CERT has officially warned companies about the risks of CEO fraud. What should we make of this and how do we protect ourselves against it?

The Centre for Cyber Security Belgium is a kind of federal cyber emergency team, which acts as a specialist independent body working on internet and network security. This summer, it warned Belgian companies of the risks of CEO fraud.

This is by no means a new trend, but CERT has announced that it has recently seen an increase in reports of this type of fraud.

What is CEO fraud?

CEO fraud is a very real problem. Cyber criminals contact a company and ask them to make an important payment.

"The criminals steal the identity of the CEO, CFO or another trusted person within the company. They then ask an employee to make an urgent payment.

Because the employee thinks this request is coming from higher up in the company, there is a real risk of the payment actually being made." CERT.be

Good news: the summer break is coming to an end. During the holiday period, more attempts at CEO fraud are made because the criminals are counting on employees' low levels of vigilance during the summer months, or hoping that their request will be sent to a replacement who is less familiar with the company's procedures.

What to do if you have fallen victim to CEO fraud

Raise the alarm immediately. Notify your superior within the company as well as the organisations or persons whose identities have been stolen. If the transfer has already been made, contact your bank immediately to cancel the payment. Lastly, report the issue to the police. CEO fraud is a criminal offence. If you have any doubts, you can always flag cases of suspected fraud to the authorities using the e-mail address cert@cert.be.

White paper

If you're interested in learning more, you can read the CERT white paper on CEO Fraud, which is available for free.

10.06.2024

Electronic invoicing between companies to become mandatory

The bill to introduce this obligation in Belgium has been submitted to the Federal Parliament. If the draft bill is approved, B2B e-invoicing will become mandatory from 1 January 2026. Our experts explain why Belgium wants to introduce these new rules, what the implications are for your company and how we can better support you.

“The bill is consistent with international developments and initiatives at the European level,” says Nicolas De Vijlder, Head of Beyond Banking at BNP Paribas Fortis. "Europe's ambition is a harmonised digital standard. Structured e-invoicing between companies will also reduce the administrative burden of invoicing, enabling companies to work more efficiently and increase their competitiveness. The automation of VAT declarations will also help governments prevent tax fraud and adjust economic policies based on more qualitative data.”

Evolution rather than a revolution

“The new legislation is an evolution rather than a revolution,” adds Erik Breugelmans, Deputy Managing Director at BNP Paribas Factoring Northern Europe. "Digitalisation is becoming pervasive at all levels of society, as we have seen with the increase in electronic payments, as well as the additional obligations in recent years regarding electronic invoicing to the government. In this sense, the bill for mandatory electronic invoicing between companies is a logical next step. Our bank is happy to contribute to this process, although we do not intend to offer the same services as accounting software or fintechs. However, we are happy to help our customers with payments and financing."

The impact on businesses

“Customers need to be aware that the new regulations will have an impact on their internal and external processes,” continues Erik Breugelmans. "The majority of Belgian companies mainly serve an international market, which means that the introduction of electronic invoicing will be more complex for them than for companies operating in the domestic market. As the legislation will be introduced in one go, they need to start preparing now."

“The new rules will affect a company’s accounting department as well as its IT department,” emphasises Nicolas De Vijlder. "The procedural requirements are key, otherwise the automated process will not work. However, one of the main benefits of advanced automation is that everything can be done faster and more efficiently. The time between sending an invoice and paying it will be shorter and cash flows more predictable. In addition, it will also reduce the risk of error and fraud, as all transactions will pass through a secure channel."

Ready to offer you even more and better support

“Thanks to the far-reaching digitisation resulting from the new regulations, we will be able to further optimise payments,” concludes Erik Breugelmans. "As a bank, we need to finance our customers’ receivables as quickly and efficiently as possible, so that they have easier access to their working capital. In addition, because we have already gone through an entire process in terms of large-scale automation, we will be able to adapt quickly to the new rules. We can also draw on the expertise of the BNP Paribas Group, which is currently developing an e-invoicing solution for large companies."

Want to know more?

Listen to the episode on B2B e-invoicing :

08.03.2024

Has your company also locked in its energy prices?

The price of energy has experienced both high highs and low lows in recent years. This yo-yo behaviour is a worry to many entrepreneurs. Once again, BNP Paribas Fortis is here to offer you stability.

Controlling the price of energy: it’s an issue that’s almost impossible to avoid, or one that has been a recurring concern in your company over the past few years? We come from a time when energy prices were very volatile, with both high highs and low lows. These fluctuations have worried many entrepreneurs and, in some cases, caused huge additional costs. There is, however, a less well-known way for entrepreneurs to carry out risk management in this area. BNP Paribas Fortis is here to advise you.

Pendulum movement

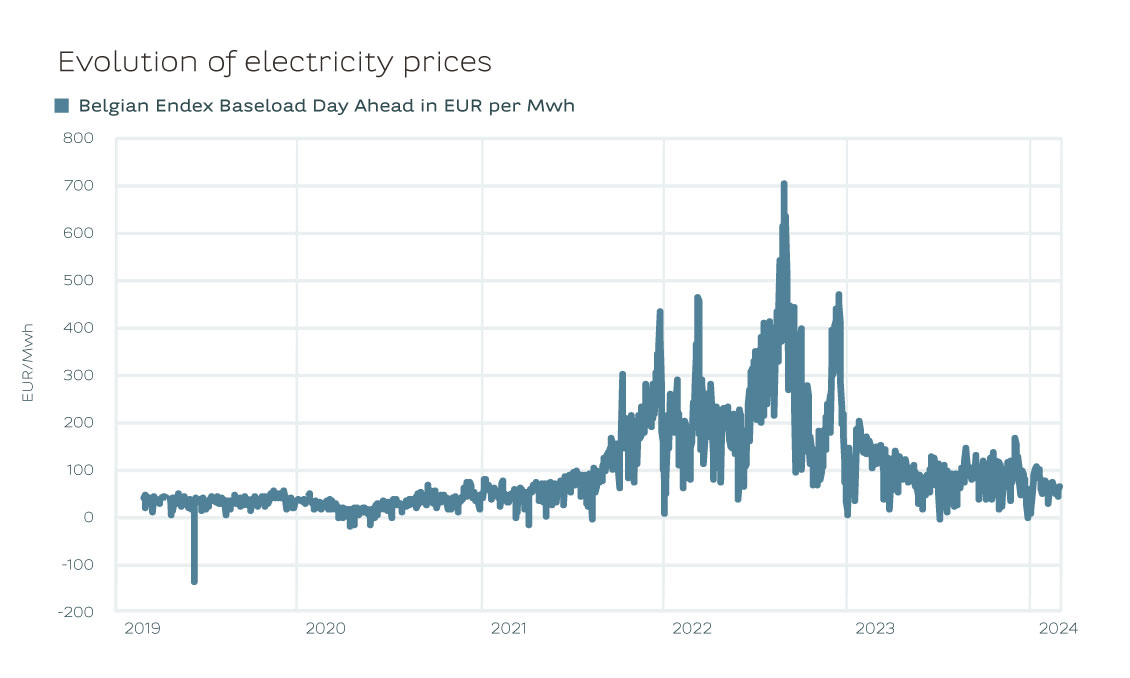

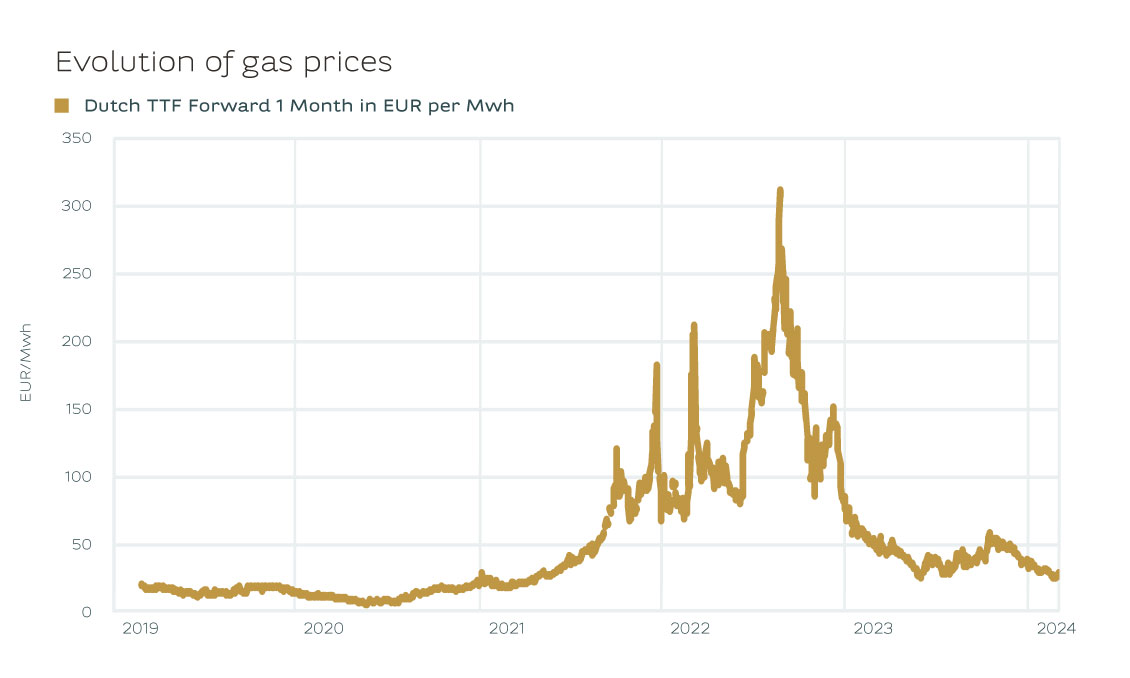

Energy prices have been on a volatile ride in recent years. After the invasion of Ukraine, they rose to unprecedented levels. Gas prices rose to EUR 300 per MWh, while in previous years they had been around EUR 10-15 per MWh. Electricity prices rose to over EUR 600 per MWh. In previous years, the price was barely EUR 50 per MWh.

Crisis management

"As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.)."

Mattias Demets, Commodity Derivatives Sales at BNP Paribas Fortis

The energy crisis of 2022 sent shock waves through the economy. Especially in energy-intensive sectors such as metallurgy or chemicals, it became clear how much affordable energy was crucial to the survival of many companies. Those that were self-sufficient in their energy needs weathered the storm better than others. The energy crisis also highlighted the importance of risk management. Companies wanted, as the legislator put it, to act like "prudent and reasonable persons" - the former "good householder principle". They fixed their energy prices and came out of the crisis virtually unscathed. While others could only hope that energy prices would come down again.

'Never waste a good crisis' is a regularly heard truism. For this energy crisis, we can use this expression once again. It’s fascinating to see companies now taking charge of their own energy supply. The rise of PPAs – Power Purchase Agreements – is particularly remarkable. A PPA is an electricity purchase agreement between a power producer and a customer.

Risk management

Companies are also making great strides in risk management. In the past, it was often up to management to lock in energy prices. They saw it as an additional responsibility to negotiate with energy suppliers. But since the energy crisis, we have seen companies become much more professional. Managing energy prices is today a job in itself. Companies are increasingly thinking about the right strategy to manage their energy costs so that their energy prices come down. How and when they lock in energy prices has become more of an informed decision than ever before, allowing them to protect their margins in the event of rising prices.

As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.). A financial swap may seem a bit complex at first, but it’s actually not such an intricate transaction. Of course, other structures are also available, depending on your needs.

This is where the “prudent and reasonable person” returns to assess what lies ahead. After all, whether you’re looking for smart investment opportunities or advice on ways to control your energy costs, it ultimately boils down to two sides of the same coin. BNP Paribas Fortis not only thinks about investing with you as an entrepreneur, but also about ways to help you smartly and safely manage important expenses such as energy costs.

Permanent drop?

Regardless of how companies choose to fix their energy prices, the current market context is very interesting at the moment. Industry in Europe is going through tough times. Nevertheless, the economy is experiencing a soft landing – a slowdown, without a real recession. This is currently leading to lower gas and electricity prices. We have also had a mild and windy autumn and winter. As a result, energy producers have generated a historically high amount of electricity from renewable sources in recent months.

And there’s nothing to suggest that prices won't continue to fall. Europe is importing more LNG from the United States than ever before. Indeed, both the price of US gas and the cost of transporting it have fallen dramatically in recent months. However, elections are coming up in more than 65% of the developed world, and the geopolitical situation (Ukraine, Israel, Taiwan) could again cause volatility.

Prudence

Gas and electricity prices have not been this low for two years and the market is currently stable. But the 2022 energy crisis has shown that we must always be on our guard. Locking in your energy price is not only the most cost-effective tactic, but it will also protect you, as a business owner in times of increasing volatility.

For more information, please contact your relationship manager.

01.05.2020

The conversation manager: essential and permanently online

Coordinating a company's social media strategy is a task in itself. Who will you use to handle this? And what about involved customers who suddenly get too involved?

Because of social media, the role of a traditional marketing manager is evolving more and more towards being a conversation manager: someone who facilitates consumer communication. This includes communication between customers themselves and communication between the customers and the company.

Some key tasks in the conversation manager's job description are:

- Uniting and activating ‘branded fans’, as they will recommend the brand to friends and family.

- Listening to what people are saying about your company and seeking their active contribution to your products and strategy.

- Creating content worth distributing in order to encourage discussions.

- Managing these discussions.

- Ensuring your work is very customer-oriented and customer-friendly through customer care, i.e.by responding faster and providing more than what the customer is expecting.

Some companies are big enough to hire a full-time conversation manager. In other cases another employee will take on this role part-time. A third possibility is using a specialised company.

Caroline Hombroukx, conversation manager at content marketing company Head Office:

“No matter which option you go for, communication in social media must come across as personal. There is definitely a reason why large companies such as Telenet and Belgacom have created a fictitious person to deal with their customers; Charlotte and Eva respectively. The conversation manager also has to know the company and its social media strategy very well. It may therefore be an advantage if someone in the company itself takes on that role. That person is right at the source and so can distribute information, take a quick picture and post it online, etc.

This task is not for everyone. A conversation manager must have experience with social media, have fluent communication and writing style and must be empathetic, positive and solution-oriented in his or her dealings with customers. Prior training is not a luxury, because the employee must be very aware of the company's content strategy. The audience is varied and unpredictable. You have to decide time and time again whether certain content is or is not suitable for your target group. It is also not a nine-to-five job: the online world keeps on turning even at night or at the weekend."

The advantage of hiring a conversation manager from an external company is that in principle the expertise is present. In that case the challenge is to know the company to such an extent that the customer has the impression that he or she is talking to a real employee.

Getting angry is out of the question

Traditional marketing and advertising are a one-way street. If they do not work, they are a waste of money. However, they are not likely to result in angry comments. A company venturing out on Facebook, Twitter or other social media, can be sure to receive comments and reactions. Including negative ones. Caroline Hombroukx:

“On social media the consumer is suddenly right next to you banging the table. It is important to respond well to that. Getting angry yourself is out of the question. You need to respond by showing that you understand and you are taking the question or complaint seriously. Everyone following the discussion must see that the company is providing a quick answer and is trying to find a solution. If a mistake has been made, you can acknowledge this openly and honestly. You can also show the problem as something positive: as an opportunity to improve your brand, product or service. Of course you must find a suitable solution in the end. If the person sharing the complaint becomes too negative, you have to try and divert him or her to a private channel: a private message on Facebook, a direct message on Twitter, an e-mail or a phone call."

An enthusiastic, understanding response also works well if the consumer is sharing something positive about your brand, company or service. Thanking the consumer strengthens the bond between the company and the customer. Caroline Hombroukx:

"The dialogue with the target group is an opportunity to improve your product or operations through constructive criticism. Make customers feel involved. It creates a strong relationship. If you are publishing a magazine or starting a poster campaign for instance, you can let customers choose the best layout or title from three options posted on Facebook, for example. Everything that engages customers can only strengthen their commitment."

Social media dos and don'ts

- The consumer is always right (even when this isn't the case).

- Be open, honest and friendly.

- Use a personal style.

- Respond quickly to any questions or reactions.

- Stay positive and be understanding.

- Do all you can to engage your customers.

- Come up with a free gift every now and then.

- As a brand, try to avoid political topics.

02.04.2020

Social media and e-commerce: opportunities and risks

The huge popularity of social media brings new opportunities, but has resulted in some new stumbling blocks as well. What are the most recent trends? And how should you respond to them?

Social media such as Facebook, YouTube, Twitter, Instagram, etc. seem cutting edge, but the principle is as old as the hills: word of mouth, sometimes abbreviated as WOM in marketing. Even in the heyday of the mass media, positive recommendations from neighbours, family and friends remained important to a company's success. Newspapers, magazines and television advertising were the first channel introducing a new product to consumers, but word-of-mouth turned out to play a decisive role in what matters most: consumer behaviour. Consumers shared experiences and thereby affected the behaviour of their fellow consumers. Today, more than ever, they do so through social media.

Consumers persuading consumers

Social media are the contemporary, more sophisticated and super-fast successor of old-fashioned word-of-mouth advertising. They are a catalyst. Social networks allow people to exchange views, share experiences, express their dissatisfaction, etc. more quickly than ever.

In addition, more and more consumers are opting for a "social search" over search engines such as Google to find information. They consciously do not search the entire internet, but approach their friends on Facebook or contacts on LinkedIn or Twitter. It speeds up the search and makes the result more reliable. The idea is that if X thinks it is good/nice/beautiful, we will probably think it is good/nice/beautiful too. There is also the option to ask questions and really discuss the product or service you need information about.

Consumers talk about all sorts of products (offline and online), from new detergents to new car models. And it is not just young people who are sharing their experiences about products and brands. Young and old, male or female: everyone does it. All these recommendations between consumers are worth gold.

We can illustrate this with an example: computer manufacturer Dell assumes that 25% of its customers choose their brand after it has been recommended by another user. The average purchase value per customer is about 210 dollars. Based on this amount, the value of every recommendation is estimated at 42 dollars. The more consumers Dell can convince to buy its products, the more money it makes.

However, the reverse is equally true: bad word-of-mouth advertising can have devastating effects. Particularly in this age of social media, a bad reputation does not take long to spread.

Social media in 2014

Perhaps Facebook will no longer exist in ten years' time, but it will most certainly have been replaced by something else. Social media are here to stay. It is therefore important for companies to build a good social media strategy. They can start by thinking about which channel they want to use for which content and objective. What do you need to take into account?

- Content (the message to the consumer) is still the key part, but the importance of segmentation is increasing. The audience is varied, so not all content and every channel is suitable for everyone. As a company, it is best to divide your target audience into sub-target groups. You can then choose specific content and a channel per sub-target group.

- Create real-time content: define a number of key moments in the year in advance and use these wisely. The World Cup, back to school, the summer holidays, etc. are all events that happen regularly and companies can respond to in a clever way. The trick is to find a good link between the key moment and your product. Be creative in this respect. If a school bag brand presents its content at the end of August, it will have to use an original approach to avoid coming across as predictable.

- Social media are predominantly a mobile story: most consumers are switching to smartphones and tablets. It is no coincidence that the four best-known social networks are also in the list of most popular mobile apps: Facebook, YouTube, Instagram and Twitter. In any case, your content (both on the website and on social media) will have to be mobile-friendly.

- The importance of customer care is only increasing. Consumers will now use social media more than ever to find information, ask questions and make comments.