Currency Guide

Our Currency Guide tells you everything you need to know about more than 130 currencies. It includes the applicable local guidelines and directives that you must adhere to when making international money transfers.

Live tracking

Our SWIFT gpi tracker gives you end-to-end visibility on the status of your payment transaction, while indicating which fees apply and when your payment will be received.

Let us help you be faster and more efficient

Contact usThe Currency Guide for seamless payments

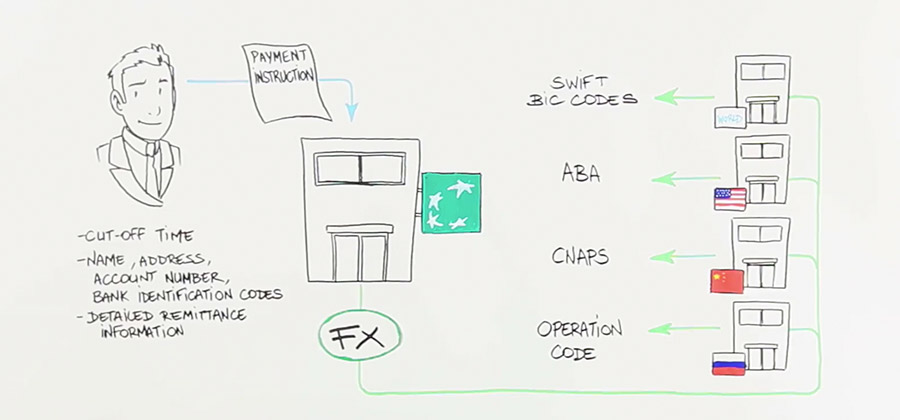

How to configure your international payments?

Rely on clear information to make and receive international transactions, with complete peace of mind, increasing the percentage of automated transactions.

Our Currency Guide helps you master the complexities of international payments and manage your cash flow optimally. This product is available for free and suitable for all organisations, regardless of their size or profile.

It contains:

- the guidelines you must follow to secure your international payments;

- comprehensive date on more than 130 currencies;

- additional information on local regulations;

- an overview of public holidays and weekends;

- tailored instructions for your payments.

Track your payments with SWIFT gpi

Did the beneficiary receive your payment? How can you confirm that you sent the payment? Which fees will your beneficiary be required to pay by their bank?

SWIFT gpi is our payment tracker, offering end-to-end visibility for your payments. Available at no additional cost, this tracker provides a clear answer to most of your questions and can be used by any company. Thanks to this tracker, you can make international payments with peace of mind.

Benefits of SWIFT gpi:

- live tracking;

- transparent overview of the bank charges of each intermediary agent, execution time and payment status;

- comprehensive information on your transaction, which is easy to access, by you and all your colleagues;

- user-friendly;

- direct access to our e-banking channels.

FX Payment integrated in our e-banking channels

Our e-banking channels allow you to carry out your international transactions from an account in your local currency. They inform you about the applicable fees and margins.

This solution combines the advantages of our global market presence with the expertise of our Cash Management teams. Moreover, this web application is available at no additional cost and can be used by all companies.

BNP Paribas Fortis applied three principles in the development of e-banking channels:

Maximum coverage

- payments in 170 countries and 130 currencies;

- receive money in more than 40 currencies;

- global presence.

A solution that benefits you

- competitive prices;

- a team of experts to optimise your cash flow;

- transparency of exchange rates and fees before you commit thanks to BNP Paribas Fortis Live Rates.

Reliability

- predefined and transparent FX margins;

- comprehensive SWIFT gpi reporting;

- solid compliance for the entire international payment process;

- secure transactions.

INQUIRO: manage compliance requests

INQUIRO by BNP Paribas helps you handle compliance requests for your international payments. It makes the process more efficient, doing away with e-mail which may give rise to payment delays and additional administration. The payment system was designed in close collaboration with our clients.

INQUIRO by BNP Paribas has many advantages:

Efficiency

- instant notifications;

- flexible delegation option;

- proactive upload functionality.

Transparency

- payment status updates;

- audit trail of activities;

- advanced guidelines, listed by question.

Digitalisation

- a secure solution;

- a centralised dashboard;

- search functionality.

Specific entrance conditions exist, contact us for more information.

European leader

BNP Paribas’s leadership position in Europe and Belgium in Cash Management was recently confirmed during the annual Coalition Greenwich ‘Large Corporate Cash Management’ survey. The survey also highlighted the bank’s status as a leading cash management provider across Asia.

How to make international payments even easier?

Let’s talk about it"As a result of significant global investments, BNP Paribas Fortis is providing our international oriented clients with a very comprehensive International payment offer, which will support a seamless client journey. With our global footprint we clearly distinguish ourselves from the local competition. The web-based Foreign Currency guide is a great example of our reach and investments.