am in no position to make forecasts."

Largest deals of 2015

|

Ranking |

Borrower |

Industry |

Deal Size (€) |

|

1 |

ZF Friedrichshafen |

Automotive |

2,206,500,000 |

|

2= |

Daimler |

Automotive |

1,100,000,000 |

|

2= |

Mann+Hummel |

Manufacturing |

1,100,000,000 |

|

4 |

Steinhoff |

Wholesale |

650,000,000 |

|

5 |

Körber |

Services |

600,000,000 |

|

6= |

Symrise |

Chemicals |

500,000,000 |

|

6= |

Asklepios |

Healthcare |

500,000,000 |

|

8 |

Gerresheimer |

Manufacturing |

425,000,000 |

|

9 |

Hamburger Energienetze |

Utilities |

329,000,000 |

|

10 |

Orpea |

Healthcare |

310,500,000 |

(Source: Thomson Reuters LPC)

09.12.2024

Managing business uncertainty with BNP Paribas Fortis

Every entrepreneur will tell you that financial markets are unpredictable, entailing inherent risks. We provide tailored solutions to protect your business as you navigate these volatile markets.

Whether you’re a small or large business, operating domestically or internationally, one thing is certain: if you enter a market and do your utmost to grow your business, sooner or later there inevitably will come a time when you expose yourself to risks. Frédéric Raxhon, Head of FI Midcap Sales, BNP Paribas Fortis Transaction Banking, is our go-to expert. Here, he explains how BNP Paribas Fortis helps customers manage this uncertainty.

Raxhon knows how market volatility can impact the daily operations of small, medium and large enterprises. Thanks to his experience of working as a banker in corporate finance, shares and derivatives, and advising holding and listed companies, he understands how the market works like no other.

Raxhon: "We are keenly aware that price uncertainty, in the form of volatility on the financial markets, can have a serious impact on the operations and profitability of businesses. That’s why we constantly monitor the markets and their volatility: if prices fluctuate sharply, our customers run the risk of buying high and selling low. The past few years are a good example of what can happen, with a sudden rise in interest rates, an energy crisis with very volatile prices, and a sharp rise in inflation. We will continue to see volatility in these markets, due to geopolitical tensions and ongoing wars. However, elections can also cause volatility, as they often cause a change in economic policy. President-elect Donald Trump has already said that he will hike tariffs on goods coming from outside the U.S., which will have an impact on global growth and inflation. The transition to a more sustainable society because of the energy transition, however positive this may be, is also a source of uncertainty. Companies will be required to make significant investments, and it is not yet clear which technologies will prevail.

All of these factors show that companies need guidance in the form of a tailor-made solution to ensure that volatile markets minimise the impact on their operations so that they can focus on their core business."

Solution-oriented

The solution to this volatility comes from a partner who is a market leader when it comes to safeguarding national and international business.

Raxhon: "At BNP Paribas Fortis, this often means managing the risks of companies that have a number of straightforward wishes: they want to conduct business on a daily basis without unnecessary complications; buy at a stable price where possible; pay wages in a stable environment; sell to customers with a profitable, stable margin, and so on. If they experience market uncertainty in their business operations, we are there to advise them and suggest solutions in different scenarios. This can range from companies that want stability when buying or selling goods in another currency, to controlling fluctuating interest rates on current or future loans, or even creating a stable financial environment in which they can steadily pay their wages. We also hedge raw materials: companies that require large quantities of energy, metal, or wheat, for example – just a few of the commodities that are subject to price fluctuations – can rely on our expertise to turn their uncertainty into certainty. When companies are calculating their budgets for the coming years at the end of the year, assumptions about budgets and costs are a factor that future markets do not take into account. This, in turn, could lead to inconsistencies in business operations during the next financial year. We regularly suggest solutions for this, which inject trust into the entire process. We help entrepreneurs make their business more resilient to market fluctuations. Because at BNP Paribas Fortis, we are always focused on finding solutions, in any given scenario."

International intelligence

Belgian companies are increasingly expanding their horizons, which is why an international perspective is so crucial.

Raxhon: "Everything is intricately connected in the economic space. The energy crisis, for example, was not a national crisis. In Belgium, electricity prices were directly impacted by the drop in nuclear power production in France in 2022. The American elections have a direct impact on international business, with anxiety gripping investors and the markets. And I can give you many more examples.

Moreover, we expect this interdependence and volatility to continue for quite some time: there are a large number of economic and global trends that are feeding this uncertainty. And that is why it is so important that we keep up with developments in this uncertain global environment. At BNP Paribas Fortis, we rely on a global network of experts who are always on the lookout for the latest updates. Whatever happens and wherever it happens, there are always people from our bank on the ground who monitor the situation and provide us with real-time advice on how best to inform our customers. This network has proven its worth time and again, both for us and our customers."

07.11.2024

BNP Paribas Fortis Factor: the oxygen to your growth story

Factoring is playing an increasingly important role in promoting the growth of Belgian and international companies. BNP Paribas Fortis Factor provides the oxygen to their growth story.

You want your business to grow and thrive, and so all the help and guidance you can get are more than welcome. The reason is clear: support brings extra energy to your entrepreneurial spirit and essential resources to fuel your innovative growth plans.

BNP Paribas Fortis Factor, a subsidiary of BNP Paribas Fortis, offers a service designed precisely for that: to relieve stress and motivate, to promote and nurture your growth. In this interview, Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, and Audrey Bourguet, Working Capital Advisor at BNP Paribas Fortis Corporate Banking, come together to discuss one key topic: Factoring and the positive role it can play for Belgian businesses and their international branches.

Explaining factoring succinctly, however, is a challenge. Jef Ramaekers, Head Factoring Benelux at BNP Paribas Fortis Factor, clarifies: “To start with, factoring is a means, not an end. It’s a tool for business owners or CFOs to optimise working capital. Every financial manager, in any company, will at some point ask the same question: ‘Who do I need to pay, when, and how can I pay them with the resources I have?’ Simply put, factoring enables businesses to pay suppliers without waiting for customer payments to come in. We finance invoices by converting them into directly available cash for the business.”

This process actively alleviates concerns and reduces stress factors, allowing entrepreneurs to focus on what they do best – running their business. Ramaekers adds, “We like to say ‘giving oxygen to growth stories.’ But I certainly see the value in the term ‘relieving stress’ here. By giving an entrepreneur or CFO the freedom to focus on core activities and by taking on a key part of the financial management, we create extra time and opportunities. And they also have less to worry about."

Positive shift

According to Ramaekers, the traditionally negative perception of factoring is a thing of the past: “Factoring was once seen by many business leaders as a ‘lender of last-resort’ – a way to borrow money from the bank by using assets, receivables, or customer invoices. In other words, a company’s last resort. Fortunately, those days are long behind us. We’ve evolved towards a very open attitude to factoring, allowing our division to grow into a true service provider. Our clients’ primary need remains short-term financing. Today, one in five invoices in our country is paid through factoring. Factoring is now a substantial market, representing more than one hundred billion euros per year. BNP Paribas Fortis Factor manages 41 per cent of this market, accounting for EUR 55 billion at the end of 2023.

Growth

From the bank’s perspective, factoring also represents a significant growth story. Audrey Bourguet, Working Capital Advisor at Transaction Banking for BNP Paribas Fortis, explains: “Today, factoring is the financial product that nicely aligns with the rising turnover of our companies. It provides a practical solution for working capital and is part of a suite of Transaction Banking services. In addition to Factor, this also includes Global Trade Solutions, Cash Management, Fixed Income, and Working Capital Advisory. All these services share a common goal: provide the best possible solution for our clients’ financial needs and be there for them in all situations where they can benefit from our support.”

Factoring, from the bank’s standpoint, represents an increasingly strong and positive story, unlinked from its past connotations. Bourguet adds, “You can see this in how we truly integrate factoring within our bank and the group, and in how we offer this service to businesses across all sectors and sizes. We work with a wide range of companies in the Belgian economy. As a result, we have seen that it is precisely those companies that succeed in optimising the funding of their working capital by making use of our factoring services, among other things. This reinforces our belief that it is a very positive story: we’re talking about a form of financing that seamlessly adapts to the growth of any business, large or small.”

Natural evolution

Factoring is available to small, medium-sized, and large companies alike. Ramaekers says, “We aim to provide a solution that supports businesses throughout their entire lifecycle – we’re genuinely unique in the market in this regard. This means that we are there for start-ups, SMEs, multinationals, and every type of business in between. We are the only bank on the market to have a digital solution for small businesses in the form of Easy2Cash. This digitalisation makes it a very cost-effective option with highly competitive margins, but also a reliable, particularly fast and up-to-date link with our customers and their accounting, using a digital yet personal approach. Although Easy2Cash is digital, it includes a dedicated contact person, making the solution both personal and accessible. For start-ups, for example, it’s often challenging to secure credit. For these modest, short-term credit needs, we provide a solution in consultation with the BNP Paribas Fortis banker, enabling them to keep growing without being hindered by their expanding requirements for financing, automation, accounting, etc. Factoring gives them additional resources to meet these needs.”

Ramaekers notes that the steady growth of young companies also demands an adaptation of financial services: “It’s a natural evolution that benefits both partners. If your business grows, we grow with you – it’s that simple. During all those specific growth moments – when entrepreneurs start considering additional staff or potential exports – factoring grows with them. And we do this together with the bank; the group behind this story plays as a team. And let’s not forget, we’re here even if more challenging times come. We’re well aware that a company’s journey is not always easy. It’s at those moments that the value of our expertise and the support we provide really stands out.”

When a company grows into a large enterprise with the profile of a multinational, the importance of factoring further increases. Ramaekers says, "More than 65% of the really large companies in Belgium, with a turnover of more than EUR 1 billion, use factoring services. And half of them are our customers. Factoring often provides additional economies of scale for large enterprises. For example, we can finance receivables that have no impact on a company’s debt ratio. By combining invoice pre-financing with credit insurance, companies can avoid having debt on their balance sheet, with the approval of the company auditor. It’s a technical matter, but it is this combination of various financial elements that makes factoring efficient, high-performing and valuable for many companies.”

Economic fabric

The two agree on the value of factoring in supporting the economic fabric. Bourguet explains, “Part of this supportive role is due to the fact that factoring is a completely transparent financial service – you can only finance what is effectively there.” Ramaekers adds, “Absolutely. Plus, factoring sits right in the middle of the value chain, embedded in the economic fabric. We work alongside our clients, their customers (debtors), the bank, and so on. This makes us a key figure in this chain. We coordinate and facilitate. And for this we need to have our feet firmly planted on economic ground, often for the benefit of all our customers. When we succeed in, for example, reducing the payment terms of invoices for a business, it has a positive ripple effect not only for that company but for the economic process as a whole. This is why I am convinced that we play a broad role in the economic ecosystem – often broader than is generally perceived.”

Opportunities and fair guidance are also crucial in this financial field. Ramaekers says, “At Factor, we engage in transparent discussions with the bank and our clients to find the best solution for their needs. This means we identify opportunities and often suggest them, but also act as an honest, proactive sounding board. It’s about dialogue, analysis, and constructive critique.” Bourguet concurs: “I completely agree. With a service like factoring, we are deeply involved in our clients’ economic activity – the entrepreneurs who rely on us. So, we take a broad view of every case, looking beyond just a banking product or a single solution. This is what makes BNP Paribas Fortis’s approach so strong: we operate as a team, consisting of specialists from both Factor and the bank. This group of experts from different, well-coordinated entities provides entrepreneurs and companies with a comprehensive approach, even for complex cases. These are the moments when we truly rely on our internal expertise: years of experience; colleagues with solid knowledge; reliable economic data applicable to numerous scenarios. This combination enables us not only to guide companies in the right direction but also to provide financial support that is fair, safe, and sound.”

Future

Just like the bank itself, BNP Paribas Fortis Factor frequently considers its strategic direction for the future. As a provider of forward-thinking services, it’s essential to adopt a future-oriented approach to financial services. Ramaekers notes, “Earlier, I mentioned our digital solution, Easy2Cash. I think we can be quite proud of this because it is a glimpse into the future – today. Beyond that, our services are evolving very organically towards the future: we’re constantly striving to make them accessible to an ever-wider group of clients across the economic landscape. Additionally, we’re very focused on sustainability.”

Bourguet adds, “This last aspect is a natural extension of what we do at the bank every day. Our commitment to sustainability extends seamlessly to factoring: we encourage and motivate our clients to join us on this sustainable path.”

The two teams also collaborate closely in developing new services. Ramaekers explains, “We see a significant evolution in the commercial sector, with many online stores offering deferred payment options, such as a 30-day extension. This practice is also increasingly common in the B2B market. Factoring can innovate in this area, so we see it as part of the future we’re actively developing. From a European perspective, there are other innovations too: e-invoicing, for example, is soon to become the standard for all businesses. This presents both a challenge and an opportunity in terms of services and advisory, which we’re shaping together with the bank.”

The two partners have also developed new services. Ramaekers: "We have observed a remarkable evolution in the commercial sector, where many online stores offer payment delays of 30 days, for example. This practice is also increasingly common in the B2B market. Factoring can offer an innovative solution, so this is part of the future that we are currently developing. On the European level, there are also new features: e-invoicing will soon become the norm for all companies. This presents both a challenge and an opportunity in terms of services and advice, which we are developing together with the bank."

Bourguet concludes, “It’s clear that this is a story of synergy, one where we work together seamlessly. This isn’t just rewarding for us but also for our clients. We’re rooted in the heart of the economic marketplace, yet we’re also focused on creating platforms and products that will lead the way and shape the future of this market.”

More information: https://factor.bnpparibasfortis.be/

Must reads

- Schuldschein benefits: simple, flexible and also discreet on request

- Schuldschein: German export for the financing market

- Schuldschein is gaining in popularity as an alternative type of investment. Why so?

- Managing business uncertainty with BNP Paribas Fortis

- BNP Paribas Fortis Factor: the oxygen to your growth story