Any company that begins to trade abroad is buying into the idea that it can conquer brand new markets, but also that new risks are an inevitability. And although the risks are often worth taking, informed directors will evaluate the danger in order to be better prepared.

In love, as in business, distance makes things more complicated. However, in an increasingly globalised world, expanding your business activity into other countries remains essential – especially in an export-oriented country like Belgium. This strategic challenge demands an appropriate approach that will allow the company to move into new territory successfully. Whether internationalisation takes a physical or virtual form, a number of risks of a new type will join those you are already managing at local level, including hazards associated with transportation, exchange rate risks, poor knowledge of regional regulations, cultural or ethical "gaps", and difficulties arising from unpaid sums and recovering these abroad, etc. To minimise the impact on your business, take precautions and correctly signpost the pathway separating you from your international customers.

Where should you venture to?

If you have identified a particular continent or country of interest, you have presumably spotted obvious commercial benefits. You know your business and are convinced that this move can work well. But before you take the plunge, a step back is necessary so that you can analyse the country-related risks: from the geopolitical context (an embargo would be disastrous for your plans) to the political and socio-economic situation on the ground. It is not uncommon, for example, for elections to have a destabilising effect on the climate of a nation.

Do you have sufficient local knowledge?

This question may appear trivial at first, but culture and traditions have a major influence on the way trade is conducted – even in a globalised world. Beyond market expectations and the chances your product has of success, it is imperative to grasp the cultural differences that could have an impact on your business. A Japanese company does not take the same approach as its equivalent in Chile. Do not hesitate to recruit a trustworthy consultant who fully understands the region.

Have you planned for the worst?

This piece of advice is highly pertinent when the country in question uses a currency other than the euro because foreign exchange rates fluctuate continuously, with the result that you could be obliged to convert money according to less favourable terms than those initially expected. Adopt an effective foreign exchange policy (stabilise your profit margins, control your cash flow, mitigate potential adverse effects, etc.) and employ hedging techniques that best suit your situation.

How do you evaluate your international customers?

Once you have analysed the context, drop down a level to gauge the reliability of your customer in terms of their financial situation and history (e.g. of making payments), their degree of solvency, etc. While such research may not be simple, it is decisive in order to prevent payment defaults that can do enormous harm. If in doubt, take out an appropriate insurance policy to protect yourself. Paying for this could prevent you from becoming embroiled in perilous (not to mention costly) recovery action abroad. Should you end up in a crisis situation, you should ideally obtain local support in the country. Finally, be aware that in the EU, debt recovery is simplified by the European Payment Order procedure.

Have you adequately adapted the tools you use?

One of the greatest risks of international trade is transportation (loss, theft, accidents, seizures, contamination, etc.) in addition to customs formalities. Once dispatched, the goods are no longer within your control, and so you must ensure your carriers accept adequate liability. This means, for example, having suitable insurance cover, but also anticipating the multitude of procedures to be launched in any dispute. More generally, you will need to review and adapt the contracts you have with transport companies, as well as your international customers. Ensure you clearly set out the terms and conditions that apply (payment deadlines, exchange rates, compensation, etc.) and include realistic clauses that safeguard your own interests.

08.03.2024

Has your company also locked in its energy prices?

The price of energy has experienced both high highs and low lows in recent years. This yo-yo behaviour is a worry to many entrepreneurs. Once again, BNP Paribas Fortis is here to offer you stability.

Controlling the price of energy: it’s an issue that’s almost impossible to avoid, or one that has been a recurring concern in your company over the past few years? We come from a time when energy prices were very volatile, with both high highs and low lows. These fluctuations have worried many entrepreneurs and, in some cases, caused huge additional costs. There is, however, a less well-known way for entrepreneurs to carry out risk management in this area. BNP Paribas Fortis is here to advise you.

Pendulum movement

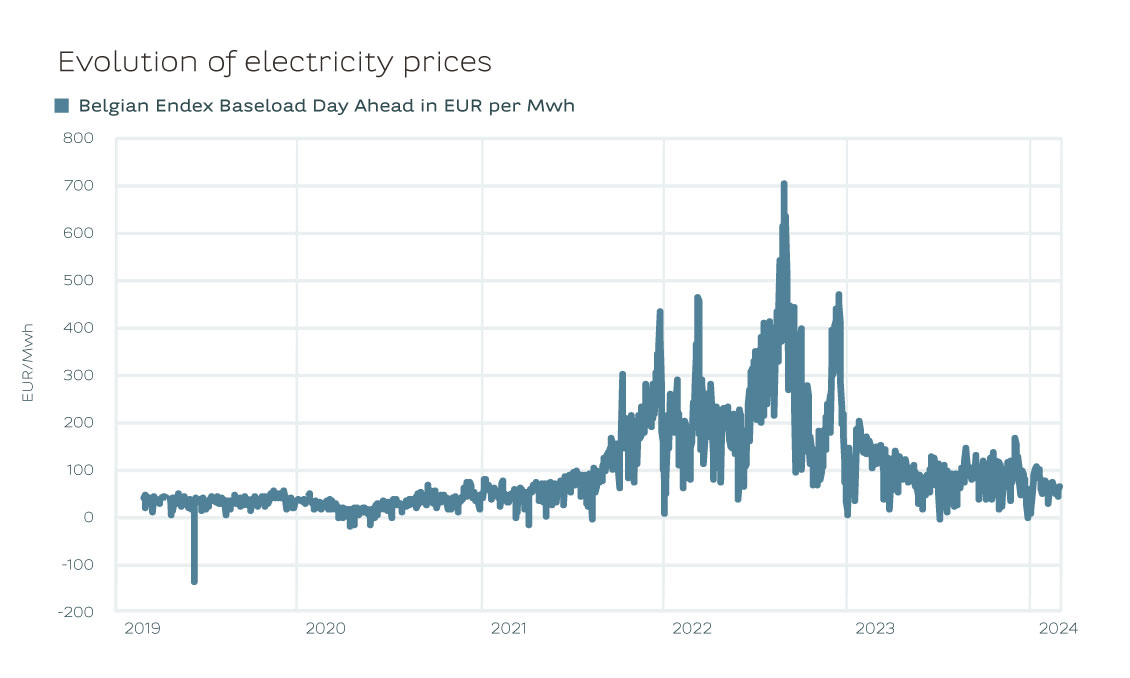

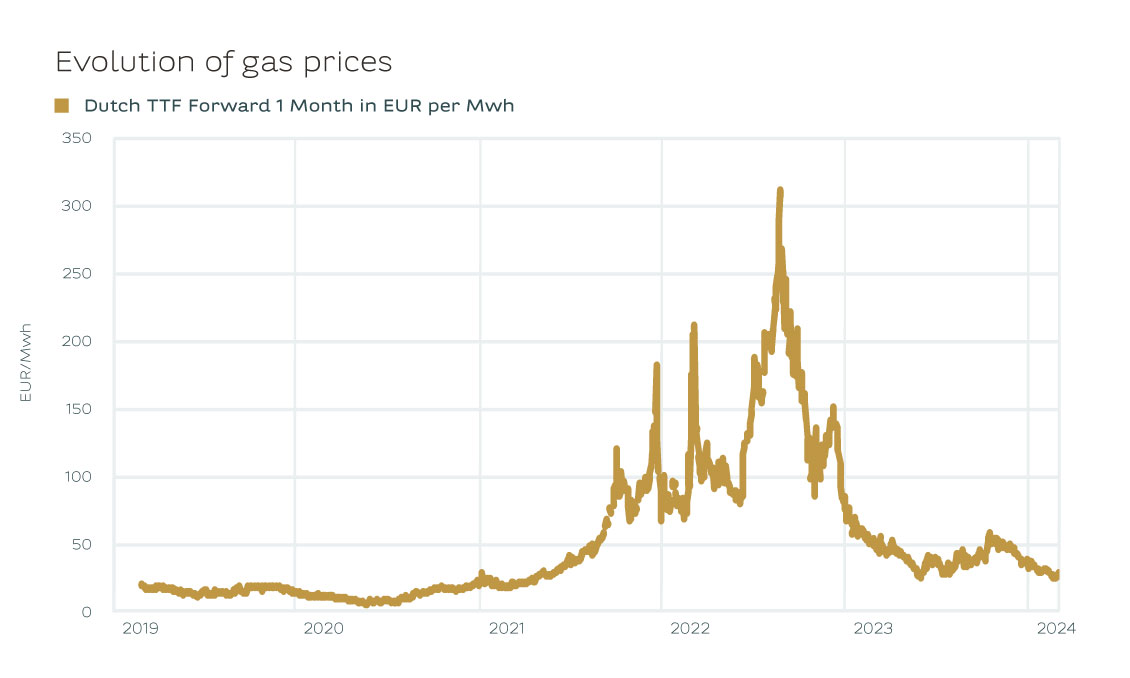

Energy prices have been on a volatile ride in recent years. After the invasion of Ukraine, they rose to unprecedented levels. Gas prices rose to EUR 300 per MWh, while in previous years they had been around EUR 10-15 per MWh. Electricity prices rose to over EUR 600 per MWh. In previous years, the price was barely EUR 50 per MWh.

Crisis management

"As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.)."

Mattias Demets, Commodity Derivatives Sales at BNP Paribas Fortis

The energy crisis of 2022 sent shock waves through the economy. Especially in energy-intensive sectors such as metallurgy or chemicals, it became clear how much affordable energy was crucial to the survival of many companies. Those that were self-sufficient in their energy needs weathered the storm better than others. The energy crisis also highlighted the importance of risk management. Companies wanted, as the legislator put it, to act like "prudent and reasonable persons" - the former "good householder principle". They fixed their energy prices and came out of the crisis virtually unscathed. While others could only hope that energy prices would come down again.

'Never waste a good crisis' is a regularly heard truism. For this energy crisis, we can use this expression once again. It’s fascinating to see companies now taking charge of their own energy supply. The rise of PPAs – Power Purchase Agreements – is particularly remarkable. A PPA is an electricity purchase agreement between a power producer and a customer.

Risk management

Companies are also making great strides in risk management. In the past, it was often up to management to lock in energy prices. They saw it as an additional responsibility to negotiate with energy suppliers. But since the energy crisis, we have seen companies become much more professional. Managing energy prices is today a job in itself. Companies are increasingly thinking about the right strategy to manage their energy costs so that their energy prices come down. How and when they lock in energy prices has become more of an informed decision than ever before, allowing them to protect their margins in the event of rising prices.

As a result, BNP Paribas Fortis has received an increasing number of enquiries in recent years from companies looking to financially lock in their energy prices. Typically as a company you pay a variable price to the energy supplier. While you fix the price with the bank via a financial swap. Such financial swaps are also used to hedge other commodities (metals, oil products, etc.). A financial swap may seem a bit complex at first, but it’s actually not such an intricate transaction. Of course, other structures are also available, depending on your needs.

This is where the “prudent and reasonable person” returns to assess what lies ahead. After all, whether you’re looking for smart investment opportunities or advice on ways to control your energy costs, it ultimately boils down to two sides of the same coin. BNP Paribas Fortis not only thinks about investing with you as an entrepreneur, but also about ways to help you smartly and safely manage important expenses such as energy costs.

Permanent drop?

Regardless of how companies choose to fix their energy prices, the current market context is very interesting at the moment. Industry in Europe is going through tough times. Nevertheless, the economy is experiencing a soft landing – a slowdown, without a real recession. This is currently leading to lower gas and electricity prices. We have also had a mild and windy autumn and winter. As a result, energy producers have generated a historically high amount of electricity from renewable sources in recent months.

And there’s nothing to suggest that prices won't continue to fall. Europe is importing more LNG from the United States than ever before. Indeed, both the price of US gas and the cost of transporting it have fallen dramatically in recent months. However, elections are coming up in more than 65% of the developed world, and the geopolitical situation (Ukraine, Israel, Taiwan) could again cause volatility.

Prudence

Gas and electricity prices have not been this low for two years and the market is currently stable. But the 2022 energy crisis has shown that we must always be on our guard. Locking in your energy price is not only the most cost-effective tactic, but it will also protect you, as a business owner in times of increasing volatility.

For more information, please contact your relationship manager.

07.09.2022

Who is in with a chance of winning a Leeuw van de Export Award in 2022?

On Wednesday 14 September, FIT will present its 21st Leeuw van de Export Award: the highest award for Flemish companies achieving outstanding export results. Will Belkorn, Twipe Mobile Solutions, XenomatiX, Bogaerts Greenhouse Logistics, Kipco-Damaco or Lambo Laboratoria win?

Every year, Flanders Investment & Trade (FIT) awards a Leeuw van de Export Award to two companies that have recorded notable achievements in the field of exports in the past year. We briefly introduce the six nominees below. Be inspired by their foreign expansion stories. On 14 September, the top exporters will be celebrated at the Brabanthal in Leuven.

Nominees in the 'Companies with up to 49 employees' category:

Belkorn from Diest

Healthy and tasty, high-quality ingredients that are good for people and the planet. Belkorn has been making this sustainable vision a reality since 1985, when it launched the first organic baby biscuit in Europe, well before the current trend for organic food. In 2010, a British brand chose Belkorn to bake its biscuits, causing the company to ramp up its export plans. Russia and Australia soon followed suit, and today Belkorn has a presence in 30 countries. More than 95% of the company's turnover is derived from exports.

CEO Jos Corthouts: "Thanks to continuous investments in innovation and a state-of-the-art production centre, we have seen rapid growth over the past five years. In the future, we hope to boost our presence in Ireland, Australia and New Zealand and gain a foothold in the German market."

Twipe Mobile Solutions from Heverlee

Heverlee-based Twipe Mobile Solutions assists 80 influential newspaper titles, helping them to increase their reader numbers and revenue with a user-friendly digital newspaper, insights into reading behaviour, and personalised news feeds. After a first mobile news app and the first exclusive digital newspaper in France, they launched JAMES in the UK, a digital butler that compiles automated, personalised reading lists for subscribers. Twipe Mobile Solutions serves newspapers in 13 countries, accounting for 92% of turnover.

CEO Danny Lein: "In the coming years, we want to develop a tech scale-up that plays in the Champions League of news media technologies, while remaining true to our Flemish roots. With intelligent innovation, a lot of hard work and team spirit, you can grow and build an international reputation."

XenomatiX from Leuven

XenomatiX develops innovative laser systems for self-driving cars. The Leuven-based company provides an answer to the automotive industry’s demand for more compact, reliable and affordable sensors. Despite its small-scale production, XenomatiX has a very local presence in major automotive countries such as Germany, the US, China, Japan and South Korea, to explain and demonstrate its technology on the ground. The company wants to make a difference worldwide with its promising technology.

CEO Filip Geuens: "We want to make an economically relevant contribution to society through our technology and the resulting employment."

Nominees in the 'Companies with 50 or more employees' category

Bogaerts Greenhouse Logistics from Hoogstraten

Bogaerts Greenhouse Logistics is the largest player in the automation of greenhouse gardening. The company develops machines, appliances and other logistical aids for spraying, harvesting and sorting in modern greenhouses. The sophisticated systems, which are produced in Hoogstraten, are now used in more than 40 countries.

CEO Joris Bogaerts: "In Europe, we're gradually hitting the ceiling in terms of terminal automation. But there are lots of large-scale projects in the pipeline in Eastern Europe, Russia and China. And the African continent still offers a lot of potential." We want to be ranked among the global top 3."

Kipco-Damaco from Oostrozebeke

The chicken in your favourite deep-frying snack or boiled sausage is probably produced at Kipco-Damaco. In recent years, the poultry slaughterhouse in West Flanders has developed into a global producer and distributor of chicken separator meat for further processing. After a first foreign sales office in Singapore, the company established 4 production sites and 11 branches in countries such as Brazil, India, the Philippines and Vietnam. This development offers significant added value thanks to local market knowledge and short lines of communication with the meat technologists at Kipco-Damaco. Exports account for 83% of the company's turnover, of which a significant proportion is bound for the EU.

Co-owner and commercial & marketing director Iris Vandaele: "We believe in taking a chance, jumping on every opportunity for expansion. We valorise chicken separator meat, but also extract proteins from feathers for animal feed, for example. We were circular long before this was a hot topic."

Lambo Laboratoria from Wijnegem

Family-owned company Lambo Laboratoria develops high-quality gelatin capsules for the pharmaceutical and food supplement industry. Instead of mass production, they produce capsules that are tailored to their customers on demand. Their choice to operate in a niche market has been driving their international growth for 15 years, with sales to 30 countries today. Currently, exports account for 78% of the company's turnover, with the majority bound for our neighbouring countries, Italy and Poland. The company thinks there is still plenty of growth potential, both geographically and in specific market segments, and is currently looking for partners in Germany and Italy. Far-flung markets also beckon.

Managing Director Uwe Leonard: "We purposefully capitalise on our Flemish roots. It is striking how we are often appreciated more abroad than in our own country. 'Made in Belgium' is a quality label around the world."

Find out on 14 September who are the 2 winners of the 2022 Leeuw van de Export Award. Register beforehand at www.leeuwvandeexport.be.

Are you ready for your first international adventure or do you want to further expand your international activities? We offer you the peace of mind you need, with a wide range of solutions to optimise, secure and finance your import and export activities.

Source: Wereldwijs magazine 2022

25.11.2020

Not words, but actions: how can you realise your internationl project?

Gaining a foothold in a foreign country is no easy task, and some good advice alone will not suffice. Trade Development at BNP Paribas Fortis is the perfect partner to turn theory into practice!

Many companies want to try their luck outside our borders and gain a foothold in new markets. This is necessary not only to be able to continue to grow, but also to remain competitive. But if you don't know where to start, it's hard to put your money where your mouth is. How do you find the right market? How do you find prospects? How do you prepare the whole operation in all its aspects? What risks do you need to cover? And which partner can you trust? All important questions that can make or break your project. And this is how international ambitions are sometimes left on ice....

"We want to help companies achieve their international ambitions", says Rob van Veen, Head of Trade Development at BNP Paribas Fortis.

"We look at the local market into which the company wants to launch and make sure the underlying potential is sufficient." And so, the first step towards success is taken.

WHEN GOOD ADVICE IS NOT ENOUGH...

There's a deep gap between theory and practice that managers do not always dare to cross. It's essential to collect a lot of data and information, but this is certainly not enough. Talk must then be followed by action. Your growth project's first stone must be laid... preferably with the greatest possible chance of success and as few risks as possible. In such an adventure, (good) guidance is not a superfluous luxury. Even more reason to call on the support of Trade Development: a partner who can assist you with a wide range of solutions and help you establish a long-term strategic vision. In Belgium and beyond.

"In their project's first phase, companies often find a lot of information and support from the Belgian export promotion agencies", says Rob van Veen. "But they don't get all the practical answers they need to roll out their activities in a given country."

CHOOSE WISELY!

Given that growth prospects in Belgium are rather limited, companies must therefore look for international growth. But where? This is where the Trade Development team comes in. Your choice of target market is certainly crucial. A vague, poorly thought-out decision can have dramatic consequences: examples of failure abound – partly because companies don't understand the local 'culture'. Companies sometimes gravitate towards exotic markets because others have gone before them. But every international project is unique: does the market fit into your overall strategy? Are you aware of all the challenges that lie ahead (regulatory, commercial, etc.)?

"Let's take the example of a company that wants to set up in Brazil. Our first question is then: what activities have you already been carrying on in Europe? Might there be new, undiscovered opportunities there? For example, it's much easier for a company to set up in Poland than in Brazil, where taxes on imports are extremely high" , continues Rob van Veen.

HIGHLY NECESSARY 'LOCAL' CONTACT PERSONS

Your project has taken shape and you've determined your target market. The time has then come for Trade Development to roll out one of its greatest assets: access to a global network of competent and reliable partners.

"We introduce the client to local specialists who can support their project abroad from start to finish. One deals with the roll-out of activities, another specialises in legal and tax issues, and a third takes care of the administrative side of things. We prefer to work with small, local agencies, most of whom are long-term BNPPF network partners", says Rob van Veen.

These contact persons have a perfect knowledge of the national rules and customs and know how to adhere to that specific framework. The company therefore has the great advantage that it can benefit from such a skilled team: a win-win situation. "In addition, our permanent contact persons are evaluated by the client after each project. This way, we can guarantee the quality of our services!"

BUILDING RELATIONSHIPS: Save TIME AND gain EFFICIENCY

Are you looking for an effective distributor or a reliable representative? An ideal on-site supplier? Do you want to determine these contacts' actual potential or get to know possible new partners? Not easy for a company…

"Most of them are looking for a white knight. Our trade developers draw up realistic selection criteria in consultation with the client. They carry out a financial analysis of the commercial partners and check their technical baggage and their reputation", explains Rob van Veen.

First, a list of four or five serious and interested candidates is drawn up, and then the contact phase follows. "Our local contact introduces the candidates to the Belgian company to ensure that both parties are interested in a partnership. Once all these issues are clarified, the relationships can be rapidly explored in depth."

SUCCESS IN THE FIELD

Every target market has its problems and risks: from the language to cultural and commercial differences. Very specific problems that are often difficult to solve from Belgium, especially in the post-COVID-19 era. Hence the importance of being surrounded by specialists who know the country like the back of their hand. Need an example? "To be able to supply retailers in the UK, you often need to be able to invoice at a local level", explains Rob van Veen. "Our trade developer can then act and take care of the local invoicing and accounting on the company's behalf at a fixed and transparent rate for each transaction. This is a simple initial structure that does not require major investments but is very interesting professionally." The client can naturally then seek its own local partner. "That too is a task they can leave to our contact person, who has the necessary experience to do so." Need another example? Russia, where everything takes a huge amount of time... Trade Development's network of experts can also speed things up considerably here and solve problems more quickly.

Contact us

18.11.2020

Who is the key partner in your international growth?

Your bank! In particular, the network of experts at BNP Paribas Fortis' Trade Development department. The missing link between your foreign ambitions and your growth project's success.

Conquering foreign markets raises new expectations within companies. Needs that go way beyond a bank's 'traditional' services... We at BNP Paribas Fortis have understood that well, and that's precisely why we established the Trade Development department. This department advises clients and provides them with a full range of support in their international ambitions. "A bank can provide practical assistance to companies' expansion projects abroad: it can open accounts, provide guarantees, underwrite cash flows, and more", says Rob van Veen, Head of Trade Development at BNP Paribas Fortis. "But that's not all clients need: they also expect their bank to think about strategy and to help them approach the market in an intelligent and efficient manner. And that's exactly what we do." What does that mean? The service provides unique and highly essential support – especially now against the backdrop of the COVID-19 crisis – for expansion beyond our national borders, reassuring business owners and connecting them to a global network of local experts or providing long-term follow-up.

KNOWN TERRAIN... EVEN ABROAD

A good example of this successful partnership between a company with international ambitions and the bank is the Besins Healthcare group, founded in 1885 by Abel Besins, and which has been expanding globally since the 1980s. Great ambitions, which the company fully embraces with BNP Paribas Fortis' sustainable support. "Once we've got new plans abroad, we first discuss them with our contact person at BNP Paribas Fortis", says Leslie Grunfeld, CEO of Besins Healthcare, which is currently active in over a hundred different markets, and has local branches in several of them. "Our treasurer will check whether the bank is present in the country in question or whether it has partnership links with local institutions." This approach means that the group never goes into a blind adventure, as it has a similar range of services throughout the world. "That's great! Especially when you consider that the local problems you have to solve can vary greatly from one country to another."

ACCESS TO A KNOWN AND RELIABLE NETWORK

One of the Trade Development team's biggest advantages is that it can provide companies with a real network of local specialists. Professionals for whom the target market holds no secrets. They know the reality of the country in question like the back of their hand and provide the company with support through all the local steps: from exploring business opportunities to bureaucratic formalities.

"Even in countries where BNP Paribas Fortis doesn't have branches, we were able to benefit from the bank's network, which made the establishment of local branches particularly smooth. We didn't have to start from scratch every time we went abroad: we had immediate access to a structured network and reliable banking partners. And that means huge time savings", Besins Healthcare's CEO emphasises.

THE HUMAN FACTOR

Personal contacts with preferred partners are of great importance in an international growth project. Not only to have reliable and proactive contacts, but also to gain access to useful information and to unlock new local opportunities. These 'local' contacts are usually long-term partners of the bank... a guarantee of reliability for the company that should not be underestimated. They are specialists with various skills and profiles – legal, business or administrative – who assist the company in question from start to finish. This includes assisting with setting up local establishments, starting up a new activity, recruiting staff (management, local contracts, etc.), setting up a new legal structure, seeking suitable suppliers and other partners (e.g. banks), responding to clients' needs (cash credit, leasing, fleet management, currency hedging, etc.) and offering them tailor-made solutions. And what happens when the company is 'launched'? Trade Development then remains on standby to continue the banking relationship and to closely monitor the client's evolution. For the long term!

TAILORED SOLUTIONS

A bank like BNP Paribas Fortis – through its Trade Development teams – is therefore the key partner for companies' international growth. And that goes way beyond simply offering financial services. It also provides:

- exploration of new markets and partners for the company. In this capacity, it can collaborate in determining the strategy at the source and opening the range of possible relationships on the ground as widely as possible;

- risk mitigation: the bank analyses and assists with the preparation of a realistic profile of the future partner (finances, real interest, reliability, reputation, etc.) and with reducing the margin of error;

- creation of ready-to-use solutions. In this regard, the bank is always available to listen to the client, anticipate their expectations and offer solutions adapted to their specific situation;

- acceleration of the foreign process to establish themselves in a market or gain a foothold there, thanks to local contacts with useful local knowledge and experience;

- facilitation of the whole process, making its extensive network available to rapidly put the company in question in contact with local partners, but also to manage or advance all kinds of situations;

- long-term support – Trade Development's experts closely monitor the company's international journey, on-site or remotely, and oversee the project's success.

Must reads

- Cover yourself before embarking on a quest for global markets

- Has your company also locked in its energy prices?

- Who is in with a chance of winning a Leeuw van de Export Award in 2022?

- Not words, but actions: how can you realise your internationl project?

- Who is the key partner in your international growth?