William De Vijlder, Group Chief Economist, BNP Paribas zooms in on increasing geopolitical uncertainties.

The slowdown of the global economy which became increasingly visible in the second half of last year has many causes, but there is broad agreement that rising trade tensions, import tariff hikes and concern about the pace of US monetary tightening acted as clear headwinds. In Europe, Brexit-related uncertainty played a role, as well as sector-specific issues, like new emission standards for the automobile sector. Clearly, uncertainty, in various guises, was a big issue: uncertainty about the economy (the international consequences of China’s slowdown), about economic policy (the Federal Reserve’s monetary stance), about political decisions (soft or hard Brexit, Italy’s budget) and about geopolitics (considering that the build-up of commercial tensions between China and the US is about more than the bilateral trade deficit).

Geopolitical uncertainties on the rise

Whereas economic, economic policy and political uncertainty tend to come and go, depending where we are in the economic and political cycle, research based on media coverage of geopolitical tensions shows that geopolitical uncertainty has on average been higher since the turn of the century compared to the 1990s. This higher average is associated with an increased frequency of uncertainty spikes, triggered by events like 9/11, the Iraq war, the Arab spring, the Crimea, Syria, terrorist attacks, etc. These events illustrate that geopolitics now covers a broad range of issues, well beyond the older concept of how nations project their power internationally and react to the behaviour in this respect from other nations.

Empirical research shows that an increase in geopolitical risk weighs on industrial production, employment, international trade, consumer confidence. Moreover, whereas certain events can have a short-lived economic impact, because after a spike, uncertainty drops quite quickly, geopolitical threats (without an event necessarily occurring) can cause a sustained increase in uncertainty and hence have a longer lasting impact. This issue of resolution of uncertainty (“how much longer do we need to wait until we know the outcome?”) has been clearly visible in the reaction to the postponements of Brexit day.

A top priority?

Newspaper articles about geopolitical risks may be numerous but, judging from the mapping in the Global Risks Report 2019 of the World Economic Forum, companies are, in recent years, more concerned about climate change and cyberattacks. In the assessment of their likelihood and impact, they score above average, whereas issues related to geopolitics score around average. This is still sufficient for companies to pay particular attention to it, given the macroeconomic headwind coming from protracted uncertainty or the possible non-linear consequences of risk events. The list of questions to be tackled is long but, as usual when dealing with uncertainty, it is about how can uncertainty be monitored, what is my exposure and how can I manage it. The monitoring is the easier task of the three, considering that there is no lack of research on geopolitical topics. High quality, media-based uncertainty indicators are even available for free on the internet.

“The tensions between the US and Turkey in the summer last year turned out to be short-lived, but they remind us of the necessity to define in advance how to cope with short-lived versus sustained increases in geopolitical risk. “ William De Vijlder, Group Chief Economist, BNP Paribas

Direct and indirect exposure

Assessing the exposure is already more complex, in particular when dealing with indirect exposure. Moreover, one should not only assess where geopolitical threats or events can impact your business, but also, and this is the more difficult question, to which extent.

Direct exposure is about: does geopolitical uncertainty influence how and where I produce (which commodities, which intermediate inputs, how complex a global value chain); does it influence the markets into which I sell; does it influence my financing costs, my access to financing, the use of my cash-flow, the repatriation of foreign profits?

When analysing indirect exposure, the questions ultimately are the same, but the channels are different, more complex and hence challenging to assess. Globalisation has enabled companies to broaden their customer base and lower their cost base, but, with a slight exaggeration, it implies that anything can hit them anywhere. When the US and China are negotiating on trade, it can end up impacting third party countries when it leads to trade diversion (the innocent bystander syndrome). There can be political contagion with unrest in one country spreading to other countries which suffer from similar problems. Financial markets can act as an accelerator or a channel of transmission. The increasingly harsh tone between the US and Turkey in the summer of last year unnerved international investors and contributed to the significant weakening of the Turkish lira. It also raised concerns about financial contagion to other emerging market currencies. Eventually, the tensions turned out to be short-lived, but they remind us of the necessity to define in advance how to cope with short-lived versus sustained increases in geopolitical risk.

Accepting or avoiding the exposure

“Coping with” can mean to just accept it as a fact of life, to build a robust strategy which takes uncertainty explicitly into account or to simply avoid the exposure. Accepting the exposure could make sense if, all in all, the financial impact of risk events would be rather limited. The cost of protracted uncertainty can be taken into account by using a sufficiently high return on investment target before committing money.

Avoiding the exposure could be justified if the trade-off between return and (tail) risk is unattractive, if it would trigger a disproportionate attention by shareholders or creditors, if attractive alternatives to grow the business are available, etc. ‘Avoiding’ could also mean ‘waiting to decide on an investment’ but this raises the question of the opportunity cost of waiting. If a company was contemplating to build a factory in the UK before the Brexit referendum, is there an opportunity cost to waiting for the type of Brexit when alternative locations, outside the UK, are available? When time is money, waiting ends up being expensive.

The question of building a robust strategy is the more interesting and challenging one. It starts from the observation that we are (or need to become) active in a country (e.g. because it is a huge market or because it is key to remain competitive) but that this could increase the exposure to geopolitical risk. In designing a robust strategy, different scenarios are analysed and eventually, the chosen approach should do well under a multitude of environments, without being optimal in any specific one, simply because, in deciding under uncertainty, we are (by construction) not in a position to anticipate which one will materialise. Ongoing geopolitical risk monitoring will allow to plan for corrective action if need be as time goes by.

24.01.2018

Exportation: risk control in the palm of your hand

The Credendo mobile application provides a solution to mastering the export risks and information associated with the various world markets...

The importance of exports for the economic strength of companies, especially SMEs, is no longer in doubt. Nevertheless, the uncertainties associated with going international can keep some companies from taking the leap. To turn uncertainties into opportunities: Credendo!

Exporting: opportunities to be taken

In an increasingly globalised world and with an explosion of digital tools, most companies sooner (sometimes much sooner) or later dream of conquering foreign markets. And with reason. Whatever the size of your company – even if big companies are more active on this issue – exporting represents an opportunity to leave the limitations of the Belgian market behind in order to energise your turnover, make economies of scale, explore new outlets for your products or even benefit from advantages in terms of employment and innovation.

Read the FPS Economy report on the performance of Belgian SMEs regarding exports in French or in Dutch.

Increasing optimism

Given their increasing confidence, companies will be even more attracted to going international in the future. In any event, this is what the Credendo and Trends-Tendances export barometer reports, indicating that four out of five Belgian companies are expecting a growth in exports during the next few years. An optimism that is only slightly dampened by the fear of protectionist barriers being raised in different regions of the world... One more fear to add to the classic obstacles in exporting, such as different legal systems, increased risk of non-payment, political-economic uncertainty in the destination country and the burden of administrative formalities.

Credendo: a new tool for exporters

Zero risk is a myth and even more so when dealing with business overseas. This is why the European credit insurance group Credendo has developed an application promising to "turn uncertainties into opportunities". How? You download the application to your smartphone and choose to export (long term) from Belgium to Portugal, for example. You immediately receive an up-to-date assessment, practically in real time, of the risks for any country or continent. In the blink of an eye, you can access various important risk parameters and also set up alerts for countries or sectors, benefit from risk analyses and in-depth thematic studies on the economy of emerging countries, for instance. The main advantage of this solution is that it provides information from the point of view of the exporter and directs you to customised solutions. Final detail: the application is free!

For more information for SMEs on going international, the Economy FPS has produced an interesting pamphlet on "International expansion of SMEs: clear findings and operational measures for SMEs" (available in French and in Dutch).

01.06.2018

Cover yourself before embarking on a quest for global markets

Any company that begins to trade abroad is buying into the idea that it can conquer brand new markets, but also that new risks are an inevitability. And although the risks are often worth taking, informed directors will evaluate the danger in order to be better prepared.

In love, as in business, distance makes things more complicated. However, in an increasingly globalised world, expanding your business activity into other countries remains essential – especially in an export-oriented country like Belgium. This strategic challenge demands an appropriate approach that will allow the company to move into new territory successfully. Whether internationalisation takes a physical or virtual form, a number of risks of a new type will join those you are already managing at local level, including hazards associated with transportation, exchange rate risks, poor knowledge of regional regulations, cultural or ethical "gaps", and difficulties arising from unpaid sums and recovering these abroad, etc. To minimise the impact on your business, take precautions and correctly signpost the pathway separating you from your international customers.

Where should you venture to?

If you have identified a particular continent or country of interest, you have presumably spotted obvious commercial benefits. You know your business and are convinced that this move can work well. But before you take the plunge, a step back is necessary so that you can analyse the country-related risks: from the geopolitical context (an embargo would be disastrous for your plans) to the political and socio-economic situation on the ground. It is not uncommon, for example, for elections to have a destabilising effect on the climate of a nation.

Do you have sufficient local knowledge?

This question may appear trivial at first, but culture and traditions have a major influence on the way trade is conducted – even in a globalised world. Beyond market expectations and the chances your product has of success, it is imperative to grasp the cultural differences that could have an impact on your business. A Japanese company does not take the same approach as its equivalent in Chile. Do not hesitate to recruit a trustworthy consultant who fully understands the region.

Have you planned for the worst?

This piece of advice is highly pertinent when the country in question uses a currency other than the euro because foreign exchange rates fluctuate continuously, with the result that you could be obliged to convert money according to less favourable terms than those initially expected. Adopt an effective foreign exchange policy (stabilise your profit margins, control your cash flow, mitigate potential adverse effects, etc.) and employ hedging techniques that best suit your situation.

How do you evaluate your international customers?

Once you have analysed the context, drop down a level to gauge the reliability of your customer in terms of their financial situation and history (e.g. of making payments), their degree of solvency, etc. While such research may not be simple, it is decisive in order to prevent payment defaults that can do enormous harm. If in doubt, take out an appropriate insurance policy to protect yourself. Paying for this could prevent you from becoming embroiled in perilous (not to mention costly) recovery action abroad. Should you end up in a crisis situation, you should ideally obtain local support in the country. Finally, be aware that in the EU, debt recovery is simplified by the European Payment Order procedure.

Have you adequately adapted the tools you use?

One of the greatest risks of international trade is transportation (loss, theft, accidents, seizures, contamination, etc.) in addition to customs formalities. Once dispatched, the goods are no longer within your control, and so you must ensure your carriers accept adequate liability. This means, for example, having suitable insurance cover, but also anticipating the multitude of procedures to be launched in any dispute. More generally, you will need to review and adapt the contracts you have with transport companies, as well as your international customers. Ensure you clearly set out the terms and conditions that apply (payment deadlines, exchange rates, compensation, etc.) and include realistic clauses that safeguard your own interests.

09.12.2024

Managing business uncertainty with BNP Paribas Fortis

Every entrepreneur will tell you that financial markets are unpredictable, entailing inherent risks. We provide tailored solutions to protect your business as you navigate these volatile markets.

Whether you’re a small or large business, operating domestically or internationally, one thing is certain: if you enter a market and do your utmost to grow your business, sooner or later there inevitably will come a time when you expose yourself to risks. Frédéric Raxhon, Head of FI Midcap Sales, BNP Paribas Fortis Transaction Banking, is our go-to expert. Here, he explains how BNP Paribas Fortis helps customers manage this uncertainty.

Raxhon knows how market volatility can impact the daily operations of small, medium and large enterprises. Thanks to his experience of working as a banker in corporate finance, shares and derivatives, and advising holding and listed companies, he understands how the market works like no other.

Raxhon: "We are keenly aware that price uncertainty, in the form of volatility on the financial markets, can have a serious impact on the operations and profitability of businesses. That’s why we constantly monitor the markets and their volatility: if prices fluctuate sharply, our customers run the risk of buying high and selling low. The past few years are a good example of what can happen, with a sudden rise in interest rates, an energy crisis with very volatile prices, and a sharp rise in inflation. We will continue to see volatility in these markets, due to geopolitical tensions and ongoing wars. However, elections can also cause volatility, as they often cause a change in economic policy. President-elect Donald Trump has already said that he will hike tariffs on goods coming from outside the U.S., which will have an impact on global growth and inflation. The transition to a more sustainable society because of the energy transition, however positive this may be, is also a source of uncertainty. Companies will be required to make significant investments, and it is not yet clear which technologies will prevail.

All of these factors show that companies need guidance in the form of a tailor-made solution to ensure that volatile markets minimise the impact on their operations so that they can focus on their core business."

Solution-oriented

The solution to this volatility comes from a partner who is a market leader when it comes to safeguarding national and international business.

Raxhon: "At BNP Paribas Fortis, this often means managing the risks of companies that have a number of straightforward wishes: they want to conduct business on a daily basis without unnecessary complications; buy at a stable price where possible; pay wages in a stable environment; sell to customers with a profitable, stable margin, and so on. If they experience market uncertainty in their business operations, we are there to advise them and suggest solutions in different scenarios. This can range from companies that want stability when buying or selling goods in another currency, to controlling fluctuating interest rates on current or future loans, or even creating a stable financial environment in which they can steadily pay their wages. We also hedge raw materials: companies that require large quantities of energy, metal, or wheat, for example – just a few of the commodities that are subject to price fluctuations – can rely on our expertise to turn their uncertainty into certainty. When companies are calculating their budgets for the coming years at the end of the year, assumptions about budgets and costs are a factor that future markets do not take into account. This, in turn, could lead to inconsistencies in business operations during the next financial year. We regularly suggest solutions for this, which inject trust into the entire process. We help entrepreneurs make their business more resilient to market fluctuations. Because at BNP Paribas Fortis, we are always focused on finding solutions, in any given scenario."

International intelligence

Belgian companies are increasingly expanding their horizons, which is why an international perspective is so crucial.

Raxhon: "Everything is intricately connected in the economic space. The energy crisis, for example, was not a national crisis. In Belgium, electricity prices were directly impacted by the drop in nuclear power production in France in 2022. The American elections have a direct impact on international business, with anxiety gripping investors and the markets. And I can give you many more examples.

Moreover, we expect this interdependence and volatility to continue for quite some time: there are a large number of economic and global trends that are feeding this uncertainty. And that is why it is so important that we keep up with developments in this uncertain global environment. At BNP Paribas Fortis, we rely on a global network of experts who are always on the lookout for the latest updates. Whatever happens and wherever it happens, there are always people from our bank on the ground who monitor the situation and provide us with real-time advice on how best to inform our customers. This network has proven its worth time and again, both for us and our customers."

08.03.2024

Has your company also locked in its energy prices?

The price of energy has experienced both high highs and low lows in recent years. This yo-yo behaviour is a worry to many entrepreneurs. Once again, BNP Paribas Fortis is here to offer you stability.

Controlling the price of energy: it’s an issue that’s almost impossible to avoid, or one that has been a recurring concern in your company over the past few years? We come from a time when energy prices were very volatile, with both high highs and low lows. These fluctuations have worried many entrepreneurs and, in some cases, caused huge additional costs. There is, however, a less well-known way for entrepreneurs to carry out risk management in this area. BNP Paribas Fortis is here to advise you.

Pendulum movement

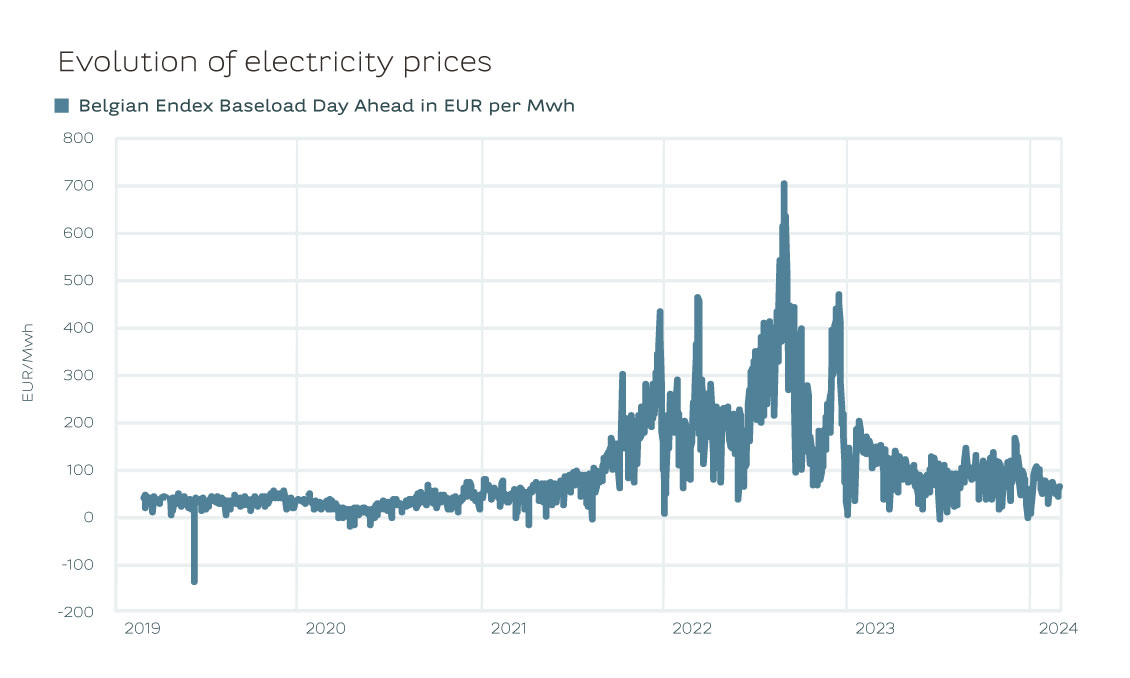

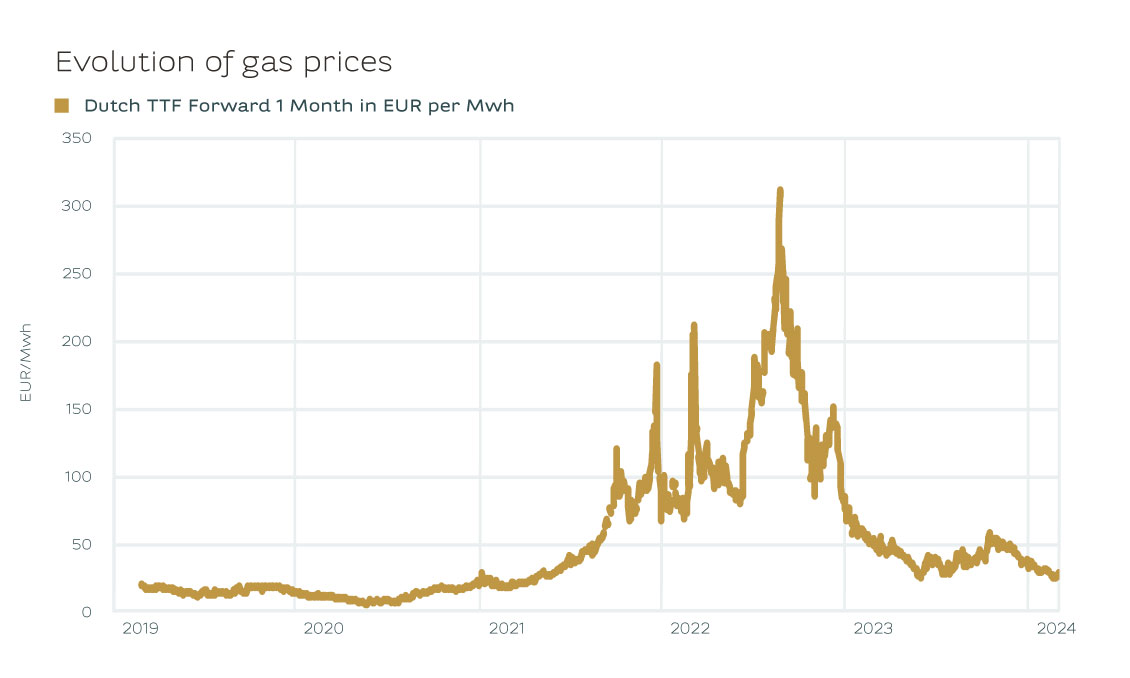

Energy prices have been on a volatile ride in recent years. After the invasion of Ukraine, they rose to unprecedented levels. Gas prices rose to EUR 300 per MWh, while in previous years they had been around EUR 10-15 per MWh. Electricity prices rose to over EUR 600 per MWh. In previous years, the price was barely EUR 50 per MWh.

Crisis management

"As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.)."

Mattias Demets, Commodity Derivatives Sales at BNP Paribas Fortis

The energy crisis of 2022 sent shock waves through the economy. Especially in energy-intensive sectors such as metallurgy or chemicals, it became clear how much affordable energy was crucial to the survival of many companies. Those that were self-sufficient in their energy needs weathered the storm better than others. The energy crisis also highlighted the importance of risk management. Companies wanted, as the legislator put it, to act like "prudent and reasonable persons" - the former "good householder principle". They fixed their energy prices and came out of the crisis virtually unscathed. While others could only hope that energy prices would come down again.

'Never waste a good crisis' is a regularly heard truism. For this energy crisis, we can use this expression once again. It’s fascinating to see companies now taking charge of their own energy supply. The rise of PPAs – Power Purchase Agreements – is particularly remarkable. A PPA is an electricity purchase agreement between a power producer and a customer.

Risk management

Companies are also making great strides in risk management. In the past, it was often up to management to lock in energy prices. They saw it as an additional responsibility to negotiate with energy suppliers. But since the energy crisis, we have seen companies become much more professional. Managing energy prices is today a job in itself. Companies are increasingly thinking about the right strategy to manage their energy costs so that their energy prices come down. How and when they lock in energy prices has become more of an informed decision than ever before, allowing them to protect their margins in the event of rising prices.

As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.). A financial swap may seem a bit complex at first, but it’s actually not such an intricate transaction. Of course, other structures are also available, depending on your needs.

This is where the “prudent and reasonable person” returns to assess what lies ahead. After all, whether you’re looking for smart investment opportunities or advice on ways to control your energy costs, it ultimately boils down to two sides of the same coin. BNP Paribas Fortis not only thinks about investing with you as an entrepreneur, but also about ways to help you smartly and safely manage important expenses such as energy costs.

Permanent drop?

Regardless of how companies choose to fix their energy prices, the current market context is very interesting at the moment. Industry in Europe is going through tough times. Nevertheless, the economy is experiencing a soft landing – a slowdown, without a real recession. This is currently leading to lower gas and electricity prices. We have also had a mild and windy autumn and winter. As a result, energy producers have generated a historically high amount of electricity from renewable sources in recent months.

And there’s nothing to suggest that prices won't continue to fall. Europe is importing more LNG from the United States than ever before. Indeed, both the price of US gas and the cost of transporting it have fallen dramatically in recent months. However, elections are coming up in more than 65% of the developed world, and the geopolitical situation (Ukraine, Israel, Taiwan) could again cause volatility.

Prudence

Gas and electricity prices have not been this low for two years and the market is currently stable. But the 2022 energy crisis has shown that we must always be on our guard. Locking in your energy price is not only the most cost-effective tactic, but it will also protect you, as a business owner in times of increasing volatility.

For more information, please contact your relationship manager.